serves as principal liaison between the non-management directors and Company management. In consultation with the Chairman and the CEO, the Lead Director approves meeting schedules, agendas and the information provided to the Board. If requested by stockholders and as appropriate, the Lead Director will also be available, as the Board’s liaison, for consultation and direct communication.

Separation of Chairman and CEO Roles

Although the Board does not have a formal policy on separation of the roles of the CEO and Chairman, we have kept these positions separate since 2007. Separating the Chairman and CEO roles allows us to develop and implement corporate strategy that is consistent with the Board’s oversight role, while facilitating strong day-to-day executive leadership. Mr. Mitchell provides leadership to the Board by chairing meetings, organizing directors and facilitating Board deliberations.

The Board believes that its leadership structure is appropriate for Cinemark. Through the role of the Lead Director, the independence of the Board’s standing committees, and the regular use of executive sessions of the non-management directors, the Board is able to maintain independent oversight of risks to our business, our long-term strategies, annual operating plan, and other corporate activities. These features, together with the role and responsibilities of the Lead Director described above, ensure a full and free discussion of issues that are important to Cinemark’s stockholders. At the same time, the Board is able to take advantage of the unique blend of leadership, experience and knowledge of our industry and business that Mr. Mitchell and Mr. Gamble separately bring to the table.

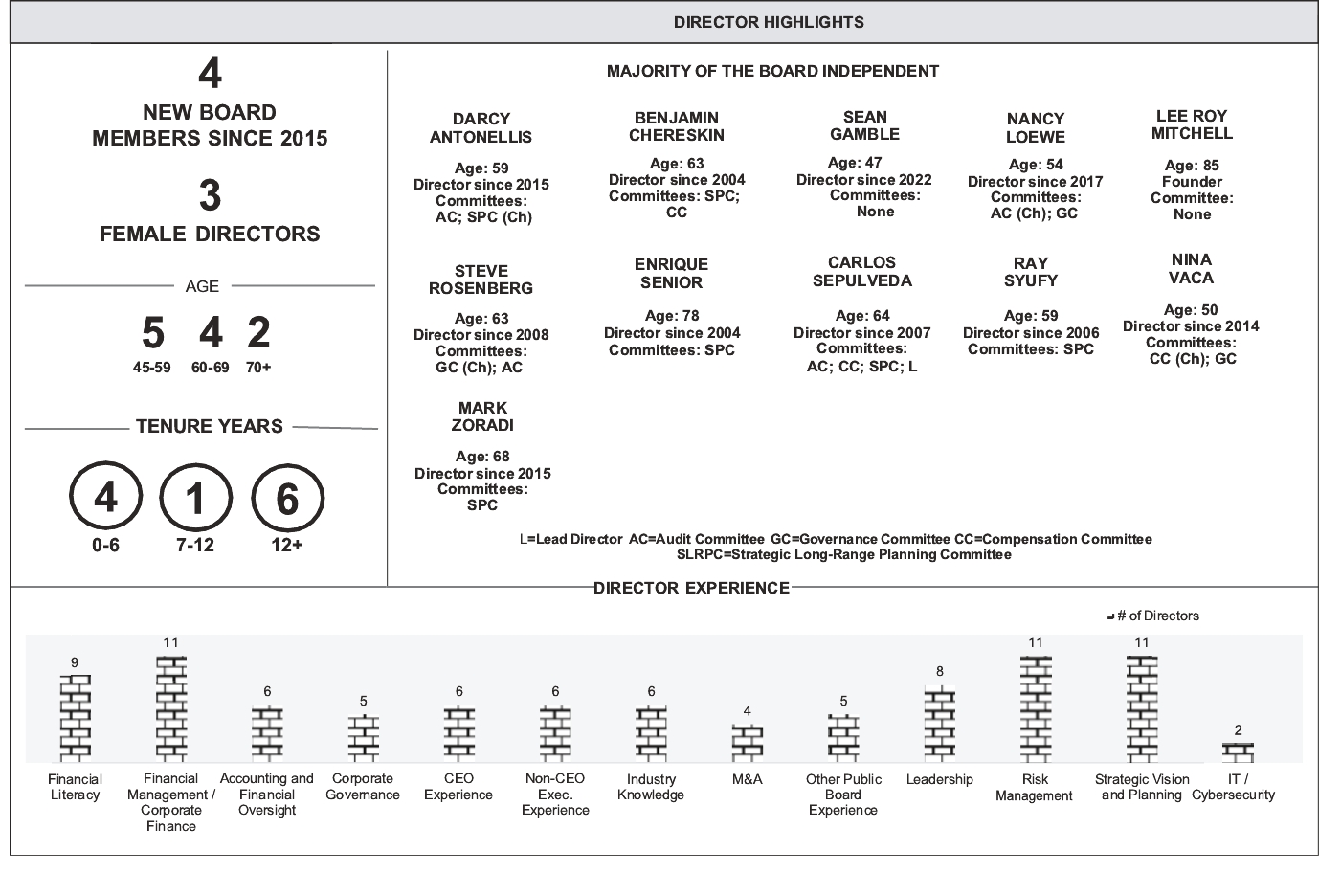

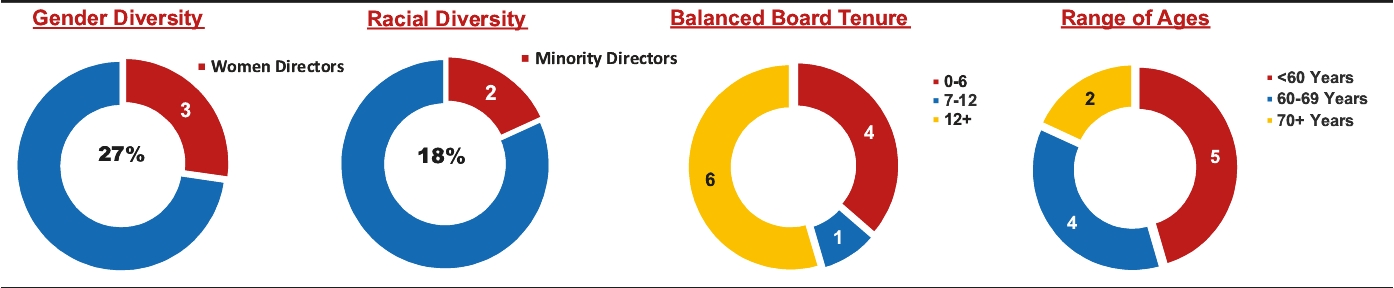

The majority of our Board is independent with 7 out of 11 directors being independent. Our Board has independently determined the independence of 7 directors taking into consideration the independence requirements of the New York Stock Exchange (NYSE) listing standards. The test for independence under the NYSE listing standards is whether the director:

1. is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company;

2. has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service);

3. (a) is a current partner or employee of a firm that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such firm and personally works on the Company’s audit; or (d) is or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;

4. is, or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or has served on that company’s compensation committee; or

5. is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues.

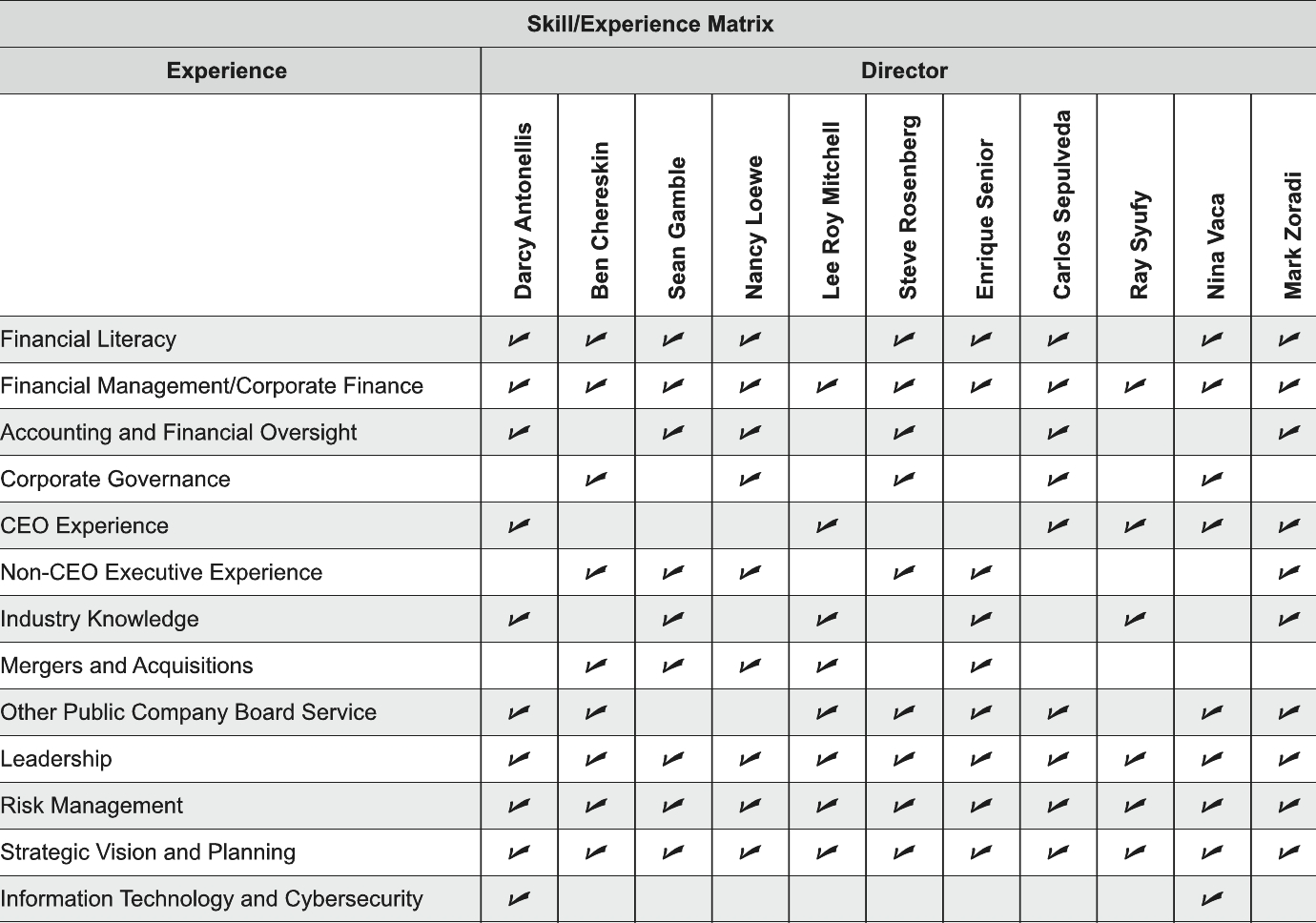

The Board, in coordination with our Governance Committee, and assistance of the Company’s general counsel, evaluated the NYSE bright-line tests and considered the transactions reported under the Certain Relationships and Related Party Transactions and other relevant factors to determine the independence of the Board members. On the basis of this review, the Board affirmatively determined, in its business judgment, that (a) the majority of the Board was, and continues to be, independent, (b) each of Mmes. Antonellis, Loewe and Vaca and Messrs. Chereskin, Rosenberg, Senior and Sepulveda are independent, (c) Messrs. Mitchell and Syufy are not independent due to their transactions with the Company exceeding $120,000 annually, (d) Messrs. Mitchell, Zoradi and Gamble are not independent because they