UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN THE PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12. |

Cinemark Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

Dear Fellow Stockholders:

We welcome you to join us at our 2021 annual meeting of stockholders (Annual Meeting) to be held virtually on May 20, 2021 at 9:00 a.m. CDT. The Notice of Annual Meeting and Proxy Statement, following this letter, provides more information regarding the virtual-only meeting and the business we will conduct at the Annual Meeting.

It is almost unfathomable that one year ago, we were reporting Cinemark’s fifth consecutive year of record results with the North American industry touting the second-highest grossing box office of all-time. At the beginning of 2020, we reflected an incredibly strong Company with areflected an incredibly strong Company with a history of discipline and consistency, operating in a stable and mature industry. It goes without saying that COVID-19 has |

| |

| caused significant distress in multiple industries, including the movie exhibition industry, and tested the strength and resiliency of our Company over the course of the past year. | ||

Cinemark is still a strong company operating with balance, discipline and consistency, while adapting to our current circumstances. This past year has only reinforced that Cinemark has tenacity and perseverance in addition to an ability and a willingness to think quickly and move nimbly as we evolve in this unpredictable, ever-changing environment.

Cinemark was one of the first theatre chains to reopen and has largely been able to remain open, government restrictions notwithstanding. At the end of the year, approximately 75% of our U.S. circuit was reopened, compared to 45% of the North American industry. Similarly, in Latin America, we had approximately 65% of our theatres operating by year-end. Our theatre teams have been proficient in executing our enhanced cleaning and safety protocols, named The Cinemark Standard. Since we began reopening in June, we have consistently received 96% guest satisfaction scores on Cinemark protecting their health and safety. Notably, we are continuing to more than cover our incremental variable costs associated with being open and are burning less cash with theatres open than we would if the theatres remained closed.

I am proud of the accomplishments the entire team has made over the past year. While we were well-positioned heading into the crisis, we have adapted the way we operate to become more efficient and navigate the current environment. We are working diligently to remain successful and further solidify our leadership position as theatrical moviegoing resurges, which will ultimately benefit long-term stockholder value.

Lastly, our Board’s active oversight has been integral to our success in helping management navigate the challenges and impacts associated with the COVID-19 pandemic with their diverse viewpoints, financial acumen and deep industry knowledge and expertise.

Thank you for your continued support, trust and investment in Cinemark. We look forward to your participation at our Annual Meeting.

YOUR VOTE IS VERY IMPORTANT TO US. Whether or not you plan to attend the Annual Meeting, I urge you to please cast your vote as soon as possible via the Internet, telephone or mail.

| Sincerely, |

|

| Mark Zoradi |

| Chief Executive Officer |

CINEMARK HOLDINGS, INC.

3900 Dallas Parkway

Plano, Texas 75093

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

April 2, 2021

Dear Stockholders:

Notice is hereby given that the Annual Meeting of the Company will be held on May 20, 2021 at 9:00 a.m. CDT, virtually, for the following purposes:

| 1. | To elect three Class II directors to serve for three years on our board of directors; |

| 2. | To ratify the appointment of Deloitte and Touche, LLP as our independent registered public accounting firm for 2021; |

| 3. | To hold the annual, non-binding, advisory vote on our executive compensation program; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only stockholders of record as of the close of business on March 25, 2021, set as the Record Date, will be entitled to notice of, and to vote at, the Annual Meeting.

For the second consecutive year, our Annual Meeting will be conducted exclusively online via live audio webcast. Conducting the meeting virtually will again ensure stockholder access in light of the expected ongoing uncertainty for large gatherings due to the COVID-19 pandemic. Stockholders will be afforded the same rights and opportunities to participate in a virtual-only Annual Meeting as they would at an in-person meeting.

To be admitted to the virtual-only Annual Meeting, stockholders as of the Record Date must use the following link: www.virtualshareholdermeeting.com/CNK2021 and enter the 16-digit control number found on the proxy card or the voting instruction form. By logging into the website, stockholders as of the Record Date will be able to vote shares electronically on all items to be considered at the Annual Meeting. If a stockholder as of the Record Date has any question pertaining to the business of the Annual Meeting, it must be submitted in advance of the Annual Meeting by visiting www.proxyvote.com. Questions may be submitted until 10:59 p.m. CDT, on Tuesday, May 18, 2021. Stockholders must have their proxy cards or voting instruction forms in hand when accessing the website and follow the instructions. To allow us to respond at the Annual Meeting to the maximum number of stockholders, each stockholder will be limited to one question.

Those without a 16-digit control number will be admitted to the virtual-only Annual Meeting as guests, but guests will not have the ability to vote or otherwise participate.

BY ORDER OF THE BOARD OF DIRECTORS,

Michael Cavalier

Executive Vice President-General Counsel & Secretary

YOUR VOTE IS IMPORTANT TO US. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented. Therefore, we urge you to promptly vote and submit your proxy in advance of the Annual Meeting. You can vote your shares via the Internet, by telephone, or by signing, dating, and returning the proxy card or voting instruction form. To vote via the Internet or telephone, follow the instructions included in the proxy card or the voting instruction form. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting.

The proxy statement and the 2020 Form 10-K are available at

http://materials.proxyvote.com/17243V

| 1 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| OVERVIEW OF 2020 EXECUTIVE COMPENSATION SET IN FEBRUARY 2020 |

38 | |||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

53 | |||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| DISCUSSION OF THE TERMS OF THE EMPLOYMENT AGREEMENTS WITH OUR NEOS |

61 | |||

| 67 | ||||

| |

67 |

| ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

68 | |||

| 70 | ||||

| DEADLINE FOR STOCKHOLDER PROPOSALS FOR THE 2022 ANNUAL MEETING |

74 | |||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

This summary highlights information contained elsewhere in this proxy statement and in our annual report on Form 10-K for the year ended December 31, 2020 (2020 Form 10-K) as filed with the Securities and Exchange Commission (SEC) on February 26, 2021 for Cinemark Holdings, Inc. (Company, Cinemark, we or us). You should read the proxy statement and the 2020 Form 10-K before voting.

| MEETING DATE

|

TIME

|

RECORD DATE

| ||

| THURSDAY, MAY 20, 2021

|

9:00 A.M. CDT | MARCH 25, 2021 | ||

|

|

HOW TO VOTE

Please act as soon as possible to vote your shares, even if you plan to attend the Annual Meeting online. If you are a beneficial stockholder, your broker will NOT be able to vote your shares with respect to non-routine matters unless you have given your broker specific instructions to do so. If you are a stockholder of record, you may vote via the Internet, by telephone, or, if you have received a printed version of these proxy materials, by mail. For more information regarding voting, see “Questions and Answers About the Annual Meeting and Voting” beginning on page 70. |

VOTE

ONLINE at www.proxyvote.com You may also attend the Annual Meeting online to vote at www.virtualshareholdermeeting.com/CNK2021

BY PHONE by calling the applicable number. For stockholders of record: (800) 690-6903 For beneficial owners: the telephone number on your voting instruction form.

For online and phone voting, you will need the 16-digit control number on your proxy card or voting instruction form.

BY MAIL if you have received a printed version of these proxy materials. |

|

|

| |||||

| ATTEND THE ANNUAL MEETING

LOGISTICS

• Attend the Annual Meeting online at www.virtualshareholdermeeting.com/CNK2021

• The Annual Meeting will begin at 9:00 a.m. CDT, with log-in beginning at 8:45 a.m., on Thursday, May 20, 2021. |

||||||||||

|

ASKING QUESTIONS

If you have a question pertaining to the business of the Annual Meeting, you must submit it in advance of the Annual Meeting by visiting www.proxyvote.com. Questions may be submitted until 10:59 p.m. CDT, on Tuesday, May 18, 2021. You should have your proxy card or voting instruction form in hand when you access the website and follow the instructions. To allow us to respond at the Annual Meeting to the maximum number of stockholders, each stockholder will be limited to one question.

|

IF YOU CANNOT ATTEND, FOLLOWING THE ANNUAL MEETING:

• Appropriate questions received that are not addressed at the Annual Meeting due to time constraints will be posted, along with our responses, on https://ir.cinemark.com as soon as practical after the conclusion of the Annual Meeting. |

|

1 |

VOTING ROADMAP

| Item | ||||||||||||

|

Elect Three Class II Director Nominees | |||||||||||

| See page 13 | The Board recommends a vote FOR each nominee | |||||||||||

| Name | Independent | |

Director Since |

Board Committees | ||||||||

| Darcy Antonellis CEO of Vubiquity, Inc. Former President of Technical Operations and Chief Technology Officer of Warner Bros. Entertainment, Inc. |

|

✓ |

|

2015 | • Audit • Strategic Long-Range Planning | |||||||

| Carlos Sepulveda Chairman of the board of directors of Triumph Bancorp, Inc. Former President and Chief Executive Officer of Interstate Battery System international, Inc. |

|

✓ |

|

2007 | • Audit • Compensation • Strategic Long-Range Planning Lead Director | |||||||

| Mark Zoradi Chief Executive Officer Former President of Walt Disney Studios Motion Picture Group |

|

X |

|

2015 | • None | |||||||

| Item | ||||||||||||

|

Ratify Deloitte and Touche, LLP as our independent registered public accounting firm for 2021 | |||||||||||

| See page 34 | The Board recommends a vote FOR this item | |||||||||||

| ❖ Independent firm with reasonable fees and significant financial reporting expertise ❖ Deloitte and Touche has audited our consolidated financial statements annually since 1987 ❖ Audit Committee annually evaluates the independence of Deloitte and Touche and has determined that its appointment continues to be in the best interests of our stockholders | ||||||||||||

| Item | ||||||||||||

|

Non-binding, annual advisory vote on our executive compensation program | |||||||||||

| See page 34 | The Board recommends a vote FOR this item | |||||||||||

| ❖ Annual say-on-pay vote ❖ At the 2020 Annual Meeting, approximately 96% of votes cast were in favor of our executive compensation program ❖ The key elements of our executive compensation program remain unchanged ❖ Our compensation principles and practices promote pay-for-performance and align executive and stockholder interests ❖ Our 2020 executive compensation was reasonable, performance-centric and balanced, and discretion-based adjustments appropriate in light of the impact of the COVID-19 pandemic on the Company and employee compensation | ||||||||||||

|

2 |

CINEMARK PERFORMANCE DURING 2020

In February 2020, we reported our 2019 performance which was the fifth consecutive year of record results for Cinemark, with the North American industry celebrating the second-highest grossing box office of all-time. Additionally, our financial performance was tracking exceptionally well at the beginning of 2020. Driven by our Continuous Improvement program and our varied strategic initiatives, on relatively flat attendance, as of February 2020 year-to-date total worldwide revenue was up 5%, Adjusted EBITDA had increased approximately 16%, and our Adjusted EBITDA margin had expanded by nearly 200 basis points compared to the same time frame in 2019. While we expected to continue our industry-leading performance, the outbreak of the COVID-19 pandemic (COVID-19, COVID or pandemic) resulted in an unprecedented, devastating impact on our industry and our Company and we had to temporarily shift our strategy to focus primarily on cash preservation.

We temporarily closed all our theatres in the U.S. and Latin America effective March 17, 2020 and March 18, 2020, respectively, to comply with COVID related government mandates. In conjunction with the temporary closure of our theatres, we implemented various cash preservation plans such as reducing personnel and base salary, limiting non-essential operating and capital expenditures, suspending our quarterly dividend, and negotiating modified timing and/or abatement of contractual payments with landlords and other major suppliers until theatre reopenings. While we had reopened 217 of our domestic theatres and 129 of our international theatres as of December 31, 2020, we continue to work aggressively to navigate through the crisis. The demonstrated leadership of our global management team, led by Chairman and founder Lee Roy Mitchell and Chief Executive Officer (CEO) Mark Zoradi, in steering the Company during the pandemic is a testament to the team’s abilities and effectiveness as faithful stewards of the Company.

Listed below are some of the highlights of our achievements during 2020:

| • Rapid and extensive liquidity actions |

-Significantly limited non-essential spending, including temporary deep payroll cuts -Secured additional liquidity of approximately $860 million as of year-end through capital raising transactions and compensation related relief provided by COVID related legislation -Abated approximately $35 million of rent and deferred approximately $75 million of rent, in addition to other contractual payment obligations | |||

| • Workforce and contract restructuring |

-Initiated first ever Cinemark voluntary and involuntary workforce reduction program -Permanently closed 27 lower performing theatres -Workforce reduction and theatre closures together estimated to save the Company approximately $10 million annually in overhead costs -Extended payment terms of existing vendor contracts and temporarily eliminated minimum rent in a significant number of leases in Latin America | |||

| • Complex reopening of theatres |

-Organized a highly effective task force to strategically plan and execute theatre reopenings -Defined and implemented set of new industry-leading cleaning and safety protocols branded The Cinemark Standard | |||

| • Strategic Process Enhancements |

-Redesigned a wide range of operating procedures to align with market realities including showtime, operating hours, staffing, and food and beverage offerings -Developed a highly successful Private Watch Party concept | |||

| • Active communication plan |

-Performed extensive localized guest and public relations outreach to engage with guests and media throughout the pandemic -Used regular Company-wide town hall meetings with employees to stay connected and boost employee morale -Maintained 96% guest satisfaction with our health and safety protocols -Maintained 950+K Movie Club members consistent with pre-pandemic subscription membership

| |||

|

3 |

We also continued to be a leader in the industry, developing innovative ways of bringing our customers back to the movies and working closely with our peers and partners to reignite the movie exhibition business. Some of the ways Cinemark provided leadership during 2020 are provided below:

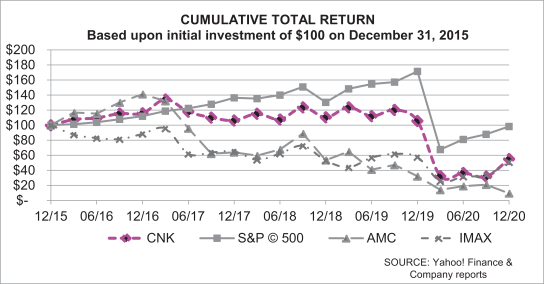

Our strength and resiliency has been tested this past year, but we have demonstrated our ability to operate with discipline and focus. We have a distinguished and consistent track record of performance and outperformance relative to our industry peers. We benchmark our financial performance against AMC Entertainment Holdings, Inc. (AMC) and IMAX Corporation (IMAX), the two other publicly-held companies in our industry with whom we compete for investor capital. The following graph sets forth the cumulative total shareholder return (assuming reinvestment of dividends) to Cinemark’s stockholders during the five-year period ended December 31, 2020, as well as the corresponding returns on an overall stock market index (S&P 500) and in each of AMC and IMAX.

|

4 |

BOARD LEADERSHIP AND SKILLS

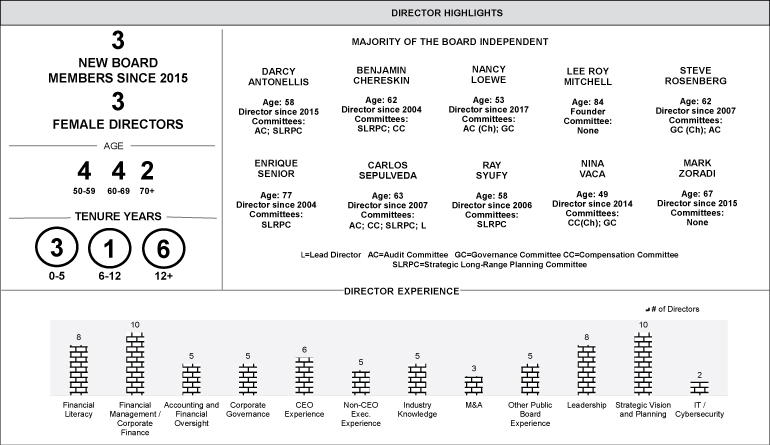

Our board of directors (Board) leadership structure promotes balance between independence, diversity, engaged oversight and extensive industry and operational expertise all of which drive value for Cinemark stockholders.

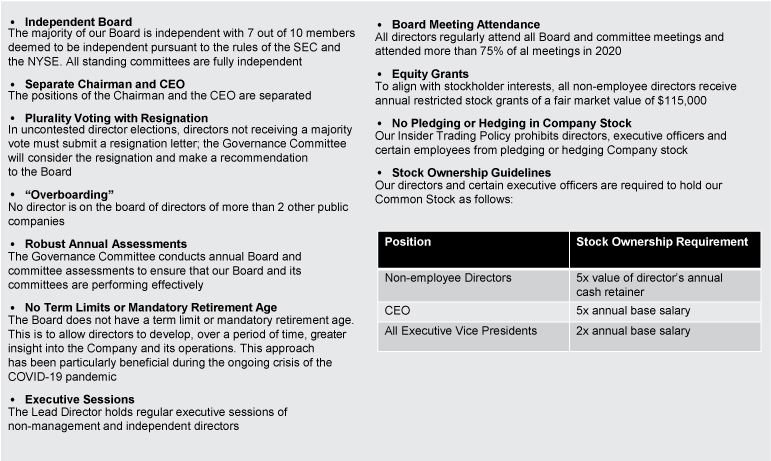

Principles of Corporate Governance

The Board has adopted Corporate Governance Guidelines and other corporate governance policies that relate to the composition, structure, interaction and operation of the Board. Copies of our Corporate Governance Guidelines and other governance documents can be found under the “Governance” tab of the “Investors” section of our website at https://ir.cinemark.com. You should review these documents for a complete understanding of these corporate governance practices, but some of the key elements of our strong governance policies and practices are summarized here:

|

5 |

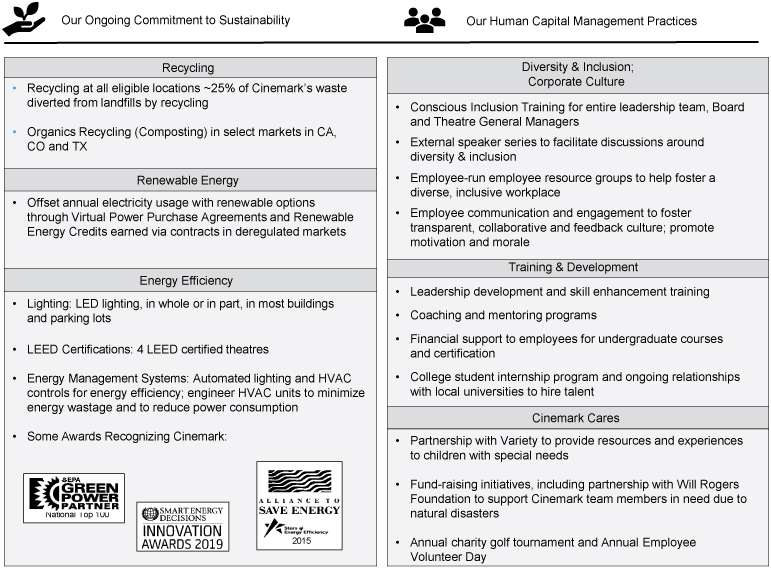

Environmental and Social Practices

Our corporate social responsibility practices are designed to help position Cinemark as an employer of choice to our existing and prospective employees, and a partner of choice in our communities. Though our practices are broad and will evolve over time, we are focused on our people and culture, community outreach and support, and environmental stewardship. Highlights of our current practices in these areas are described below.

|

6 |

|

7 |

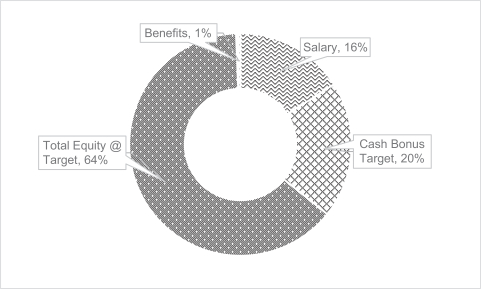

2020 Compensation Highlights

Executive compensation for 2020 was set by the Compensation Committee in February 2020, following Cinemark’s outstanding performance in 2019, and prior to the onset of the global COVID-19 pandemic. Given high stockholder approval, at 96%, for the Company’s executive compensation practices in 2019, the Compensation Committee did not make any material changes to the 2020 executive compensation program.

The business environment for our Company drastically changed beginning mid-March, with the start of the pandemic. This resulted in significant impacts on our employee compensation. Some of these effects were management implemented Company-wide base salary reductions for a period of approximately five months, negation of the Company’s short-term and long-term performance-metrics which determine a significant portion of our executive compensation payout, loss of dividend income, and loss of cash value of equity awarded as long-term incentive compensation due to depressed price of our Common Stock. Many members of our management team, including the named executive officers (NEOs), opted for deeper base salary reductions than was mandatory, with Messrs. Mitchell and Zoradi declining any base salary for four and two months, respectively. Our Board members also opted to forego their cash retainers for the second quarter of 2020.

Despite the very challenging business conditions, Cinemark has demonstrated its resilience, innovation and leadership as it has navigated the pandemic. This was possible because of the strategic leadership of our executive management team and incredible hard work and dedication of all our employees. Therefore, to retain, motivate and reward employees for their performance, and to compensate them for their lost pay, the Compensation Committee made certain discretion-based decisions through the year regarding equity awards and vesting. These decisions followed our core compensation objectives and served the best interests of the stockholders by ensuring the Company’s continued operation, innovation, and strategic leadership, while preserving cash and leveraging certain compensation related relief provided by COVID related legislation. The table below tracks the compensation events of 2020, both as part of the annual process as well as those driven by the pandemic.

| Month | All Employees | CEO/Other NEOs/Board Members | ||

| Annual Grant | ||||

| February |

• Compensation Committee approves, for the first-time, time-based restricted stock grant with 1-year vest for all corporate employees and certain field employees, who are not typically covered under the annual grant cycle (E20 Grant); annual grant cycle for covered employees, domestic and international |

• Compensation Committee approves 2020 base salary, cash bonus percentage, target incentive compensation for all NEOs as part of the annual grant cycle • Compensation Committee sets Company targets for performance metrics for 2020 | ||

| IMPACT OF COVID-19 ON EMPLOYEE COMPENSATION | ||||

| Base Salary Reductions To | ||||

| April |

• 20% for furloughed employees • 65% for non-furloughed corporate employees • 50% for all theatre general managers • 30% to 60% for international employees, percentage varying by country • Retention grant of time-based restricted stock for small group of critical employees |

• 50% for all NEOs • Board members opt to receive no cash retainer for the second quarter | ||

| Further Base Salary Reductions To | ||||

|

May |

• 50% for non-furloughed corporate employees • Annual grant cycle for theatre general managers |

• 0% for Messrs. Mitchell and Zoradi • 20% for Messrs. Gamble, Cavalier and Fernandes | ||

|

8 |

| Month | All Employees | CEO/Other NEOs/Board Members | ||

| Base Salary Reinstatement To | ||||

| July |

• 80% for non-furloughed corporate employees and field employees |

• 0% for Mr. Mitchell • 50% for Mr. Zoradi • 80% for Messrs. Gamble, Cavalier and Fernandes | ||

| Retention Equity Grant | ||||

| August |

Compensation Committee approves retention grants of restricted stock for all corporate employees, including NEOs (except Mr. Mitchell), and theatre general managers. The restricted stock will vest 100% in August 2022 | |||

| Base Salary Reinstatement To | ||||

| September |

• All corporate employees, including all NEOs, and theatre general managers of theatres reopened, begin receiving 100% of base salary; theatre general managers of theatres closed continue to receive 80% of base salary; international employees begin receiving 80% of base salary • Board members begin receiving cash retainers | |||

| Bonus Equity Grant and Accelerated Vests | ||||

|

December |

• Compensation Committee approves a stock bonus grant to all domestic bonus-eligible employees. The shares of Common Stock vested immediately for all grantees except for the NEOs for whom the shares are restricted with a one-year vest. • Compensation Committee approves accelerated vest of restricted stock scheduled to vest on or before May 2021, and certified performance shares due to vest in February 2021 for all domestic grantees | |||

The following summary provides an overview of the executive compensation set in February 2020 and how it was impacted by the compensation decisions described above. For a detailed discussion, see Compensation Discussion and Analysis (CD&A) beginning on page 35.

Base Salary:

As part of the annual compensation review, in February 2020, the Compensation Committee made adjustments to the base salaries of the NEOs on the basis of factors such as market comparables, executive’s evolving role within the Company and retention. The 2020 base salaries that were set in February 2020 including the variances from 2019, and the actual base salaries earned by the NEOs during 2020 with the percentage loss due to the COVID related pay reductions were as follows:

| Name | 2020 Base Salary Approved |

Change from 2019 |

Actual Base Salary Received Due to |

Percentage Loss of Base

| ||||||||

| Lee Roy Mitchell |

$ | 1,020,001 | Up 2.0% | $ | 589,394 | 42.2% | ||||||

| Mark Zoradi |

$ | 1,100,000 | No change | $ | 740,632 | 32.7% | ||||||

| Sean Gamble |

$ | 660,000 | Up 5.6% | $ | 521,435 | 21.0% | ||||||

| Michael Cavalier |

$ | 555,012 | Up 2.8% | $ | 440,923 | 20.6% | ||||||

| Valmir Fernandes |

$ | 555,012 | Up 2.8% | $ | 441,633 | 20.4% | ||||||

|

9 |

Cash Bonus:

In February 2020, the Compensation Committee set (i) the target cash bonus opportunity as a percentage of base salary for each NEO and (ii) the Adjusted EBITDA target for purposes of determining the annual cash bonus payout for the year.

Mr. Gamble’s target opportunity was raised from 90% for 2019 to 100% for 2020 based on market norms, internal pay equity and his increased role and responsibilities within the Company. The cash bonus target opportunities for Messrs. Mitchell, Zoradi, Cavalier and Fernandes remained the same as 2019.

The Adjusted EBITDA targets for the cash bonus payouts were set at $542 million for domestic, $104 million for international and $646 million for worldwide results. Given the devastating impact of the COVID-19 pandemic on our Company, including circuit-wide closures both in the U.S. as well as in Latin America for a significant part of the year, the Company could not meet the Adjusted EBITDA targets. Consequently, at year-end the Compensation Committee did not approve any cash bonus payouts for 2020. However, the Compensation Committee made discretion-based equity awards equal in value to a certain percentage of the bonus-eligible employee’s cash bonus target (Bonus Equity Grant). See discussion under Discretion-based Incentive Awards Due to the Impact of COVID-19 for details regarding the Bonus Equity Grant.

The individual targets (as a percentage of base salary) for 2020 and 2019, expected target cash bonus for the year as set in February 2020 for each NEO, and the actual cash bonus earned for 2020 by each NEO was as follows:

|

Name |

Target Cash Bonus (Percentage of Base Salary)

|

Expected Target Cash |

Actual Cash |

|||||||||

| 2020 | 2019 | |||||||||||

| Lee Roy Mitchell | 100% | 100% | $ | 1,020,001 | $ | 0 | ||||||

| Mark Zoradi | 125% | 125% | $ | 1,375,000 | $ | 0 | ||||||

| Sean Gamble | 100% | 90% | $ | 660,000 | $ | 0 | ||||||

| Michael Cavalier | 90% | 90% | $ | 499,511 | $ | 0 | ||||||

| Valmir Fernandes | 90% | 90% | $ | 499,511 | $ | 0 | ||||||

Long-term Incentive Compensation:

Consistent with our compensation philosophy of driving performance, in February 2020, the Compensation Committee raised the target values of the long-term equity incentive compensation for Messrs. Zoradi and Gamble. These calibrations were deemed appropriate based on market comparables and the roles of these executives as the principal architects and drivers of the Company’s strategic growth.

The split between performance-based and time-based awards remained the same as in 2019 for all NEOs.

The target values of the long-term equity compensation for each of the NEOs for 2020 as compared to 2019 and the split between the performance-based and time-based awards were as follows:

| Name |

Target Long-term Equity (Percentage of Base Salary)

|

Split Between Performance-based and Time-based Awards | ||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Lee Roy Mitchell | N/A | N/A | N/A | N/A | ||||||||||||||||

| Mark Zoradi | 400% | 275% | 75% | 25% | ||||||||||||||||

| Sean Gamble | 180% | 175% | 60% | 40% | ||||||||||||||||

| Michael Cavalier | 150% | 150% | 60% | 40% | ||||||||||||||||

| Valmir Fernandes | 125% | 125% | 60% | 40% | ||||||||||||||||

Discretion-based Incentive Awards Due to the Impact of COVID-19:

The Company’s business performance metrics for 2020 were severely impacted, beyond predictability or control, by the COVID-19 pandemic. However, the Company demonstrated its resilience and leadership through exceptional organization, strategic planning and execution of operational efficiencies and business innovations that allowed it to

|

10 |

evolve and persevere in an unpredictable, ever-changing environment. To ensure the Company’s continued performance and recovery during uncertain and challenging business conditions, the Compensation Committee made certain discretion-based equity related decisions for purposes of employee retention, motivation and reward for performance, dedication and their hard work during the pandemic. These discretion-based decisions allowed the Company to appropriately address the above needs while preserving cash and leveraging certain compensation related relief provided by COVID related legislation. None of the discretion-based decisions were exclusive to the NEOs but were applicable to larger groups of employees based on the nature of the grant.

The discretion-based compensation decisions were as follows:

Retention Equity Grant: In April, the Compensation Committee approved time-based restricted stock grants to a small group of critical employees who management believed were essential to manage the sudden business crisis brought about by the pandemic. The NEOs did not receive any retention grant in April.

In August, the Compensation Committee again reviewed employee retention concerns with management in light of significant loss of cash compensation due to salary reductions over approximately five months, potential loss of cash bonus payout for the year for bonus-eligible employees, reduction in the value of our Common Stock due to depressed stock price and the loss of dividend income. To address concerns regarding the prolonged and continued impact of COVID-19 on the industry and the Company, the Compensation Committee deemed it to be in the Company’s best interest to review certain options to address the base salary loss of all employees without impacting the Company’s cash reserves. Based on this review, the Compensation Committee determined that it would be prudent to utilize time-based restricted stock as an effective retention tool (Retention Equity Grant). All corporate employees, including the NEOs, and theatre general managers received Retention Equity Grants. The values of the Retention Equity Grants were calculated using base pay multipliers corresponding to the pay grades of the employees. Mr. Mitchell did not receive any Retention Equity Grant.

The Retention Equity Grants will vest 100% in August 2022. The respective loss in pay and the estimated fair market value of the Retention Equity Grant for each NEO was as follows:

|

Name |

Loss in Pay Amount |

Fair Market Value of

| ||

| Lee Roy Mitchell |

N/A | N/A | ||

| Mark Zoradi |

$ 359,368 | $ 329,997 | ||

| Sean Gamble |

$ 138,565 | $ 138,596 | ||

| Michael Cavalier |

$ 114,089 | $ 116,549 | ||

| Valmir Fernandes |

$ 113,379 | $ 116,549 | ||

See Grants of Plan-Based Awards in 2020 table on page 57 for the number of shares granted to the NEOs as Retention Equity Grant.

Bonus Equity Grant: In December, the Compensation Committee determined there would be no cash bonus payouts for 2020, but it also recognized the Company’s achievements, employee performance and strong management leadership in an exceptionally difficult business environment. Therefore, to compensate employees for their performance while preserving liquidity, the Compensation Committee made the discretion-based decision to award equity. The Compensation Committee believes the Bonus Equity Grant appropriately serves the long-term interests of the stockholders in terms of rewarding employees for performance and motivating and retaining them for continued value creation. Under the Bonus Equity Grant program, all bonus-eligible employees received immediately vested shares of Common Stock, the value of which was based, depending on the employee’s performance, within a range of 75% to 90% of the individual’s target cash bonus. The shares awarded under the Bonus Equity Grant vested immediately for all grantees, except for the NEOs for whom the award was time-based restricted stock grants with a vest period of one year from the date of grant. The NEOs (including Mr. Mitchell) received a stock grant with a fair market value of 75% of each of their respective target cash bonus opportunity. The Bonus Equity Grants for the NEOs will vest in December 2021.

|

11 |

The projected cash bonus target set in February 2020 and the fair market value of the Bonus Equity Grant for each NEO was as follows:

|

Name |

Projected Target |

Fair Market Value of Bonus | ||

| Lee Roy Mitchell |

$ 1,020,001 | $ 764,998 | ||

| Mark Zoradi |

$ 1,375,000 | $ 1,031,239 | ||

| Sean Gamble |

$ 660,000 | $ 494,990 | ||

| Michael Cavalier |

$ 499,511 | $ 374,618 | ||

| Valmir Fernandes |

$ 499,511 | $ 374,618 | ||

See Grants of Plan-Based Awards in 2020 table on page 57 for the number of shares granted to the NEOs as Bonus Equity Grant.

Accelerated Vests: In December, in addition to the Bonus Equity Grant, the Compensation Committee decided to accelerate the vests of certain equity awards granted in 2017 and 2019. These accelerated vests were deemed to be in the best interest of the Company as they provided employees with an additional source of compensation at year-end which helped motivate and reward employees for their performance while conserving cash and allowing the Company to leverage certain compensation related relief provided by COVID related legislation. The accelerated vests were as follows:

| A. | All time-based restricted shares that were due to vest on or before May 2021, were accelerated to vest in December 2020. This decision impacted all employees, included those who received restricted shares for the first time in February 2020. See table on page 8. For the NEOs, these restricted shares were (i) the remaining 50% of the restricted shares granted in February 2017 and (ii) 50% of the restricted shares granted in February 2019. |

| B. | Performance-based restricted stock units granted in 2017 (2017 RSU) to all NEOs and certain other key employees, were also accelerated to vest in December 2020. The 2017 RSUs were certified by the Compensation Committee in February 2019 to vest at 96% of target and were due to vest in February 2021 after the satisfaction of the additional two-year service period. |

See Stock Option Exercises and Stock Vested in 2020 table on page 60 for number of shares of Common Stock realized upon vesting of all long-term incentive compensation during 2020. See Beneficial Ownership Table on page 68 for the total ownership numbers as of December 31, 2020.

Certification of the 2019 and 2020 performance-based awards: In February 2021, the Compensation Committee evaluated the impact of the pandemic on the Internal Rate of Return (IRR), the metric used to determine the vest of the performance-based equity compensation granted in February 2019 and 2020 (2019 and 2020 RSU Grants). Given the projected continuation of the macroeconomic conditions through 2021 and beyond, and the uncertain timing as to the recovery of our industry to a pre-COVID state, the Compensation Committee made a discretion-based decision to certify the vest of the 2019 and 2020 RSU Grants at target. See page 50 for a summary of other 2021 compensation related decisions.

|

12 |

The Board is soliciting proxies in connection with the Annual Meeting (and any adjournment thereof) to be held virtually on May 20, 2021 at 9 a.m. CDT. The approximate date on which this proxy statement and the enclosed proxy are first being sent to stockholders is April 2, 2021.

SHARES OUTSTANDING AND VOTING RIGHTS

As of the Record Date, 119,539,989 shares of common stock, par value $0.001 per share (Common Stock) of the Company were outstanding. The Common Stock constitutes the only class of voting securities of the Company. Only stockholders of record as of the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting. Holders of Common Stock are entitled to one vote for each share so held.

The majority of our Board is independent and is currently comprised of 10 members. The size of the Board may be fixed from time to time exclusively by our Board as provided in our Certificate of Incorporation. Our Certificate of Incorporation also provides that our Board consists of three classes of directors, designated as Class I, Class II and Class III. The members of each class are elected to serve a three-year term, with the terms of office of each class ending in successive years.

ITEM ONE — ELECTION OF THREE CLASS II DIRECTORS

The terms of the current Class II directors, Mme. Antonellis and Messrs. Sepulveda and Zoradi expire at the Annual Meeting. All nominees have been recommended by the Nominating and Corporate Governance Committee (Governance Committee) and nominated by the Board for election at the Annual Meeting.

Each of Mme. Antonellis and Messrs. Sepulveda and Zoradi has consented to be nominated for re-election to the Board as a Class II director. If elected, they will serve on the Board for a three-year term expiring on the date of our 2024 annual meeting of stockholders. At this time, we have no reason to believe that any nominee will be unable or unwilling to serve if elected. However, should any of them become unavailable or unwilling to serve before the Annual Meeting, your proxy card authorizes us to vote for a replacement nominee if the Board names one.

|

13 |

|

CLASS II DIRECTOR NOMINEES

|

|

Darcy Antonellis

| ||||

|

Director Since: 2015

Nominee of: Board

Board Committees: Audit Committee; Strategic Long-Range Planning Committee

Age: 58

Other Public Company Boards: 1

|

Skills and Qualifications

• Current CEO and previous executive experience • Critical technology and cybersecurity experience • Accounting and financial management expertise

Other Current Board Experience

• Xperi

Previous Board Experience

• Not Applicable

|

Professional Highlights

Since January 2014, Ms. Antonellis has been the CEO of Vubiquity, Inc., a subsidiary of Amdocs Inc. (NASDAQ: DOX), a leading software, services provider to communications and media companies. From June 1998 until December 2013, Ms. Antonellis held numerous positions at Warner Bros. Entertainment Inc., (a Time Warner company) including President of Technical Operations and Chief Technology Officer.

| ||

|

| ||||

|

Carlos Sepulveda

| ||||

|

Director Since: 2007

Nominee of: Mitchell Investors

Board Committees: Audit Committee; Compensation Committee; Strategic Long-Range Planning Committee

Lead Director

Age: 63

Other Public Company Boards: 1

|

Skills and Qualifications

• Extensive public accounting experience; certified public accountant • CEO and executive experience • Strong accounting and financial oversight experience, strategic planning and management expertise

Other Current Board Experience

• Triumph Bancorp, Inc.

Previous Board Experience

• Matador Resources Company |

Professional Highlights

Since May 2010, Mr. Sepulveda has been the Chairman of the board of directors of Triumph Bancorp, Inc. (Triumph Bancorp, NASDAQ: TBK), financial services company providing community banking, national lending and commercial finance. Prior to Triumph Bancorp, Mr. Sepulveda was the President and CEO of Interstate Battery System International, Inc. (Interstate Battery), a seller of automotive and commercial batteries, from March 2004 until April 2013 and its Executive Vice President from 1993 until March 2004. Prior to joining Interstate Battery, Mr. Sepulveda was an audit partner with the accounting firm of KPMG Peat Marwick in Austin, New York and San Francisco for 11 years.

| ||

|

14 |

|

Mark Zoradi

| ||||

|

Director Since: 2015

Nominee of: Board

Board Committees: None

Age: 67

Other Public Company Boards: 1

|

Skills and Qualifications

• Veteran motion picture executive with a background in distribution • Wealth of knowledge regarding strategic partnerships within the exhibition industry and exhibitor relationships with movie studios • Management and oversight experience at large public companies within the industry

Other Current Board Experience

• National CineMedia, Inc.

Previous Board Experience

• Not Applicable |

Professional Highlights

Since August 2015, Mr. Zoradi has served as our CEO. Mr. Zoradi spent 30 years at The Walt Disney Company, a major motion picture studio, including serving as the President of Walt Disney Studios Motion Picture Group. Prior to that, Mr. Zoradi served in a variety of positions of increasing responsibility with The Walt Disney company, including as the General Manager of Buena Vista Television and President of Buena Vista International with responsibility for the international theatrical and home entertainment marketing and distribution of Disney, Touchstone and Pixar films. Mr. Zoradi also served as the President and Chief Operating Officer (COO) of Dick Cook Studios from January 2011 until July 2014 and the COO of Dreamworks Animation SKG, Inc. from August 2014 until January 2015.

| ||

|

OUR BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR ELECTION OF EACH CLASS II NOMINEE

|

|

15 |

| CLASS III DIRECTORS TERM EXPIRING 2022 |

||||

|

Benjamin Chereskin

| ||||

|

Director Since: 2004

Nominee of: Board

Board Committees: Compensation Committee; Strategic Long-Range Planning Committee (Chair)

Age: 62

Other Public Company Boards: 1

|

Skills and Qualifications

• Strategic planning and finance growth opportunities • Extensive knowledge and experience in corporate finance, mergers and acquisitions • Executive compensation experience

Other Current Board Experience

• CDW, Corporation

Previous Board Experience

• Boulder Brands, Inc.

|

Professional Highlights

Mr. Chereskin is President of Profile Capital Management LLC (Profile Management), an investment management firm, which he founded in October 2009. Prior to founding Profile Management, Mr. Chereskin was a Managing Director and Member of Madison Dearborn Partners, LLC, a private equity firm, from 1993 until October 2009, having co-founded the firm in 1993.

| ||

|

Lee Roy Mitchell

| ||||

|

Founder

Nominee of: Mitchell Investors

Board Committees: None

Age: 84

Other Public Company Boards: 0

|

Skills and Qualifications

• Depth of experience in the motion picture industry • Long-term historic industry perspective • Leadership experience, including past memberships on public company boards

Other Current Board Experience

• Not Applicable

Previous Board Experience

• National CineMedia, Inc.

|

Professional Highlights

Mr. Mitchell is the founder of the Company. He has served as Chairman of the Board since March 1996 and as a director since our inception in 1987. Mr. Mitchell has been engaged in the motion picture exhibition business for over 50 years. His depth of experience in the motion picture industry has been invaluable to the Board. Additionally, Mr. Mitchell brings a long-term historic industry perspective and leadership experience to the Board.

| ||

|

16 |

|

Ray Syufy

| ||||

|

Director Since: 2006

Nominee of: Board

Board Committees: Strategic Long-Range Planning Committee

Age: 58

Other Public Company Boards: None

|

Skills and Qualifications

• Deep knowledge of the motion picture industry • Strategic planning expertise, particularly with respect to competition from other forms of entertainment • Operational expertise

Other Current Board Experience

• Not Applicable

Previous Board Experience

• Not Applicable |

Professional Highlights

Mr. Syufy began working for Century Theatres, Inc. (Century Theatres), a regional movie exhibitor, in 1977, and held positions in each of the major departments within Century Theatres. In 1994, Mr. Syufy was named President of Century Theatres and was later appointed CEO and Chairman of the board of directors of Century Theatres. Mr. Syufy resigned as an officer and director of Century Theatres upon the consummation of our acquisition of Century Theatres in 2006. Since then, Mr. Syufy has presided as CEO of Syufy Enterprises, Inc. (Syufy Enterprises) a retail and real estate holding company with operations in California, Nevada, Arizona, Colorado, and Texas.

| ||

|

17 |

|

CLASS I DIRECTORS

|

|

Nancy Loewe

| ||||

|

Director Since: 2017

Nominee of: Board

Board Committees: Audit Committee (Chair and Financial Expert); Governance Committee

Age: 53

Other Public Company Boards: 0

|

Skills and Qualifications

• Accounting and financial management expertise • Risk oversight experience • Previous management and oversight experience at large public companies • Management and executive experience

Other Current Board Experience

• Not Applicable

Previous Board Experience

• Not Applicable

|

Professional Highlights

Ms. Loewe has been the Chief Financial Officer (CFO) of Weyerhaueser Company, one of the world’s largest private owners of timberlands, since 2021. Prior to that, Ms. Loewe was a Senior Vice-President - Finance of Visa, Inc. (Visa), a multinational financial services corporation, since March 2019. Prior to Visa, Ms. Loewe served as the CFO for Kimberly-Clark International and prior to that she was the Chief Strategy Officer and Global Treasurer for Kimberly-Clark Corporation, a multinational personal care corporation. She has also served as Vice President and CFO of Frito Lay North America. Additionally, Ms. Loewe held numerous positions during her 20-year tenure at GE, inside and outside the U.S., including Vice President - Strategic Transactions & Cash, as well as CFO for varying business units, such as Plastics Asia, Healthcare, and Consumer & Industrial.

| ||

|

18 |

|

Steven Rosenberg

| ||||

|

Director Since: 2008

Nominee of: Board

Board Committees: Governance Committee (Chair)

Age: 62

Other Public Company Boards: 1

|

Skills and Qualifications

• Risk management, board governance and general management expertise • Accounting and financial management expertise • Management experience

Other Current Board Experience

• Texas Capital Bancshares, Inc.

Previous Board Experience

• Not Applicable

|

Professional Highlights

Mr. Rosenberg is the Manager of SPR Ventures Inc., a private investment firm he founded in 1997. He was the President of SPR Packaging LLC, a manufacturer of flexible packaging, from 2006 to 2018.

| ||

|

Enrique Senior

| ||||

|

Director Since: 2004

Nominee of: Board

Board Committees: Strategic Long-Range Planning Committee

Age: 77

Other Public Company Boards: 2

|

Skills and Qualifications

• Extensive knowledge of film, media and entertainment, and beverage industries • Strong strategic planning and management expertise • Executive experience

Other Current Board Experience

• Group Televisa S.A.B.; Coca-Cola FEMSA, S.A.

Previous Board Experience

• Not Applicable

|

Professional Highlights

Mr. Senior is a Managing Director of Allen & Company LLC, a boutique investment bank, and has been employed by the firm since 1972. He has served as a financial advisor to several corporations including Coca-Cola Company, General Electric, CapCities/ABC, Columbia Pictures and QVC Networks.

| ||

|

19 |

|

Nina Vaca | ||||

|

Director Since: 2014

Nominee of: Board

Board Committees: Governance Committee; Compensation Committee (Chair);

Age: 49

Other Public Company Boards: 1

|

Skills and Qualifications

• Wealth of leadership and business experience particularly with regards to information technology and e-commerce • Governance and executive compensation knowledge • Management and executive experience

Other Current Board Experience

• Comerica, Inc.

Previous Board Experience

• Kohls, Corp.

|

Professional Highlights

Ms. Vaca is the founder, Chairman and CEO of the Pinnacle Group of companies, including Pinnacle Technical Resources, Inc. (together, Pinnacle) and Vaca Industries, Inc. Founded in 1996, Pinnacle is an information technology services and solutions provider.

| ||

NOMINATIONS FOR ELECTION TO THE BOARD

Our Governance Committee is responsible for identifying and recommending director candidates to our Board for nomination. This is an ongoing process through which the Board has added three new directors – Mmes. Antonellis and Loewe and Mr. Zoradi - since 2015. These directors have not only added to the Board’s portfolio of skills in finance, accounting, leadership experience and industry knowledge but have also particularly supplemented the experience in the information technology and cybersecurity areas.

Although the Board retains ultimate responsibility for approving candidates for election, the Governance Committee conducts the initial screening and evaluation. The Governance Committee has not established any minimum qualifications that must be met by a director candidate or identified any set of specific qualities or skills that it deems to be mandatory. Based on the director qualifications discussed under Board Diversity and Director Qualifications, the Governance Committee’s goal is to maintain a mix of different viewpoints such that the Company benefits from the fresh perspectives brought by new directors and the institutional knowledge and industry insights of directors having longer experience on our Board. The Governance Committee’s policy regarding consideration of potential director nominees acknowledges that choosing a director is dependent upon a number of subjective and objective criteria many of which are difficult to categorize. The Governance Committee considers candidates recommended by current directors, management, third party search firms engaged by the Governance Committee, and stockholders. Under the director nomination agreement which we entered into on April 9, 2007 with certain of our then current stockholders (Director Nomination Agreement), the Mitchell Investors (as defined in the Director Nomination Agreement) have a right to designate two nominees to the Board. Mr. Sepulveda is a nominee of the Mitchell Investors. All candidates, including candidates recommended by stockholders, are evaluated on the basis of the same criteria. Stockholders who wish to recommend a candidate to the Governance Committee or submit nominees for election at the 2022 annual meeting should follow the instructions on page 74.

Lead Independent Director

Mr. Sepulveda serves as the Board’s Lead Independent Director (Lead Director). The Lead Director has the authority to preside at all meetings of the Board at which the Chairman is not present, including executive sessions of the

|

20 |

non-management directors and has the authority to call meetings of the non-management directors. The Lead Director serves as principal liaison between the non-management directors and Company management. In consultation with the Chairman and the CEO, the Lead Director approves meeting schedules and agendas and the information provided to the Board. If requested by stockholders and as appropriate, the Lead Director will also be available, as the Board’s liaison, for consultation and direct communication.

Separation of Chairman and CEO Roles

Although the Board does not have a formal policy on separation of the roles of the CEO and Chairman, we have kept these positions separate since 2007. Separating the Chairman and CEO roles allows us to develop and implement corporate strategy that is consistent with the Board’s oversight role, while facilitating strong day-to-day executive leadership. Mr. Mitchell provides leadership to the Board by chairing meetings, organizing directors and facilitating Board deliberations. His in-depth knowledge of the motion picture industry for more than five decades and his long-standing relationships within the industry provide the Board an invaluable resource and leadership particularly in the area of strategic initiatives, including evaluating new diversification and growth opportunities.

The Board believes that its leadership structure is appropriate for Cinemark. Through the role of the Lead Director, the independence of the Board’s standing committees, and the regular use of executive sessions of the non-management directors, the Board is able to maintain independent oversight of risks to our business, our long-term strategies, annual operating plan, and other corporate activities. These features, together with the role and responsibilities of the Lead Director described above, ensure a full and free discussion of issues that are important to Cinemark’s stockholders. At the same time, the Board is able to take advantage of the unique blend of leadership, experience and knowledge of our industry and business that Mr. Mitchell and Mr. Zoradi separately bring to the table.

The majority of our Board is independent with 7 out of 10 directors being independent. We comply with the independence requirements of the New York Stock Exchange (NYSE) listing standards. The test for independence under the NYSE listing standards is whether the director

1. is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company;

2. has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service);

3. (a) is a current partner or employee that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such firm and personally works on the Company’s audit; or (d) is or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;

4. is, or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or has served on that company’s compensation committee; or

5. is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues.

|

21 |

The Board in coordination with our Governance Committee, and assistance of the Company’s general counsel, followed the NYSE bright-line tests and considered the transactions reported under the Certain Relationships and Related Party Transactions to determine the independence of the Board members. On the basis of this review, the Board affirmatively determined, in its business judgment, that (a) the majority of the Board was, and continues to be, independent, (b) each of Mmes. Antonellis, Loewe and Vaca and Messrs. Chereskin, Rosenberg, Senior and Sepulveda are independent, (c) Messrs. Mitchell and Syufy are not independent due to their transactions with the Company exceeding $120,000 annually, (d) Messrs. Mitchell and Zoradi are not independent because they are employees of the Company, (e) each of Mmes. Antonellis and Loewe and Messrs. Rosenberg and Sepulveda meet all applicable requirements for membership in the Audit Committee, (f) Ms. Loewe and Mr. Sepulveda qualify as “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC and satisfy the NYSE’s financial experience requirements, and (g) each of Ms. Vaca and Messrs. Chereskin and Sepulveda meet all applicable requirements for membership in the Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our Board has adopted a written policy supplementing our Code of Business Conduct and Ethics relating to the review, approval and ratification of transactions between us and “related parties” as generally defined by applicable rules under the Securities Act of 1933, as amended. The policy covers any related party transaction in which the amount involved exceeds $120,000. Our Board has determined that the Audit Committee is best suited to review and approve related party transactions, although in certain circumstances the Board may determine that a particular related party transaction be reviewed and approved by a majority of disinterested directors. In reviewing and approving a related party transaction, the Audit Committee, after satisfying itself that it has received all material information regarding the related party transaction under review, shall approve based upon the determination whether the transaction is fair and in the best interest of the Company.

Management presents any proposed related party transaction at an Audit Committee meeting for review and approval. If management becomes aware of a proposed or existing related party transaction that has not been presented or pre-approved by the Audit Committee, management shall promptly notify the Chair of the Audit Committee who shall submit such related party transaction to the full Audit Committee for approval or ratification, if the Audit Committee determines that such transaction is fair to the Company. If management, in consultation with our CEO, CFO or General Counsel determines that it is not practicable to wait until the next Audit Committee meeting, the Chair of the Audit Committee has been delegated the authority to review, consider and approve any such transaction. In such event, the Chair of the Audit Committee shall report any related party transaction approved by him or her at the next Audit Committee meeting. The Audit Committee may establish guidelines it determines as necessary and appropriate for management to follow in dealings with related parties and related party transactions. The procedures followed in considering a related party transaction are evidenced in the resolutions and minutes of the meetings of the Audit Committee or Board, as applicable.

The Company has the following related party transactions with Mr. Mitchell and Mr. Syufy.

Laredo Theatre

We manage theatres for Laredo Theatre, Ltd., (Laredo). We are the sole general partner and own 75% of the limited partnership interests of Laredo. Lone Star Theatres, Inc. (Lone Star) owns the remaining 25% of the limited partnership interests in Laredo and is 100% owned by Mr. David Roberts, Lee Roy Mitchell’s son-in-law. Under the agreement, management fees are paid by Laredo to us at a rate of 5% of annual theatre revenues up to $50 million and 3% of annual theatre revenues in excess of $50 million. We recorded approximately $0.15 million of management fee revenue from Laredo during 2020. As the sole general partner and the majority limited partner of Laredo, we control the affairs of the limited partnership and have the rights to dissolve the partnership or sell the theatres. We also have a license agreement with Laredo permitting Laredo to use the “Cinemark” service mark, name and corresponding logos and insignias in Laredo, Texas.

|

22 |

Copper Beech LLC

Effective September 2, 2009, Cinemark USA, Inc. (CUSA), a wholly-owned subsidiary of the Company, entered into an Aircraft Time Sharing Agreement (Aircraft Agreement), with Copper Beech Capital, LLC, a Texas limited liability company (Operator), for the use of an aircraft and flight crew on a time sharing basis. Lee Roy Mitchell, our Chairman of the Board, and his wife, Tandy Mitchell own the membership interests of the Operator. Prior to the execution of the Aircraft Agreement, the Company had an informal agreement with the Operator to use, on occasion, a private aircraft owned by the Operator. The private aircraft is used by Mr. Mitchell and other executives who accompany Mr. Mitchell to business meetings for the Company. The Aircraft Agreement specifies the maximum amount that the Operator can charge the Company under the applicable regulations of the Federal Aviation Administration for the use of the aircraft and flight crew. The Company pays the Operator the direct costs and expenses related to fuel, pilots, landing fees, storage fees, insurance obtained for the specific flight, flight planning, weather contract services and expenses such as in-flight food and beverage services and passenger ground transportation incurred during a trip. For 2020, the aggregate amounts paid to Copper Beech LLC for the use of the aircraft was approximately $10,000.

FE Concepts, LLC

The Company, through its wholly-owned indirect subsidiary CNMK Texas Properties, LLC, formed a joint venture, FE Concepts, LLC (FE Concepts), with AWSR Investments, LLC (AWSR), an entity owned by Lee Roy Mitchell and Tandy Mitchell. FE Concepts operates a family entertainment center that offers bowling, gaming, movies and other amenities. The Company and AWSR each invested approximately $20.0 million and each have a 50% voting interest in FE Concepts. The Company has a theatre services agreement with FE Concepts under which the Company receives management fees for providing film booking and equipment monitoring services for the facility. The Company recorded $0.34 million of management service fees during the year ended December 31, 2020.

Family Relationships

Walter Hebert III, brother-in-law of Mr. Mitchell, is the Executive Vice President – Purchasing of the Company. Mr. Hebert received a total compensation of $519,860 for 2020. Such amount included base salary of $244,624, fair market value of annual restricted stock grant of $114,980, cash value of retention grant of $43,122, cash value of bonus equity of $86,240, and all other compensation of $30,894.

Tandy Mitchell, wife of Mr. Mitchell, participated in the voluntary workforce reduction program and is no longer an employee of the Company. Ms. Mitchell’s compensation for 2020 was $145,875.

Century Theatres

Our subsidiary, Century Theatres, currently leases 14 theatres and one parking facility from Syufy Enterprises or affiliates of Syufy Enterprises. Raymond Syufy, one of our directors, is an officer of the general partner of Syufy Enterprises. All of the leases except one have fixed minimum annual rent. The remaining lease has rent based upon a specified percentage of gross sales as defined in the lease with no minimum annual rent. For 2020, we paid approximately $24 million in rent for these leases. Since 2019, we began providing digital equipment support to drive-in theatres owned by Syufy Enterprises. We recorded $0 of management fees related to these services during 2020.

Director Nomination Agreement

Under the Director Nomination Agreement which we entered into on April 9, 2007 with certain of our then current stockholders, the Mitchell Investors (as defined in the Director Nomination Agreement) have a right to designate two nominees to the Board and Messrs. Mitchell (Class III) and Sepulveda (Class II) are its current nominees.

|

23 |

BOARD DIVERSITY AND DIRECTOR QUALIFICATIONS

Our Corporate Governance Guidelines contain Board membership criteria which are set as broad tenets rather than as specific weighted criteria. To carry out its responsibilities and set the appropriate tone at the top, our Board is keenly focused on its leadership structure, and the character, integrity, and qualifications of its members. Our directors have a proven record of accomplishment and an ability to exercise sound and independent judgment in a collegial manner.

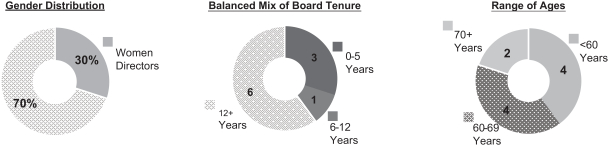

Our Board does not have a formal diversity policy. It broadly construes diversity to mean diversity of backgrounds, experience, qualifications, skills, age and expertise, among other factors, which when taken together best serve our Company and our stockholders. The following presentation highlights some of the diversity metrics of our Board.

In selecting board members, the Board takes into account, in addition to the core attributes, the range of talents, experience and expertise that are needed and would complement those that are currently represented on the Board. The Board seeks to achieve a mix of members whose experience and backgrounds are relevant to the Company’s strategic priorities and the scope and complexity of our business.

|

Our directors complement each other in their mix of skills by bringing to the Board expertise and experience on the entertainment industry, capital markets, financial management, real estate, cybersecurity, technology, strategic planning and corporate governance. Additionally, in selecting Board members, our Governance Committee follows applicable regulations to ensure that our Board includes members who are independent, possess financial literacy and expertise, an understanding of risk management principles, policies, and practices, and can appropriately oversee and guide management. | ||

|

Core Director Attributes

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

24 |

The following chart summarizes the core competencies of each director.

| Skill/Experience Matrix | ||||||||||||||||||||

| Experience

|

Director

| |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| Financial Literacy |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||

| Financial Management/Corporate Finance |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||

| Accounting and Financial Oversight/Enterprise Risk Management |

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||||

| Corporate Governance |

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||

| CEO Experience |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||||

| Non-CEO Executive Experience |

✓

|

✓

|

✓

|

✓

|

✓ | |||||||||||||||

| Industry Knowledge |

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||||

| Mergers and Acquisitions |

✓

|

✓

|

✓

|

✓ | ||||||||||||||||

| Other Public Company Board Service |

✓ | ✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓ | ||||||||||||

| Leadership |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||

| Strategic Vision and Planning |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||

| Information Technology and Cybersecurity |

✓

|

✓

|

||||||||||||||||||

Throughout 2020, governance and risk management played a critical role in our response to the COVID-19 pandemic. As we confronted the challenges to our industry, we implemented operational teams to oversee daily decision-making to ensure our actions remained consistent with our priorities and in compliance with government mandates. The Board played a pivotal oversight role in our business continuity planning and execution in the face of the pandemic and oversaw the management by our executive team of risks related to continuing business operations, industry, financial controls, liquidity, employee retention, health and safety and IT operations.

Our Board believes that risk management is an important part of establishing, updating and executing Cinemark’s business strategy. The Board, as a whole and at the committee level, has oversight responsibility relating to risks that could affect the corporate strategy, business objectives, compliance, operations and the financial condition and performance of the Company. The Board focuses its oversight on the most significant risks facing the Company and on the processes that the Board has established to identify, prioritize, assess, manage and mitigate those risks.

Annually, and if needed more frequently, the Board reviews and considers Cinemark’s long-term strategic plan and its annual financial and operating plan. The Board and its committees also receive regular reports from members of senior management on areas of material risk to the Company, including strategic, operational, financial, legal and regulatory risks. While the Board has an oversight role, management is principally tasked with direct responsibility for managing and assessing the risks and implementing processes and controls to mitigate their effects on the Company.

|

25 |

The Board’s leadership structure, with a Lead Director, separate Chairman and CEO, independent Board standing committees, the active participation of committees in the oversight of risk, and open communication with management support the risk oversight function of the Board. Each committee has risk oversight responsibilities and provides regular reports to the Board. Our risk governance structure is as follows:

| BOARD OF DIRECTORS

Oversight of overall risks. Oversight of the Company’s risk management and risk |

||||||||

| AUDIT COMMITTEE

Oversees risks related to financial controls

and |

COMPENSATION COMMITTEE

Oversees risks related to compensation policies, practices, incentive-related risks and succession planning |

GOVERNANCE COMMITTEE

Manages risks associated with governance structures, policies and processes | ||||||

|

STRATEGIC PLANNING COMMITTEE

Oversees and advises on risks related to alternative |

MANAGEMENT

Responsible for identification, assessment and | |

During 2020, the Board held six (6) meetings and took action by written consent on four (4) occasions. All directors attended at least seventy-five percent (75%) of all meetings held by the Board and all meetings held by committees of the Board on which such director served.

All directors are strongly encouraged to attend the Annual Meeting, but we do not have a formal attendance requirement. Eight directors attended our virtual 2020 Annual Meeting.

Pursuant to our Corporate Governance Guidelines and the rules of the NYSE, our non-management directors meet periodically in executive sessions with no Company personnel present. Our Corporate Governance Guidelines require separate sessions of the non-management directors at least twice a year.

The presiding director of the executive sessions is currently our Lead Director, Mr. Sepulveda. During 2020, our non-management directors met four times and our independent directors met once in executive sessions.

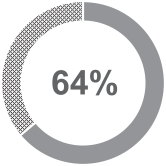

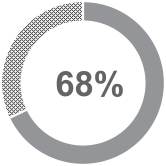

We value the input and insights of our stockholders and are committed to continued engagement with our investors. As part of our proactive stockholder engagement program to ensure management and the Board understand and consider the issues that matter the most to our stockholders, we offered meetings to our top institutional investors, representing nearly 60% of our stockholder base. We held meetings with all that accepted our request, totaling more than 20% of the total shares outstanding. Key themes discussed included the impact of COVID-19 on our industry and the Company, succession planning for the Board, executive compensation and corporate social responsibility and sustainability. Our corporate governance profile reflects the input of stockholders from our outreach efforts.

|

26 |

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

As stated in our Corporate Governance Guidelines, any Company stockholder or other interested party who wishes to communicate with the non-management directors as a group may direct such communications by writing to the:

Company Secretary

Cinemark Holdings, Inc.

3900 Dallas Parkway

Plano, TX 75093

The communication must be clearly addressed to the Board or to a specific director. If a response is desired, the individual should also provide contact information such as name, address and telephone number. All such communications will be reviewed initially by the Company Secretary. The Company Secretary will forward to the appropriate director(s) all correspondence, except for items of the following nature:

| • | advertising; |

| • | promotions of a product or service; |

| • | patently offensive material; and |

| • | matters completely unrelated to the Board’s functions, Company performance, Company policies or that could not reasonably be expected to affect the Company’s public perception. |

The Company Secretary will prepare a periodic summary report of all such communications for the Board. Correspondence not forwarded to the Board will be retained by the Company and will be made available to any director upon request.

OUR ENVIRONMENTAL AND SOCIAL PRACTICES

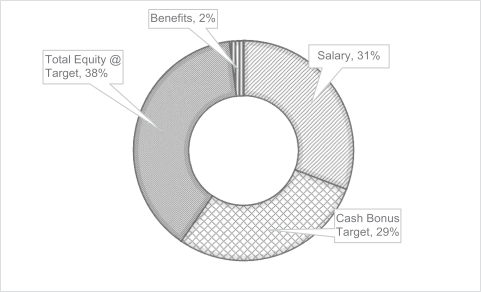

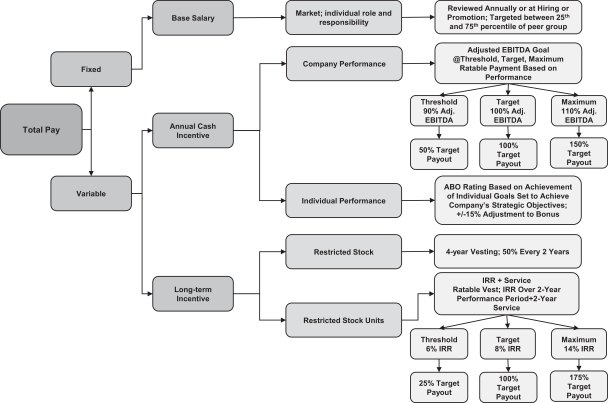

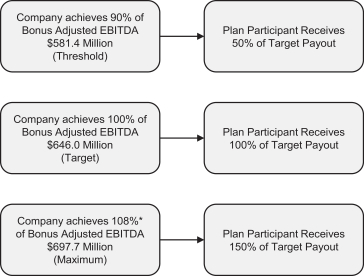

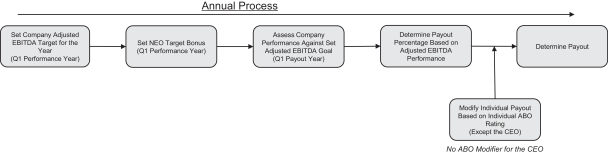

Sustainability Initiatives: