UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN THE PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12. |

Cinemark Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

CINEMARK HOLDINGS, INC.

3900 Dallas Parkway, Suite 500

Plano, Texas 75093

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 22, 2014

Dear Stockholder:

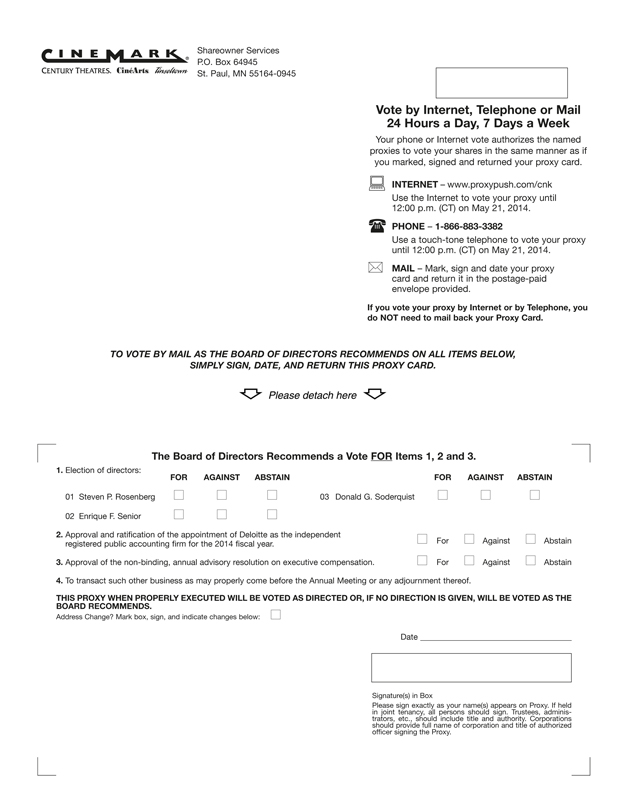

Notice is hereby given that the Annual Meeting of Cinemark Holdings, Inc. will be held on May 22, 2014, at 9 a.m. CDT at our West Plano Theatre located at 3800 Dallas Parkway, Plano, TX 75093, for the following purposes:

| 1. | To elect three Class I directors to serve for three years on our Board; |

| 2. | To approve and ratify the appointment of Deloitte as our independent registered public accounting firm for the 2014 fiscal year; |

| 3. | To hold a non-binding, annual advisory vote on executive compensation; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Accompanying this notice is the proxy statement, which provides information on our Board and management team, and further describes the business we will conduct at the Annual Meeting.

Only stockholders of record as of the close of business on April 2, 2014 will be entitled to notice of, and to vote at, the Annual Meeting.

Your vote is important to us. Whether or not you attend the Annual Meeting, it is important that your shares be represented. Therefore, we urge you to promptly vote.

For details regarding the methods of voting please refer to ‘What Different Methods Can I Use to Vote’ under ‘Questions and Answers About the Meeting and Voting’ in this proxy statement.

This notice of Annual Meeting and proxy statement is also available online at http://www.cinemark.com/About/Investor Relations/Proxy Materials.

| BY ORDER OF THE BOARD OF DIRECTORS, |

|

| Michael Cavalier |

| Executive Vice President — General Counsel and Secretary |

Plano, Texas

April 11, 2014

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement and in the Annual Report on Form 10-K for Cinemark Holdings, Inc. (the “Company”, “Cinemark”, “we”, “us” or “our”) for the year ended December 31, 2013 filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2014 (the “2013 Form 10-K”). You should carefully read the entire proxy statement and the Company’s 2013 Form 10-K before voting.

|

Annual Meeting of Stockholders

|

| • Time and Date: |

May 22, 2014; 9:00 a.m. CDT | |

| • Place: |

Cinemark West Plano Theatre 3800 Dallas Parkway, Plano, TX 75093 | |

| • Record Date: |

April 2, 2014 | |

| • Voting: |

Stockholders as of the Record Date are entitled to vote. Each share of common stock, par value $0.001 per share (“Common Stock”), is entitled to one vote for each nominee and one vote for each of the proposals to be voted upon. | |

| • Mailing: |

The approximate date on which this proxy statement and the enclosed proxy are first being sent to stockholders is April 11, 2014. | |

|

Annual Meeting Agenda and Vote Recommendations

|

| Board Proposals |

|

Board Recommendation |

|

Page Reference (for more detail) | ||

| Election of three Class I directors to serve for three years on our Board |

FOR each nominee | 12 | ||||

| Ratification of the appointment of Deloitte as our independent registered public accounting firm for the 2014 fiscal year | FOR | 66 | ||||

|

Non-binding, annual advisory vote on executive compensation |

FOR | 67 |

1

ITEM 1 – ELECTION OF DIRECTORS

Board Nominees

The following table provides summary information about each Class I director who is nominated for election at the Annual Meeting. Each nominee will serve for a term of three years expiring at the 2017 annual meeting or until their successors are elected.

As previously reported, Roger T. Staubach, a Class I director, has notified the Company that he will not stand for re-election at the Annual Meeting. Pursuant to our Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), our Board of Directors (the “Board”) may fill the vacancy created by Mr. Staubach’s resignation, and any director so chosen shall serve for the remainder of the term of the Class I directors until his/her successor has been elected and qualified, subject however, to such director’s death, resignation, retirement, disqualification or removal.

|

Name |

Age | Director Since |

Occupation | Experience | Other Public Boards |

Independent | Committee Assignments | |||||||

|

Steven P. Rosenberg |

55 | 2008 | President, SPR Ventures Inc. |

Public company management, corporate leadership, private investment; corporate governance | 2 | Yes | Audit; Governance | |||||||

|

Enrique F. Senior |

70 | 2004 | Managing Director, Allen & Company, LLC | Financial advisory services | 2 | Yes | Strategic; New Ventures | |||||||

| Donald G. Soderquist |

80 | 2007 | Business counselor to OnCourse, LLC | Board leadership; corporate governance | x | Yes |

Governance; Compensation |

In 2013, Messers. Rosenberg, Senior, Soderquist and Staubach attended at least 75% of all Board and respective committee meetings.

ITEM 2 – RATIFICATION OF THE APPOINTMENT OF DELOITTE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE 2014 FISCAL YEAR

The Audit Committee has appointed and the Board has ratified the appointment of Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte”) as the Company’s independent registered public accounting firm for the 2014 fiscal year. As a matter of good corporate governance, we are seeking stockholder ratification of the appointment of Deloitte. If the stockholders do not ratify the appointment of Deloitte, the Audit Committee may review its future selection of auditors.

One or more representatives of Deloitte are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to answer appropriate questions.

The fees paid to Deloitte during the 2013 fiscal year are detailed on page 27.

2

ITEM 3 – NON-BINDING, ANNUAL ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a matter of good corporate governance, we are seeking a non-binding, stockholder advisory vote approving our compensation program for our named executive officers and the compensation paid to our named executive officers for the 2013 fiscal year. The Board believes that our compensation policies and practices attract talented and experienced executives and appropriately motivates them to enhance stockholder value over the short and long terms.

Stockholder Support of Our Executive Compensation

At the annual meeting held in May 2013 (the “2013 Annual Meeting”), our executive compensation program garnered the support of approximately 94% of the stockholders who voted either in person or via proxy at the 2013 Annual Meeting. Given the strong stockholder support, the Compensation Committee did not make any changes to our executive compensation program for the 2013 fiscal year.

Executive Compensation Philosophy and Structure

Our compensation philosophy is to ensure that pay is aligned to performance while being competitive enough to attract and retain executive talent and motivate them to increase stockholder value over the short and long terms.

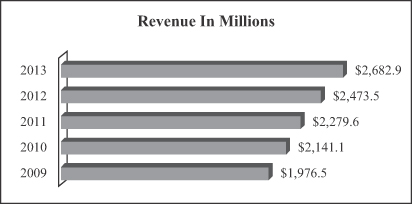

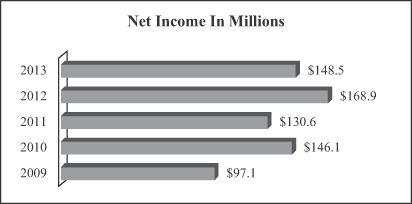

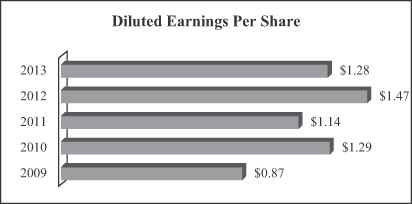

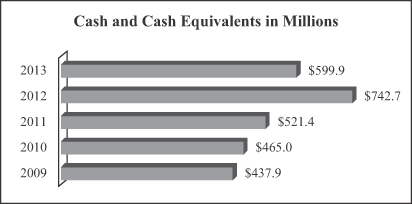

The Company’s financial performance over the five- year period1 and the long service record of the Company’s named executive officers lend credence to our executive compensation program. The following table contains key summary financial information for each of the last five fiscal years:

| Five-Year Summary (Dollars in millions, except per share data) |

2009 | 2010 | 2011 | 2012 | 2013 | |||||||||||||||

|

Revenues |

$ | 1,976.5 | $ | 2,141.1 | $ | 2,279.6 | $ | 2,473.5 | $ | 2,682.9 | ||||||||||

| Net Income Attributable to the Company |

$ | 97.1 | $ | 146.1 | $ | 130.6 | $ | 168.9 | $ | 148.5 | ||||||||||

| Cash and Cash Equivalents2 |

$ | 437.9 | $ | 465.0 | $ | 521.4 | $ | 742.7 | $ | 599.9 | ||||||||||

| Diluted Earnings Per Share |

$ | 0.87 | $ | 1.29 | $ | 1.14 | $ | 1.47 | $ | 1.28 |

| • | Revenues increased a cumulative 35.7% over the 5- year period; |

| • | Net income attributable to Cinemark Holdings, Inc. increased a cumulative 52.9% over the 5- year period; |

| • | Cash & cash equivalents increased a cumulative 37% over the 5- year period; |

| • | Diluted earnings per share increased a cumulative 47.1% over the 5- year period; and |

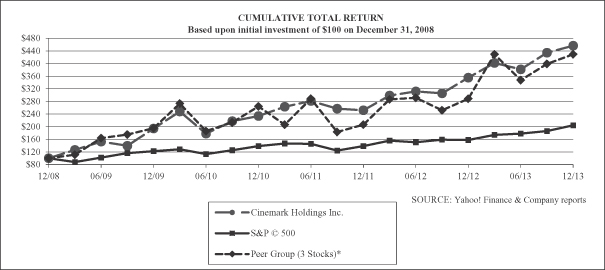

| • | Cumulative total stockholder return (“TSR”) for the five- year period was 405.8%. |

1 See Company Performance Highlights in 2013 beginning page 34 for additional information on the Company’s financial performance over the one- year, three- year and five- year periods.

2 Data is as of December 31 for each respective year.

3

Following are the specific elements of our executive compensation program:

|

Type |

Form | Terms | ||

| Fixed |

• Base Salary |

• The only guaranteed portion of compensation | ||

| Variable |

• Annual cash incentive bonus • Annual grant of restricted stock • Annual grant of performance award either as restricted stock or restricted stock units |

• Subject to Company achieving annual performance targets established by the Compensation Committee during the first quarter of the fiscal year; target annual cash incentive bonus opportunity is a percentage of base salary • Subject to continued employment, restricted stock vests 50% each on the second and fourth anniversary of the grant date • Shares underlying performance awards are issued pro rata based upon the Company achieving performance targets established by the Compensation Committee at the beginning of a performance period and a year of continued employment after the end of the performance period | ||

|

Retirement |

• Matching 401(k) Plan contributions |

Company matches up to 6% of employee contribution (100% up to 3% and 75% for the remaining 3% of employee cash compensation) | ||

|

Other |

• Benefits |

Group, life and disability insurance |

Other key compensation features are as follows:

| Compensation Features |

2013 | |

| All members of the Compensation Committee are independent |

Yes | |

|

Independent compensation consultant |

Yes | |

| Annual cash incentive bonus payments capped at the lesser of 200% of annual base salary or $3 million | Yes | |

| Excise tax gross-ups for change-in-control payments |

None | |

|

Perquisites |

Limited | |

| Deferred compensation |

None | |

| Pension benefits |

None | |

| Double trigger for change-in-control payments |

Yes | |

| Annual stockholder advisory vote on executive compensation |

Yes | |

|

Prohibition on hedging transactions |

Yes | |

|

Prohibition on pledging Company securities without prior approval |

Yes | |

|

Prohibition on holding Company securities in a margin account |

Yes |

4

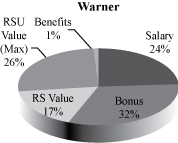

Components of the Chief Executive Officer’s Compensation for 2013

Pursuant to Mr. Warner’s Amended and Restated Employment Agreement dated March 30, 2012 (the “Warner Employment Agreement’), the terms of Mr. Warner’s compensation for the 2013 fiscal year were as follows:

|

Type |

Form | Terms | ||

| Cash |

• Base Salary • Annual cash incentive bonus |

• The only guaranteed portion of compensation • Subject to Company achieving performance targets established by the Compensation Committee during the first quarter of the fiscal year; target annual cash incentive bonus at 100% of annual base salary | ||

| Equity |

• Annual grant of restricted stock • Annual grant of performance award either as restricted stock or restricted stock units |

• Aggregate equity award (restricted stock and performance award) value to be at least 125% of annual base salary • Restricted stock to vest equally over three years • Performance award to vest over a three year performance period and a year of continued employment after the end of the performance period • Upon expiration of the Warner Employment Agreement, all outstanding restricted stock to vest immediately; performance awards to remain outstanding for the performance period and, subject to Company achieving performance targets, to vest immediately without any additional employment requirement | ||

|

Retirement |

• Matching 401(k) Plan contributions |

• Company matches up to 6% of employee contribution (100% up to 3% and 75% for the remaining 3% of employee cash compensation) | ||

|

Other |

• Benefits |

• Group, life and disability insurance |

Effective January 21, 2014, the Company entered into the Second Amended and Restated Employment Agreement with Mr. Warner (the “Second Amended Agreement”), which extended the term of the Warner Employment Agreement to April 1, 2016.

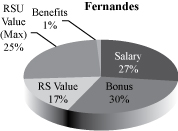

Compensation Highlights of the Named Executive Officers for 2013

| • | Base salary increase for 2013 for each of the named executive officers was 1% from 2012; |

| • | Cash bonus for the 2013 fiscal year was paid at 133.33% of the target annual cash incentive bonus opportunity of each named executive officer, based on an adjusted EBITDA of $625.3 million against a target of $557.1 million; |

| • | Equity compensation was granted as time-based and performance-based as a 50/50 mix at the target level with the value of the potential maximum level of performance-based equity grant at 150% of the value of the time-based equity grant; and |

5

| • | The mix of fixed and variable components of the 2013 summary compensation of each of the named executive officers for 2013 were as follows: |

| Name |

Fixed (annual base salary) |

Variable (annual cash incentive bonus, grant date fair market value of annual time-based equity grant and performance-based equity grant at maximum level) | ||

| Lee Roy Mitchell3 |

42% | 57% | ||

| Tim Warner |

24% | 75% | ||

| Robert Copple |

26% | 73% | ||

| Valmir Fernandes |

27% | 72% | ||

| Mike Cavalier |

29% | 70% |

Corporate Governance

Commitment to good governance is essential for the Company’s growth and performance. Our Board periodically identifies and implements changes in our governance practices. Following are some features of the Company’s general corporate governance:

| Board and Other Governance Features |

2013 | |||

| Size of Board (including 1 vacancy after Annual Meeting) |

10 | |||

| Majority voting for uncontested elections |

Yes | |||

| Majority of independent directors |

Yes | |||

| Separate Chairman and Chief Executive Officer |

Yes | |||

| No director on the board of directors of more than 3 public companies |

Yes | |||

|

Independence of all members of the Audit, Compensation and Governance Committees |

Yes | |||

|

Non-management directors meet without management |

Yes | |||

| Annual Board and committee evaluations |

Yes | |||

| Annual equity grant to non-employee directors |

Yes | |||

| Number of directors attending at least 75% of all Board and committee meetings in 2013 |

All |

3 As in previous years, there was no equity compensation granted to Mr. Mitchell because of his substantial equity ownership in the Company of approximately 5% (excluding The Mitchell Special Trust), as of the Record Date.

6

CINEMARK HOLDINGS, INC.

3900 Dallas Parkway, Suite 500

Plano, Texas 75093

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 22, 2014

GENERAL INFORMATION

Solicitation and Revocability of Proxies

The Board is soliciting proxies in connection with the 2014 annual meeting of stockholders and any adjournment thereof (the “Annual Meeting”) to be held on May 22, 2014, at 9 a.m. CDT at the Company’s West Plano Theatre located at 3800 Dallas Parkway, Plano, TX 75093. The approximate date on which this proxy statement and the enclosed proxy are first being sent to stockholders is April 11, 2014.

Shares Outstanding and Voting Rights

As of April 2, 2014, 115,689,880 shares of the Company’s Common Stock were outstanding. The Common Stock constitutes the only class of voting securities of the Company. Only stockholders of record as of the close of business on April 2, 2014 (the “Record Date”) are entitled to receive notice of, and to vote at the Annual Meeting. Holders of Common Stock are entitled to one vote for each share so held.

QUESTIONS AND ANSWERS ABOUT

THE MEETING AND VOTING

| ¡ | What is the purpose of holding the Annual Meeting? |

We are holding the Annual Meeting to elect three Class I directors, to ratify the selection of Deloitte as our independent registered public accounting firm for the 2014 fiscal year and to hold a non-binding, advisory vote of stockholders on our executive compensation program and the compensation paid to our named executive officers for the 2013 fiscal year. Our Nominating and Corporate Governance Committee of the Board (the “Governance Committee”) has recommended the nominees to our Board and our Board has nominated the nominees. Our Audit Committee has appointed Deloitte as our independent registered public accounting firm for the 2014 fiscal year and our Board has ratified the appointment. Our Compensation Committee has approved our executive compensation program and the Board has recommended that the stockholders vote to approve our executive compensation program and the compensation paid to our named executive officers for the 2013 fiscal year. If any other matters requiring a stockholder vote properly come before the Annual Meeting, those stockholders present at the Annual Meeting and the proxies who have been appointed by our stockholders will vote as they deem appropriate.

| ¡ | What is the Record Date and what does it mean? |

The Record Date for the Annual Meeting is April 2, 2014. The Record Date is established by the Board as required by Delaware law. Owners of record of Common Stock at the close of business on the Record Date are entitled to:

| (a) | receive notice of the Annual Meeting, and |

| (b) | vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting. |

| ¡ | What is the difference between a stockholder of record and a stockholder who holds stock in street name? |

(a) Stockholder of record: If your shares are registered in your name with our transfer agent, Wells Fargo Shareowner Services, you are a stockholder of record with respect to those shares. As a stockholder of record, you have the right to grant your proxy directly to us or to a third party, or to vote in person at the Annual Meeting.

7

(b) Stockholder who holds stock in street name: If your shares are held by a broker or by a bank, you are considered to be a beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker or bank on how to vote and you are also invited to attend the Annual Meeting. Your broker or bank, as the record holder of your shares, may exercise discretionary authority to vote on “routine” proposals but may not vote on “non-routine” proposals without your instructions.

These proxy materials are being forwarded to you on behalf of your broker or bank. Your broker or bank has enclosed or provided voting instructions for you to use in directing the broker or bank on how to vote your shares. Since a beneficial owner in street name is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker or bank that holds your shares, giving you the right to vote the shares at the Annual Meeting.

| ¡ | How many shares must be present to hold the Annual Meeting? |

A majority of our outstanding Common Stock as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Unless a quorum is present at the Annual Meeting, no action may be taken at the Annual Meeting except the adjournment thereof until a later time. Shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting, if you vote via the Internet, by telephone, or if you are represented by proxy. Abstentions and “broker non-votes” are counted as present for the purpose of determining the presence of a quorum.

| ¡ | What is a proxy and how does the proxy process operate? |

A proxy is your legal designation of another person to vote the stock you own. The person(s) that you designate to vote your shares are called proxies. Tim Warner, Robert Copple and Michael Cavalier of the Company have been designated as proxies for the Annual Meeting. The term “proxy” also refers to the written document or “proxy card” that you sign to authorize those persons to vote your shares.

By executing the proxy card, you authorize the above-named individuals to act as your proxies to vote your shares in the manner that you specify. The proxy voting mechanism is vitally important to us. In order for us to obtain the necessary stockholder approval of proposals, a quorum of stockholders must be represented at the Annual Meeting in person or by proxy. Since few stockholders can spend the time or money to attend stockholder meetings in person, voting by proxy is necessary to obtain a quorum and complete the stockholder vote. It is important that you attend the Annual Meeting in person or grant a proxy to vote your shares to assure a quorum is obtained so corporate business can be transacted. If a quorum is not obtained, we must postpone the Annual Meeting and solicit additional proxies, which is an expensive and time-consuming process.

| ¡ | What different methods can I use to vote? |

If you are a stockholder of record, you may vote:

| • | Via the Internet or by telephone — In order to vote via the Internet or by telephone, please follow the instructions shown on your proxy card. Votes submitted via the Internet or by telephone must be received by 12 p.m. (noon), CDT, on May 21, 2014. The Internet and telephone voting procedures have been designed to verify stockholders’ identities and allow stockholders to confirm that their voting instructions have been properly recorded. |

| • | By mail — In order to vote by mail, simply complete, sign, date and return the proxy card in the postage paid envelope provided so that it is received before the Annual Meeting. If the accompanying proxy card is duly executed and returned, the shares of Common Stock represented thereby will be voted in accordance with the Board’s recommendations set forth herein and if you make a specification, the shares of Common Stock will be voted in accordance with such specification. |

| • | In person — We will pass out written ballots at the Annual Meeting and you may deliver your completed and signed proxy card in person. Submitting your proxy or voting instructions, whether via the Internet, by telephone, or by mail will not affect your right to vote in person should you decide to attend the Annual Meeting. |

8

If you are a beneficial holder, you may vote:

| • | By instructing your bank or broker — You should receive a voting instruction card from your bank or broker which you must return with your voting instructions to have your shares voted. If you have not received a voting instruction card from your bank or broker, you may contact it directly to provide instructions on how you wish to vote. Voting instructions submitted by beneficial owners to brokers or banks via the Internet or by telephone must be received by 12 p.m. (noon), CDT, on May 21, 2014; |

| • | In person — If you wish to vote in person at the Annual Meeting, you will need to obtain a “legal proxy” form from your broker or bank that holds your shares of record and you must bring that document to the Annual Meeting. |

| ¡ | What happens if I do not give specific voting instructions? |

Stockholder of Record.

If you are a stockholder of record and you:

| • | Indicate when voting on the internet or by telephone that you wish to vote as recommended by the Board; or |

| • | Sign and return a proxy card without specific voting instructions; |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner.

If you own shares through a broker or bank and do not provide voting instructions to the broker or bank holding your shares, your broker or bank may represent your shares at the Annual Meeting for purposes of obtaining a quorum. Your broker or bank may vote your shares in its discretion on some “routine matters”. However, with respect to “non-routine matters”, your broker or bank may not vote your shares for you. With respect to these “non-routine matters”, the aggregate number of unvoted shares is reported as “broker non-votes”.

| ¡ | What are broker non-votes? |

If you are the beneficial owner of shares and hold stock in street name, then the broker or bank, as the stockholder of record of the shares, may exercise discretionary authority to vote your shares with respect to “routine” matters but will not be permitted to vote the shares with respect to “non-routine” matters. A broker non-vote occurs when you do not provide the broker with voting instructions on “non-routine” matters for shares owned by you but held in the name of the broker. For such matters, the broker cannot vote and reports the number of such shares as “broker non-votes.”

| ¡ | How are “broker non-votes” and abstentions treated? |

“Broker non-votes” and abstentions are counted for purposes of determining a quorum. However, see below with regards to the effect of “broker non-votes” and abstentions on approval of specific agenda items.

| ¡ | Which ballot measures are called “routine” or “non-routine”? |

Under the broker voting rules of the New York Stock Exchange (the “NYSE”), the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the 2014 fiscal year (Item 2) is considered a “routine” matter. “Broker non-votes” will not arise in the context of Item 2 as brokers may exercise discretionary authority to vote your shares on Item 2.

Under the broker voting rules of the NYSE, the election of directors (Item 1) and the non-binding, annual advisory vote on executive compensation (Item 3) are considered “non-routine” matters. As a consequence, brokers will not be able to vote on Item 1 and Item 3 without receiving instructions from the beneficial owners. As a result, “broker non-votes” could arise in the context of these proposals.

9

| ¡ | What is the voting requirement for each of the proposals? |

Approval of Item 1: Beginning the Annual Meeting, pursuant to the Company’s Fourth Amended and Restated Corporate Governance Guidelines (the “Corporate Governance Guidelines”), the Board has adopted a form of majority voting standard for uncontested director elections that is sometimes referred to as a “plurality plus” standard. Under this “plurality plus” standard if a director nominee does not receive a majority of the “for” votes cast in an uncontested director election, then the director nominee shall promptly tender his resignation from the Board and all committees of the Board following certification of the results of the Annual Meeting by the Inspector of Elections. The Governance Committee (excluding the nominee in question if applicable) would then consider the resignation offer and make a recommendation to the Board as to whether to accept or reject the resignation, or whether to take other action such as allowing the director to continue to serve on the Board as a “holdover director” as permitted by Delaware corporate law. Within 90 days following certification of the stockholder vote, the Board will make a final determination as to whether to accept the director’s resignation. The Board’s explanation of its decision would then be promptly disclosed in a Form 8-K filed with the SEC.

Votes marked “For” Item 1 will be counted in favor of all director nominees.

Approval of Item 2: The ratification of the appointment of Deloitte requires the affirmative vote of a majority of the shares present or represented by proxy and voting at the Annual Meeting. Since this proposal is considered a “routine” matter, “broker non-votes” do not arise and brokers and banks may exercise discretionary authority to vote your shares. Abstention will have the same effect as a vote against this proposal. Therefore, abstentions might prevent the approval of Item 2 if the number of affirmative votes does not constitute a majority of the shares of Common Stock present or represented by proxy and voting at the Annual Meeting.

Approval of Item 3: The advisory vote on executive compensation requires the affirmative vote of a majority of the shares present or represented by proxy and voting at the Annual Meeting. Since this proposal is considered a “non-routine” matter, “broker non-votes” may arise and abstentions and “broker non-votes” could prevent the approval of this Item.

| ¡ | How does the Board recommend I vote? |

The Board recommends that you vote:

| • | FOR each of the nominees for director; |

| • | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm for the 2014 fiscal year; and |

| • | FOR the non-binding, advisory vote to approve our executive compensation. |

| ¡ | Can I revoke or change my proxy? If so, how? |

You may revoke your proxy and change your vote at any time before the proxy has been exercised at the Annual Meeting.

If you are a stockholder of record, your proxy can be revoked in several ways:

| • | by timely delivery of a written revocation to the Company Secretary; |

| • | by submitting another valid proxy bearing a later date; or |

| • | by attending the Annual Meeting in person and giving the inspector of election notice that you intend to vote your shares in person. |

If your shares are held in street name, you must contact your broker or bank in order to revoke your proxy. Generally, you may change your vote by submitting new voting instructions to your broker or bank, or, by attending the Annual Meeting and voting in person if you have obtained a “legal proxy” from your broker or bank giving you the right to vote your shares.

10

| ¡ | Who counts the votes? |

The Company has retained a representative of Wells Fargo Shareowner Services to serve as an independent tabulator to receive and tabulate the proxies and as an independent inspector of election to certify the results.

| ¡ | Who pays for this proxy solicitation? |

The Company pays for this proxy solicitation. We use our transfer agent, its agents, and brokers to distribute all proxy materials to our stockholders. We will pay them a fee and reimburse any expenses they incur in making the distribution. Proxies will be solicited on behalf of the Board by mail, telephone, other electronic means or in person. We have retained D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, to assist with the solicitation for a fee of $7,000 plus reasonable out-of-pocket expenses.

| ¡ | How can I obtain copies of the Company’s annual report and other available information about the Company? |

Stockholders may receive a copy of the Company’s 2013 Form 10-K at no charge by sending a written request to Michael Cavalier, Company Secretary at Cinemark Holdings, Inc., 3900 Dallas Parkway, Suite 500, Plano, Texas 75093.

You can also visit our Web site at www.cinemark.com for free access to our corporate governance documents and our filings with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to these reports. The SEC also maintains a Web site that contains reports, proxy and information statements and other information regarding registrants. The address of the Web site is www.sec.gov.

| ¡ | What is the deadline to propose actions for the 2015 annual meeting of stockholders? |

Stockholder proposals requested to be included in our proxy statement and form of proxy for our 2015 annual meeting must be in writing and received by the end of business on December 12, 2014 at our principal executive offices at 3900 Dallas Parkway, Suite 500, Plano, Texas 75093, Attention: Michael Cavalier, Company Secretary.

Stockholders who wish to nominate a director or introduce a proposal not included in the proxy statement at the 2015 annual meeting may do so in accordance with our by-laws. These procedures provide that stockholders who wish to bring a proper subject of business before the 2015 annual meeting must do so by a written notice in proper written form to the Company Secretary received not less than 90 and not more than120 days before the anniversary date of the Annual Meeting and must be accompanied by certain information about the stockholder making the proposal, in accordance with our by-laws. As a result, any notice given by or on behalf of a stockholder pursuant to these provisions of our by-laws (and not pursuant to the SEC’s Rule 14a-8) must be received no earlier than January 22, 2015, and no later than February 21, 2015 at our principal executive offices at 3900 Dallas Parkway, Suite 500, Plano, Texas 75093, Attention: Michael Cavalier, Company Secretary.

A copy of our by-laws is available from the Company Secretary upon written request.

11

ITEM 1 — ELECTION OF DIRECTORS

Composition of the Board, Nomination of Class I Directors and Director Elections

Our Board is currently comprised of ten members. The size of the Board may be fixed from time to time exclusively by our Board as provided in our Certificate of Incorporation. Our Certificate of Incorporation also provides that our Board consists of three classes of directors, designated as Class I, Class II and Class III. The members of each class are elected to serve a three-year term, with the terms of office of each class ending in successive years. On April 9, 2007, immediately prior to our initial public offering, we entered into a director nomination agreement with certain of our then current stockholders permitting those certain stockholders to designate persons for appointment or nomination for election to the Board (the “Director Nomination Agreement”). Currently, only the Mitchell Investors (as defined in the Director Nomination Agreement) have a right to designate two nominees to the Board and Messers. Mitchell and Sepulveda were nominated to the Board by the Mitchell Investors. Madison Dearborn Capital Partners IV, L.P. (“MDCP”), Syufy Enterprises, LLP (“Syufy Enterprises”) and Quadrangle Investors (as defined in the Director Nomination Agreement) no longer have any beneficial ownership in the Company’s Common Stock. However, Messers. Chereskin, Dombalagian, Senior and Soderquist (former nominees of MDCP), Mr. Peter Ezersky (a former nominee of Quadrangle Investors) and Mr. Raymond Syufy (a former nominee of Syufy Enterprises) are continuing to serve as directors subject to their re-election upon the expiry of their respective terms.

The terms of the current Class I directors, Messers. Rosenberg, Senior, Soderquist and Staubach expire at the Annual Meeting. Each of Messers. Rosenberg, Senior and Soderquist has consented to be nominated for re-election to the Board as a Class I director. However, Mr. Staubach has notified the Company that he will not stand for re-election at the Annual Meeting. His decision is not due to any disagreements with us on any of our operations, policies or practices.

We have no reason to believe that any of the director nominees (Messers. Rosenberg, Senior and Soderquist) will be unable or unwilling to serve if elected. However, should any of them become unavailable or unwilling to serve before the Annual Meeting, your proxy card authorizes us to vote for a replacement nominee if the Board names one.

The Governance Committee has recommended to the Board, and the Board has approved, the nomination of Messers. Rosenberg, Senior and Soderquist for election to the Board as Class I directors. Each of Messers. Rosenberg, Senior and Soderquist, if elected, will serve on the Board for a three-year term expiring on the date of our 2017 annual meeting of stockholders.

Beginning at the Annual Meeting, the Board has adopted a form of majority voting standard for uncontested director elections that is sometimes referred to as a “plurality plus” standard. Under this “plurality plus” standard if a director nominee does not receive a majority of the “for” votes cast in an uncontested director election, then the director nominee shall promptly tender his resignation from the Board and all committees of the Board following certification of the results of the Annual Meeting by the Inspector of Elections. The Governance Committee (excluding the nominee in question if applicable) would then consider the resignation offer and make a recommendation to the Board as to whether to accept or reject the resignation, or whether to take other action such as allowing the director to continue to serve on the Board as a “holdover director” as permitted by Delaware corporate law. Within 90 days following certification of the stockholder vote, the Board will make a final determination as to whether to accept the director’s resignation. The Board’s explanation of its decision would then be promptly disclosed in a Form 8-K report filed with the SEC.

Director Qualifications and Board Diversity

Our Corporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on our Board. The Board has not adopted a formal diversity policy but pursuant to the Company’s Corporate Governance Guidelines, the Board seeks candidates of diverse background, education, skills, age and expertise with a proven record of accomplishment and the ability to work well with others. The Governance

12

Committee does not assign specific weight to any particular factor but in selecting members for open Board positions takes into account such factors as it deems appropriate, which may include the current composition of the Board, the range of talents, experiences and skills that would best complement those already represented on the Board and the need for financial or other specialized expertise. The Board seeks to achieve a mix of members whose experience and backgrounds are relevant to the Company’s strategic priorities and the scope and complexity of the Company’s business. Overall, each of our Board members is committed to the growth of the Company for the benefit of the stockholders, contributes new ideas in a productive and congenial manner and regularly attends board meetings.

The Governance Committee receives nominations from the stockholders and the Board and evaluates nominees against the standards, qualifications and diversity criteria set forth in the Company’s Corporate Governance Guidelines. The Governance Committee annually evaluates the criteria for the selection of new directors and recommends any proposed changes to the Board.

Candidates nominated for election or re-election to the Board should possess the following qualifications:

| • | high personal and professional ethics, integrity, practical wisdom, and mature judgment; |

| • | broad training and experience at the policy-making level in business, government, education, or technology; |

| • | expertise that is beneficial to the Company and complementary to the background and experience of other Board members; |

| • | willingness to devote the required amount of time to carrying out duties and responsibilities of Board membership; |

| • | commitment to serve on the Board over a period of several years to develop knowledge about the Company’s principal operations; and |

| • | willingness to represent the best interests of all stockholders and objectively appraise management performance. |

13

Information on each of our nominees and continuing directors is given below.

Nominees for Class I Directors

Term Expiring 2017

| Name | Business Experience | |

| Steven P. Rosenberg | Director Since: April 2008

Age: 55

Board Committees: Audit Committee; Governance Committee (Chair)

Other Public Company Boards: Texas Capital Bancshares, Inc.; PRGX Global, Inc.

Professional Experience: Mr. Rosenberg is the President of SPR Ventures Inc., a private investment firm he founded in 1997, and has been the President of SPR Packaging LLC, a manufacturer of flexible packaging, since 2006. From 1992 until 1997, Mr. Rosenberg was the President of the Arrow division of ConAgra, Inc., a leading manufacturer of grocery products.

Director Qualifications: Mr. Rosenberg’s background in corporate leadership, private entrepreneurial investment and public company management brings to the Board strategic planning, risk management, board governance and general management skills that are critical to the implementation of our growth strategies and oversight of our enterprise and operational risk management. His experience in accounting and financial management, having served in corporate leadership positions and on audit committees of other public companies, is valuable to the Board with respect to the oversight of our financial reporting and enterprise risk management.

| |

| Enrique F. Senior | Director Since: April 2004

Age: 70

Board Committees: Strategic Long-Range Planning Committee; New Ventures Committee

Other Public Company Boards: Grupo Televisa S.A.B.; Coca-Cola FEMSA, S.A.

Professional Experience: Mr. Senior is a Managing Director of Allen & Company LLC, a boutique investment bank, and has been employed by the firm since 1972. He has served as a financial advisor to several corporations including Coca-Cola Company, General Electric, CapCities/ABC, Columbia Pictures and QVC Networks. Mr. Senior is also a member of the board of directors of Univision Communications, Inc.

Director Qualifications: Mr. Senior’s experience in financial advisory services has given him extensive knowledge of the film and entertainment and beverage industries. Mr. Senior’s experience has brought key insight into these two critical components of the Company’s business.

|

14

| Name | Business Experience | |

| Donald G. Soderquist | Director Since: June 2007

Age: 80

Board Committees: Compensation Committee; Governance Committee

Other Public Company Boards: None

Professional Experience: Since 2001, he has been a motivational speaker and business counselor to OnCourse, LLC, a financial planning and investment advisory firm. Mr. Soderquist was with Wal-Mart Stores, Inc., the world’s largest retailer, from 1980 until 2003, in various capacities including Senior Vice Chairman and Chief Operating Officer.

Director Qualifications: As the lead independent director, Mr. Soderquist brings corporate governance expertise to the Board garnered through his leadership positions and board service with other entities. His experience and qualifications provide sound leadership to the Board.

|

Roger T. Staubach, a Class I director, has notified the Company that he will not stand for re-election at the Annual Meeting. Pursuant to our Certificate of Incorporation, the Board may fill the vacancy created by Mr. Staubach’s resignation, and any director so chosen shall serve for the remainder of the term of the Class I directors until his/her successor has been elected and qualified, subject however, to such director’s death, resignation, retirement, disqualification or removal.

Our Board unanimously recommends that the stockholders vote “FOR” each of the above nominees.

Unless marked to the contrary, proxies received will be voted “FOR” the election of each of the Class I nominees.

15

Continuing Class II Directors

Term Expiring 2015

| Name | Business Experience | |

| Vahe A. Dombalagian | Director Since: April 2004

Age: 40

Board Committees: Governance Committee; Compensation Committee

Other Public Company Boards: TransUnion Corp. (June 2010 to April 2012).

Professional Experience: Mr. Dombalagian is a Managing Director of Madison Dearborn Partners, LLC (“MDP”), a private equity investment firm and an affiliate of MDCP. He has been with MDP since July 2001. Prior to joining MDP, Mr. Dombalagian was with Texas Pacific Group and Bear, Stearns & Co., Inc.

Director Qualifications: Mr. Dombalagian’s experience in investment banking and private equity has provided significant contributions to the Board on investment and strategic planning in a challenging economic environment. His advice on compensation plans and structures as well as financing and acquisition decisions has been valuable to the Board.

| |

| Peter R. Ezersky | Director Since: December 2004

Age: 53

Board Committees: Audit Committee; New Ventures Committee; Compensation Committee (Chair)

Other Public Company Boards: Dice Holdings, Inc.; Protection One, Inc. (October 2009 to June 2010).

Professional Experience: Since 2000, Mr. Ezersky has been the Managing Principal of Quadrangle Group LLC (the “Quadrangle Group”), a private equity firm, focused on the firm’s media and communications business. Prior to the formation of the Quadrangle Group in March 2000, Mr. Ezersky was a Managing Director of Lazard Frères & Co. LLC and headed the firm’s worldwide Media and Communications Group.

Director Qualifications: Mr. Ezersky’s career in private equity has given him knowledge of finance and the filmed entertainment creation and distribution business. His contribution to the Board is primarily in the area of capital market issues and his experience in media and communications has been beneficial for the Company in its relationships with the movie studios.

|

16

| Name | Business Experience | |

| Carlos M. Sepulveda | Director Since: June 2007

Age: 56

Board Committees: Audit Committee (Chair and financial expert); Strategic Long-Range Planning Committee

Other Public Company Boards: Matador Resources Company

Professional Experience: Mr. Sepulveda has been the Executive Chairman of the board of directors of Triumph Bancorp, Inc. (“Triumph Bancorp”), a bank holding company with interests in wholesale banking, commercial finance and real estate investments, since May 2013. Prior to Triumph Bancorp, Mr. Sepulveda was the President and Chief Executive Officer of Interstate Battery System International, Inc. (“Interstate Battery”), a seller of automotive and commercial batteries, from March 2004 until April 2013 and its Executive Vice President from 1995 until March 2004. Prior to joining Interstate Battery, Mr. Sepulveda was an audit partner with the accounting firm of KPMG Peat Marwick in Austin, New York and San Francisco for 11 years.

Director Qualifications: Mr. Sepulveda’s extensive public accounting background provides the Board invaluable financial and accounting expertise. As a certified public accountant with proven management skills, having served as the Chief Executive Officer of a major corporation, Mr. Sepulveda brings to the Board strong accounting and financial oversight coupled with experience in enterprise and operational risk management.

|

17

Continuing Class III Directors

Term Expiring 2016

| Name | Business Experience | |

| Benjamin D. Chereskin | Director Since: April 2004

Age: 55

Board Committees: Strategic Long-Range Planning Committee (Chair); Governance Committee (from April 2007 until August 2013) (Chair); Compensation Committee (from April 2007 until August 2013) (Chair)

Other Public Company Boards: CDW, Corporation; Boulder Brands, Inc.; Tuesday Morning, Corporation (1997 – November 2011)

Professional Experience: Mr. Chereskin is President of Profile Management LLC (“Profile Management”), an investment management firm, which he founded in October 2009. Prior to founding Profile Management, Mr. Chereskin was a Managing Director and Member of MDP, from 1993 until October 2009, having co-founded the firm in 1993. Prior to co-founding MDP, Mr. Chereskin was with First Chicago Venture Capital for nine years.

Director Qualifications: Mr. Chereskin’s background in private equity and investment banking is a valuable resource to us in our efforts to attract capital, which helps us implement our business strategies and finance growth opportunities. Mr. Chereskin’s knowledge and experience in business operations contributes to the Board’s expertise on strategic planning.

| |

| Lee Roy Mitchell | Director Since: Founder

Age: 77

Board Committees: Chairman of the Board; New Ventures Committee (Chair)

Other Public Company Boards: National CineMedia, Inc.; Texas Capital Bancshares (June 1999 – May 2011)

Professional Experience: Mr. Mitchell is the founder of the Company. He has served as Chairman of the Board since March 1996 and as a director since our inception in 1987. Mr. Mitchell served as our Chief Executive Officer from our inception in 1987 until December 2006. Mr. Mitchell was Vice Chairman of the Board from March 1993 until March 1996 and was President from our inception in 1987 until March 1993.

Related Party: Mr. Mitchell is the husband of Tandy Mitchell, an employee of the Company and the brother-in-law of Walter Hebert III, the Executive Vice President – Purchasing of the Company.

Director Qualifications: Mr. Mitchell has been engaged in the motion picture exhibition business for over 50 years. His depth of experience in the motion picture industry has been invaluable to the Board. Additionally, Mr. Mitchell brings a long-term historic industry perspective and leadership to the Board.

|

18

| Name | Business Experience | |

| Raymond W. Syufy | Director Since: October 2006

Age: 51

Board Committees: Strategic Long-Range Planning Committee; New Ventures Committee

Other Public Company Boards: None

Professional Experience: Mr. Syufy began working for Century Theatres, Inc. (“Century Theatres”) in 1977 and held positions in each of the major departments within Century Theatres. In 1994, Mr. Syufy was named president of Century Theatres and was later appointed Chief Executive Officer and Chairman of the board of directors of Century Theatres. Mr. Syufy resigned as an officer and director of Century Theatres upon the consummation of our acquisition of Century Theatres in 2006. Since then Mr. Syufy has presided as Chief Executive Officer of Syufy Enterprises, a retail and real estate holding company with operations in California, Nevada, Arizona, Colorado, and Texas.

Director Qualifications: Mr. Syufy’s experience in managing a successful, family-owned movie theatre business brings to the Board industry insight and knowledge and experience in operations. Mr. Syufy’s background also brings key strategic planning expertise to the Board, particularly with respect to competition from other forms of entertainment.

|

19

CORPORATE GOVERNANCE

General

We are governed by our Board which, in turn, appoints executive officers to manage our business operations. The Board oversees our executive management on your behalf. The Board reviews our long-term strategic plans and exercises oversight over all major decisions, such as acquisitions, the declaration of dividends, major capital expenditures and the establishment of key Company policies.

Board Leadership Structure

We believe that a key factor in a company’s performance is a leadership structure that provides a balance between independent oversight by an engaged Board and day-to-day operations by management to implement the Board’s strategic vision. To achieve this balance, since December 2006, we have split the roles of the Chairman of the Board and the Chief Executive Officer such that the Board is separated from the day-to-day operations of the Company. This structure has served us well. Lee Roy Mitchell, the founder of the Company, is currently the Chairman of the Board and Mr. Warner is the Chief Executive Officer. As the founder of the Company with more than 50 years of experience in the movie exhibition industry, Mr. Mitchell is uniquely positioned to lead the Board as well as to guide the Company’s management team in strategic planning. Mr. Mitchell is assisted by Board members, each of whom has extensive experience in sectors that are relevant to the Company’s business. The Board’s oversight function is enhanced by the Board’s Audit, Governance and Compensation Committees, each of which is comprised entirely of independent directors.

The day-to-day operations of the Company are managed by the executives under the direction of Mr. Warner, our Chief Executive Officer. Mr. Warner brings over 30 years of motion picture exhibition industry experience to the Chief Executive Officer position, including more than 17 years with the Company. Prior to becoming the Chief Executive Officer, in his roles as the President and Chief Operating Officer of the Company and President of Cinemark International, L.L.C., Mr. Warner has been critical in the growth of the Company’s domestic as well as international business. Mr. Warner’s extensive industry experience and relationships, coupled with proven management and operational skills, make him well-suited to direct the Company’s day-to-day management and implement the strategic vision of the Board.

In addition to the separation of the positions of the Chairman of the Board and the Chief Executive Officer, the Board has a lead independent director, which role provides leadership and an organizational structure to the non- management directors. Our lead independent director is currently Mr. Donald Soderquist. The position of the lead independent director has significant authority and responsibilities under our Corporate Governance Guidelines, which are as follows:

| • | To act as a liaison between the non-management directors and the Company’s management; |

| • | To call meetings of non-management directors; |

| • | Chair the executive sessions of non-management directors; |

| • | Chair Board meetings when the Chairman is not present; |

| • | Consult with the Chairman and the Chief Executive Officer and approve the schedules, agendas and information provided to the Board for each meeting; |

| • | Be available for consultation and communication with stockholders upon request; and |

| • | Provide the Chairman and the Chief Executive Officer the results of the Board’s annual performance review. |

Board’s Role in Risk Oversight

Responsibility for risk oversight rests with the Board. The Board has oversight responsibility of the processes established to identify, report and mitigate material risks applicable to the Company. The Board

20

approves management’s policies related to key risk areas and provides input to management regarding risk issues and the appropriateness of management’s response. The Board also approves actions surrounding our capital structure, dividend payments, material legal settlements, potential material acquisitions and approves our annual budget. While the Board considers risk in all its decisions, it also recognizes that appropriate and measured risk-taking may be required for the Company to retain its competitiveness and thus increase stockholder value.

The Board implements its risk oversight function both as a whole and through delegation to Board committees.

The Board has delegated its oversight responsibility with respect to financial and accounting risks to the Audit Committee. The Audit Committee periodically discusses with management the Company’s major financial risk exposures and the Company’s risk assessment and risk management policies. On a periodic basis throughout the year, management responsible for managing credit, liquidity, market and financial risks, provide the Audit Committee an update on key risks and the processes and systems of internal control to manage the risks. The Chair of the Audit Committee reports to the full Board regarding material risks as deemed appropriate.

The Compensation Committee reviews the executive compensation program to ensure that the design of the program does not encourage excessive risk-taking. It also reviews succession plans to ensure the Company has appropriate practices in place to support the retention and development of the talent necessary to achieve the Company’s business goals and objectives. See Compensation Risk Assessment section of the Compensation Discussion and Analysis (the “CD&A”) for more detail on how the Compensation Committee mitigates risk without diminishing the incentive nature of compensation.

During 2013, the Board established two new committees – the Strategic Long-Range Planning Committee and the New Ventures Committee – to further enhance the Board’s risk oversight function. The Strategic Long-Range Planning Committee provides oversight of the risks associated with strategic planning by assisting management in the analysis of alternative strategic options and reviewing with management the key industry and market issues and external developments impacting the Company. The New Ventures Committee provides guidance on business development initiatives and growth opportunities for the Company.

Director Independence

Our standards of director independence comply with the independence requirements of the NYSE. With the assistance of legal counsel to the Company, the Governance Committee has reviewed the NYSE standards for Board and committee member independence. On the basis of this review, the Board has affirmatively determined, in its business judgment, that (a) the majority of the Board is independent, (b) each of Messrs. Chereskin, Dombalagian, Ezersky, Rosenberg, Senior, Staubach, Sepulveda and Soderquist is independent, (c) Messers. Mitchell and Syufy are not independent due to their transactions with the Company exceeding $120,000 annually, (d) each of Messrs. Ezersky, Rosenberg and Sepulveda meets all applicable requirements of the SEC and NYSE for membership in the Audit Committee and (e) Mr. Sepulveda is an “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC and satisfies the NYSE’s financial experience requirements. The NYSE bright-line tests for independence are whether the director:

| 1. | is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

| 2. | has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service); |

| 3. | (a) is a current partner or employee that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such firm and personally works on the Company’s audit; or (d) is or an immediate family member was within the last 3 years a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

21

| 4. | is, or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or has served on that company’s compensation committee; or |

| 5. | is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. |

Meetings

The Board held six (6) meetings and took action by written consent on five (5) occasions during the 2013 fiscal year. All directors attended at least seventy-five percent (75%) of all meetings held by the Board and all meetings held by committees of the Board on which such director served.

All directors are strongly encouraged to attend the Annual Meeting, but we do not have a formal attendance requirement. Eight directors attended the 2013 Annual Meeting.

Executive Sessions

Pursuant to our Corporate Governance Guidelines and the rules of the NYSE, our non-management directors meet periodically in executive sessions with no Company employees present. The presiding director of the executive sessions is currently our lead independent director, Mr. Donald Soderquist. During 2013, our non-management directors met twice in executive sessions.

Stockholder Communications with the Board

Any Company stockholder or other interested party who wishes to communicate with the non-management directors as a group may direct such communications by writing to the:

Company Secretary

Cinemark Holdings, Inc.

3900 Dallas Parkway, Suite 500

Plano, TX 75093

The communication must be clearly addressed to the Board or to a specific director. If a response is desired, the individual should also provide contact information such as name, address and telephone number.

All such communications will be reviewed initially by the Company Secretary. The Company Secretary will forward to the appropriate director(s) all correspondence, except for items of the following nature:

| • | advertising; |

| • | promotions of a product or service; |

| • | patently offensive material; and |

| • | matters completely unrelated to the Board’s functions, Company performance, Company policies or that could not reasonably be expected to affect the Company’s public perception. |

The Company Secretary will prepare a periodic summary report of all such communications for the Board. Correspondence not forwarded to the Board will be retained by the Company and will be made available to any director upon request.

Corporate Governance Policies and Charters

The following documents make up our corporate governance framework:

| • | Corporate Governance Guidelines; |

| • | Amended and Restated Charter of the Audit Committee (the “Audit Committee Charter”); |

22

| • | Charter of the Nominating and Corporate Governance Committee (the “Governance Committee Charter”); and |

| • | First Amendment to Amended and Restated Compensation Committee Charter (the “Compensation Committee Charter”). |

Current copies of the above policies and guidelines are available publicly on the Company’s Web site at www.cinemark.com under the Investor Relations tab.

Code of Business Conduct and Ethics

The Company has also adopted a Code of Business Conduct and Ethics, which applies to directors, executive officers and employees. The Code of Business Conduct and Ethics sets forth the Company’s policies on critical issues such as conflicts of interest, insider trading, protection of our property, business opportunities and proprietary information. Prompt disclosure to stockholders will be made regarding any waiver of the Code of Business Conduct and Ethics for executive officers and directors that have been approved by our Board or any Board committee. The Code of Business Conduct and Ethics is available on our Web site at www.cinemark.com. We will post on our Web site any amendments or waivers to the Code of Business Conduct and Ethics.

23

BOARD COMMITTEES

Our Board currently has five committees – Audit Committee, Compensation Committee, Governance Committee, New Ventures Committee and the Strategic Long-Range Planning Committee – each of which is further described below.

Governance Committee

Members

Steven P. Rosenberg (Chair)*

Vahe A. Dombalagian

Donald G. Soderquist*

* Joined the Governance Committee on September 1, 2013.

Mr. Benjamin Chereskin was a member of the Governance Committee until August 31, 2013.

The Governance Committee is composed solely of directors who satisfy all criteria for independence under the rules of the NYSE. The Governance Committee is governed by the Governance Committee Charter setting forth the purpose and responsibilities of this committee.

Functions

The functions of the Governance Committee include the following:

| • | identifying individuals qualified to become Board members and evaluate candidates for Board membership, including those recommended by stockholders in compliance with the Company’s by-laws; |

| • | recommending to the Board the director nominees for election or to fill any vacancies and newly created directorships on the Board; |

| • | identifying and recommending to the Board members qualified to fill any vacancies on a committee of the Board; |

| • | developing and recommending to the Board a set of corporate governance guidelines and reviewing and reassessing the adequacy of such guidelines at least annually; |

| • | overseeing the Board’s annual self-evaluation process and the Board’s evaluation of management; |

| • | periodically reviewing the criteria for the selection of new directors to serve on the Board and recommending any proposed changes to the Board for approval; |

| • | periodically reviewing and making recommendations regarding the composition and size of the Board; |

| • | periodically reviewing and making recommendations regarding the composition, size, purpose, structure, operations and charter of each of the Board’s committees, including the creation of additional committees or elimination of existing committees; |

| • | annually recommending to the Board the chairpersons and members of each of the Board’s committees; |

| • | conducting an annual performance evaluation of the Governance Committee; and |

| • | reviewing and reassessing the adequacy of the Governance Committee Charter on an annual basis and recommend any proposed changes to the Board for approval. |

24

Director Nominations

The Governance Committee considers candidates recommended by our stockholders. To recommend a candidate for election to the Board for the 2015 annual meeting of stockholders, a stockholder must submit the following information to the Company Secretary no later than 90 and no earlier than 120 days in advance of the anniversary date of this Annual Meeting:

| • | the name and address of the stockholder of record and the beneficial owner, if any, on whose behalf the proposal is made; |

| • | a representation that the stockholder intends to appear in person or by proxy at the annual meeting; |

| • | the number of shares of capital stock of the Company that are owned beneficially and of record by such stockholder and the beneficial owner, if any, on whose behalf the nomination is made; |

| • | a description of any arrangements or understandings between the stockholder, the beneficial owner and the nominee or any other person (including their names); |

| • | the name, age, business and residential addresses of the stockholder’s nominee for director; |

| • | the biographical and other information about the nominee (including the number of shares of capital stock of the Company owned beneficially or of record by the nominee) that would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC; and |

| • | the nominee’s consent to be named as a nominee and to serve on the Board. |

Candidates recommended by stockholders will be evaluated under the same process as candidates recommended by existing directors and the Chief Executive Officer.

As provided in the Company’s Corporate Governance Guidelines, nominees will be selected based on, among other things, consideration of the following factors:

| • | wisdom and integrity; |

| • | experience; |

| • | skills in understanding finance and marketing; |

| • | educational and professional background; and |

| • | sufficient time to devote to the affairs of the Company. |

In considering whether to nominate directors who are eligible to stand for election or re-election, the Governance Committee considers the director’s personal and professional ethics, integrity, practical wisdom, judgment, training and expertise that will be beneficial to the Company and complementary to the background and experience of other Board members, willingness to devote required amount of time to carry out Board responsibilities, commitment to serve on the Board for several years to develop knowledge about the Company, willingness to represent the interest of all stockholders and objectively appraise management performance.

Meetings: The Governance Committee held one (1) meeting during 2013.

Audit Committee

Members

Carlos M. Sepulveda (Chair)

Steven P. Rosenberg

Peter R. Ezersky

Each of the Audit Committee members satisfies the standards for independence of the NYSE and the SEC as they relate to audit committees. Our Board has determined that each member of the Audit Committee is

25

financially literate and that Mr. Sepulveda, a licensed certified public accountant with extensive public company accounting experience, qualifies as an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC. Please refer to Mr. Sepulveda’s biography on page 17 under Item 1 for further information regarding his qualifications to be an “audit committee financial expert”.

The Audit Committee is governed by the Audit Committee Charter which sets forth the purpose and responsibilities of this committee.

Functions

The functions of the Audit Committee include the following:

| • | assisting the Board in its oversight responsibilities regarding (1) the integrity of our financial statements, (2) our risk management compliance with legal and regulatory requirements, (3) our systems of internal control and (4) our accounting, auditing and financial reporting processes generally, including the qualifications, independence and performance of the independent registered public accountants; |

| • | approving the report required by the SEC for inclusion in our annual proxy or information statement; |

| • | appointing, retaining, compensating, evaluating and replacing our independent registered public accountants; |

| • | approving audit and non-audit services to be performed by the independent registered public accountants; |

| • | establishing procedures for the receipt, retention and resolution of complaints regarding accounting, internal control or auditing matters submitted confidentially and anonymously by employees through the whistleblower hotline; and |

| • | performing such other functions as the Board may from time to time assign to the Audit Committee. |

Further, the Board has delegated its authority to approve related party transactions to the Audit Committee.

Meetings: The Audit Committee held five (5) meetings and took action by written consent on two (2) occasions during 2013.

Approval of Audit and Non-Audit Services

The Audit Committee approves all audit and permissible non-audit services (including the fees and terms of the services) performed for the Company by its independent registered public accounting firm prior to the time that those services are commenced. The Audit Committee may, when it deems appropriate, form and delegate this authority to a sub-committee consisting of one or more Audit Committee members, including the authority to grant pre-approvals of audit and permitted non-audit services. The decision of such sub-committee is presented to the full Audit Committee at its next meeting. The Audit Committee pre-approved all fees for 2013 noted in the table below.

26

Fees Paid to Independent Registered Public Accounting Firm

We paid the following fees to Deloitte for professional and other services rendered by them during fiscal years ended 2013 and 2012, respectively:

| Fees | 2013 | 2012 | ||

|

Audit |

$2,100,993 | $1,930,598 | ||

|

Audit Related |

$- | $- | ||

|

Tax(1) |

$ 156,934 | $ 262,320 | ||

|

Other |

$- | $- | ||

|

Total |

$2,257,927 | $2,192,918 |

(1) Fees primarily include transfer pricing studies and tax compliance services.

Audit Committee Report

Our committee has reviewed and discussed with management the Company’s audited financial statements for the 2013 fiscal year. We have discussed with Deloitte the matters required to be discussed by the Statement on Auditing Standard No. 16, Communications with Audit Committees, and Related and Transitional Amendments to PCAOB Standards. We have received the written disclosures and the letter from Deloitte as required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and have discussed with Deloitte its independence. Based on the review and discussions referred to above, we recommended to the Board that the audited financial statements for the Company be included in the Company’s 2013 Form 10-K for filing with the SEC.

Respectfully submitted,

Carlos M. Sepulveda (Chair)

Steven P. Rosenberg

Peter R. Ezersky

Compensation Committee

Members

Peter R. Ezersky (Chair)*

Vahe A. Dombalagian

Donald G. Soderquist*

Roger T. Staubach*

* Joined the Compensation Committee on September 1, 2013.

Mr. Benjamin Chereskin was a member of the Compensation Committee until August 31, 2013.

Each of the Compensation Committee members qualify as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and “non-employee directors” within the meaning of Rule 16b-3 promulgated under Section 16 of the Exchange Act. The Compensation Committee is governed by the Compensation Committee Charter which sets forth the purpose and responsibilities of this committee.

Functions

The functions of the Compensation Committee include the following:

| • | making recommendations to the Board on the Company’s general compensation philosophy and objectives and on all matters of policy and procedures relating to executive compensation; |

27

| • | reviewing and approving corporate goals and objectives relevant to the chief executive officer’s compensation, and determining and approving the chief executive officer’s compensation level; |

| • | determining and approving the compensation of the other executive officers; |

| • | administering (to the extent such authority is delegated to the Compensation Committee by the Board) the incentive compensation and equity-based plans and recommending to the Board any changes with respect to and any modifications of such plans; |

| • | confirming the achievement of performance levels under the Company’s incentive compensation plans; |

| • | reviewing, recommending, and discussing with management the Compensation Discussion and Analysis section included in the Company’s annual proxy statement; and |

| • | developing a succession planning program for the Chief Executive Officer and senior management; |