UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

INFORMATION REQUIRED IN THE PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12. |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

LETTER FROM OUR PRESIDENT AND CEO |

|

Dear Fellow Stockholders:

The enduring and timeless appeal of shared, cinematic experiences that are unique and exclusive to movie theaters was reaffirmed once again in 2024. Confronted with significant headwinds imposed by the prior year’s strikes in Hollywood, North American industry box office reached approximately $8.8 billion, which meaningfully surpassed expectations and climbed to within 3% of 2023’s results. Throughout the year, audiences showcased their sustained enthusiasm for being immersed in captivating stories and events on a grand, larger-than-life scale with cutting-edge sight and sound technology. As a growing volume of compelling films were released to the big screen, moviegoing momentum surged, delivering multiple record-breaking results and a series of new franchise installments that outperformed their predecessors.

Against this backdrop of better-than-expected industry performance, our exceptional Cinemark team achieved outsized results, extending our domestic box office outperformance trend to 14 of the past 16 years. We entertained more than 201 million moviegoers across our global footprint, generated revenue of more than $3 billion dollars, including all-time high food and beverage sales, and delivered $590 million dollars of Adjusted EBITDA. Furthermore, we maintained a solid 19.4% Adjusted EBITDA margin that was flat year-over-year despite a 4% decline in attendance, and we produced strong free cash flow of $315 million dollars as we further fortified our balance sheet.

Our robust 2024 operating results were the byproduct of diligent in-year execution, as well as the impact of our ongoing strategic initiatives to further elevate the experiences we provide our guests, build audiences, grow new sources of revenue, streamline processes, and optimize our theater footprint. These successes continue to be propelled by the meticulous focus of Cinemark’s executive leadership team, the valuable oversight of our Board of Directors, and the tireless commitment of our more than 25,000 team members across the U.S. and Latin America.

The advancement of our strategic initiatives over the past several years has helped us to establish a distinguished and advantaged market position that we believe will continue to yield significant benefits moving forward. Along these lines, we remain highly optimistic about the future of our company and industry on account of Cinemark’s strength, sustained consumer enthusiasm for the types of experiences we offer, the significant, enhanced value theatrical exhibition provides films and the studios that produce them, and the ongoing recovery of wide release volume into theaters. Moreover, the confidence we have in our company, team, and the direction of our industry led us to recently reinstate our annual cash dividend, which marks another major milestone in our recovery from the pandemic and reflects our ongoing commitment to creating long-term value for all Cinemark shareholders.

Thank you for your continued support, trust, and investment in Cinemark. We invite you to join us for our 2025 Annual Meeting of Stockholders at 3800 Dallas Parkway, Plano, Texas 75093 on May 15, 2025, and we look forward to your participation.

YOUR VOTE IS VERY IMPORTANT TO US.

Whether or not you plan to attend the Annual Meeting, I urge you to please cast your vote as soon as possible via the internet, telephone or mail.

Sincerely, |

|

|

Sean Gamble |

President and Chief Executive Officer

|

* Cinemark has presented supplemental non-GAAP financial measures as part of this Proxy Statement. Definitions of each non-GAAP measure and a reconciliation of each non-GAAP financial measure with the most comparable GAAP measure are set forth in Annex A. The non-GAAP financial measures presented in this Proxy Statement should not be considered as alternative measures for the most directly-comparable GAAP financial measures. The non-GAAP financial measures presented in this Proxy Statement are used by management to monitor the financial performance of the business, inform business decision-making and forecast future results.

Notice of Annual Meeting

of Stockholders

DATE & TIME

Thursday, May 15, 2025 8:30 am CDT

|

PLACE

Cinemark West Plano & XD Theater 3800 Dallas Parkway Plano, Texas 75093

|

RECORD DATE

All stockholders of record of the Company’s common stock at the close of business on March 20, 2025, are entitled to vote at the meeting and any postponements or adjournments of the meeting. |

Voting Matters

|

Board’s Recommendation |

Page Reference |

|

|

|

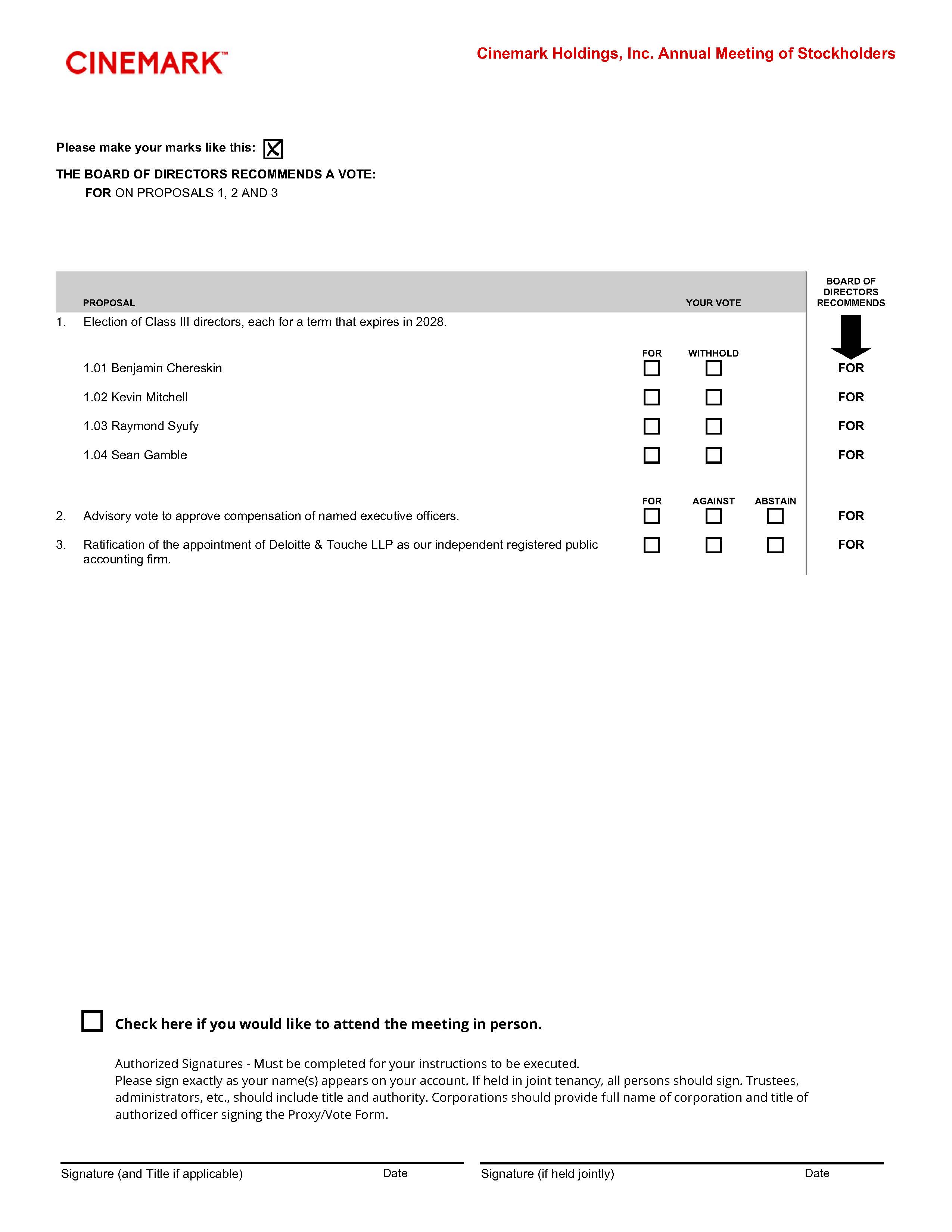

1 Election of Class III directors, each for a term that expires in 2028. |

FOR each nominee |

Page 9 |

|

|

5 |

2 Advisory vote to approve compensation of named executive officers. |

FOR |

Page 29 |

|

|

|

3 Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm. |

FOR |

Page 54 |

|

|

|

|

|

|

|

|

|

We are holding our 2025 Annual Meeting of Stockholders (the “Annual Meeting”).

You will be able to attend the Annual Meeting in person and vote your shares. Even if you do not attend the Annual Meeting, it is important that your shares are represented. Therefore, we urge you to promptly vote and submit your proxy before the Annual Meeting.

By order of the Board of Directors,

Michael Cavalier EVP – General Counsel & Business Affairs, Secretary |

|

VOTING YOUR SHARES Your vote is important! Please act as soon as possible to vote your shares, even if you plan to attend the Annual Meeting in person. If you are a beneficial stockholder, your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented during the meeting unless you have given your broker specific instructions to do so. Stockholders of record can vote by: |

|

|

TELEPHONE 1.866.503.2691 |

||

|

INTERNET www.proxypush.com/cnk |

||

|

Return the signed proxy card. |

||

|

|

||

|

|

||

Table of Contents

3 |

|

38 |

||

|

|

|

39 |

|

5 |

|

40 |

||

5 |

|

41 |

||

Item 2: Advisory Vote to Approve Compensation of Named Executive Officers |

5 |

|

42 |

|

|

|

43 |

||

6 |

|

43 |

||

|

|

|

|

|

7 |

|

46 |

||

7 |

|

46 |

||

7 |

|

|

||

9 |

|

46 |

||

13 |

|

|

||

17 |

|

47 |

||

20 |

|

|

||

20 |

|

48 |

||

20 |

|

48 |

||

20 |

|

49 |

||

21 |

|

52 |

||

21 |

|

|

|

|

22 |

|

|

|

|

23 |

|

|

||

23 |

|

52 |

||

24 |

|

|

|

|

|

|

|

||

24 |

|

54 |

||

25 |

|

54 |

||

|

|

|

|

|

25 |

|

|

||

25 |

|

55 |

||

25 |

|

|

|

|

26 |

|

57 |

||

26 |

|

57 |

||

26 |

|

58 |

||

26 |

|

59 |

||

26 |

|

|

||

27 |

|

60 |

||

27 |

|

|

|

|

27 |

|

61 |

||

28 |

|

61 |

||

|

|

|

61 |

|

29 |

|

|

||

|

|

|

A-1 |

|

29 |

|

|

|

|

Item 2: Advisory Vote to Approve Compensation |

29 |

|

|

|

30 |

|

|

|

|

30 |

|

|

|

|

31 |

|

|

|

|

32 |

|

|

|

|

33 |

|

|

|

|

35 |

|

|

|

|

36 |

|

|

|

|

37 |

|

|

|

|

37 |

|

|

|

|

38 |

|

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 2 |

ATTEND THE ANNUAL MEETING

You may attend the Annual Meeting in person or vote your shares electronically at the website listed below using the control number included in your Notice of Internet Availability of Proxy Materials ("Notice") on your proxy card or on any additional voting instructions accompanying these proxy materials.

This Notice will first be sent to stockholders, and this proxy statement and the form of proxy relating to our 2025 Annual Meeting will first be made available to stockholders, on or about April 2, 2025. In accordance with SEC rules, the website www.proxypush.com/cnk provides complete anonymity with respect to stockholders accessing the website.

LOGISTICS

2024 PERFORMANCE Highlights

Cinemark’s 2024 results outpaced industry and peer performance, driven by an intense focus on effectively navigating the dynamic ebbs and flows of film release volume throughout the year, while simultaneously advancing a wide range of strategic initiatives geared toward positioning our company for future success. The many actions we have pursued to enhance the experiences we provide our guests, build audiences, establish new growth channels, strengthen our operating capabilities, optimize our circuit, and bolster our financial position, are delivering significant impact. We believe Cinemark is well-positioned because of these strategic initiatives, and we maintain an advantaged market position as we move ahead.

Some of our significant 2024 accomplishments include:

Continued to effectively navigate our industry’s extended recovery

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 3 |

Expanded our content pipeline and audiences

Further evolved Cinemark for future growth and stability

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 4 |

pROXY SUMMARY: 2025 Proposals

This summary highlights information contained elsewhere in this proxy statement. You should read the entire proxy statement and our Annual Report on Form 10-K before voting.

ITEM 1 |

Election of Directors |

|

|

The Board recommends a vote FOR each director nominee.

|

See page 9 |

|

Nominee |

Independent |

|

Age |

Director Since |

|

Committee Membership |

||||

|

AC |

CC |

NGC |

SPC* |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benjamin Chereskin |

✓ |

|

66 |

2004 |

|

|

✓ |

|

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Mitchell |

|

|

56 |

2023 |

|

|

|

|

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Raymond Syufy |

|

|

62 |

2006 |

|

|

|

|

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sean Gamble |

|

|

50 |

2022 |

|

|

|

|

|

|

*AC = Audit Committee |

CC = Compensation Committee |

NGC = Nominating & Corporate Governance Committee |

SPC = Strategic Planning Committee |

ITEM 2 |

Advisory Vote to Approve Compensation of

|

|

The Board recommends a vote FOR this proposal. |

See page 29 |

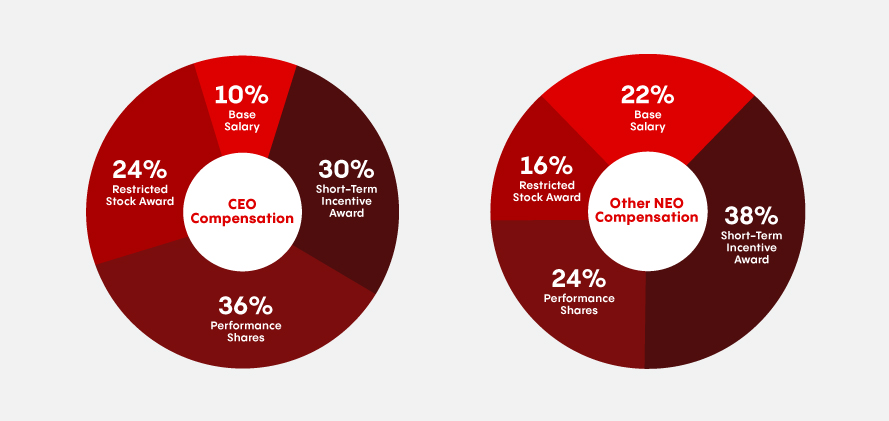

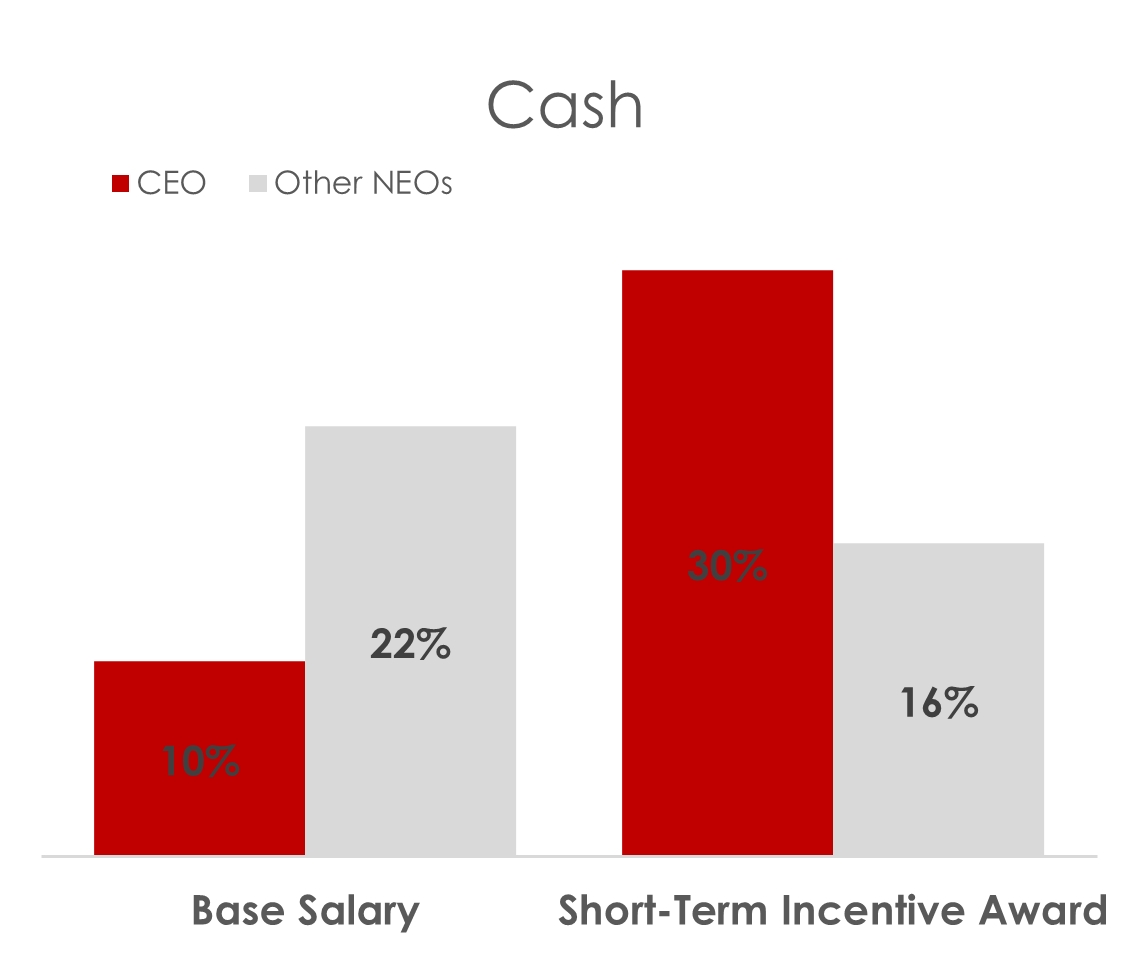

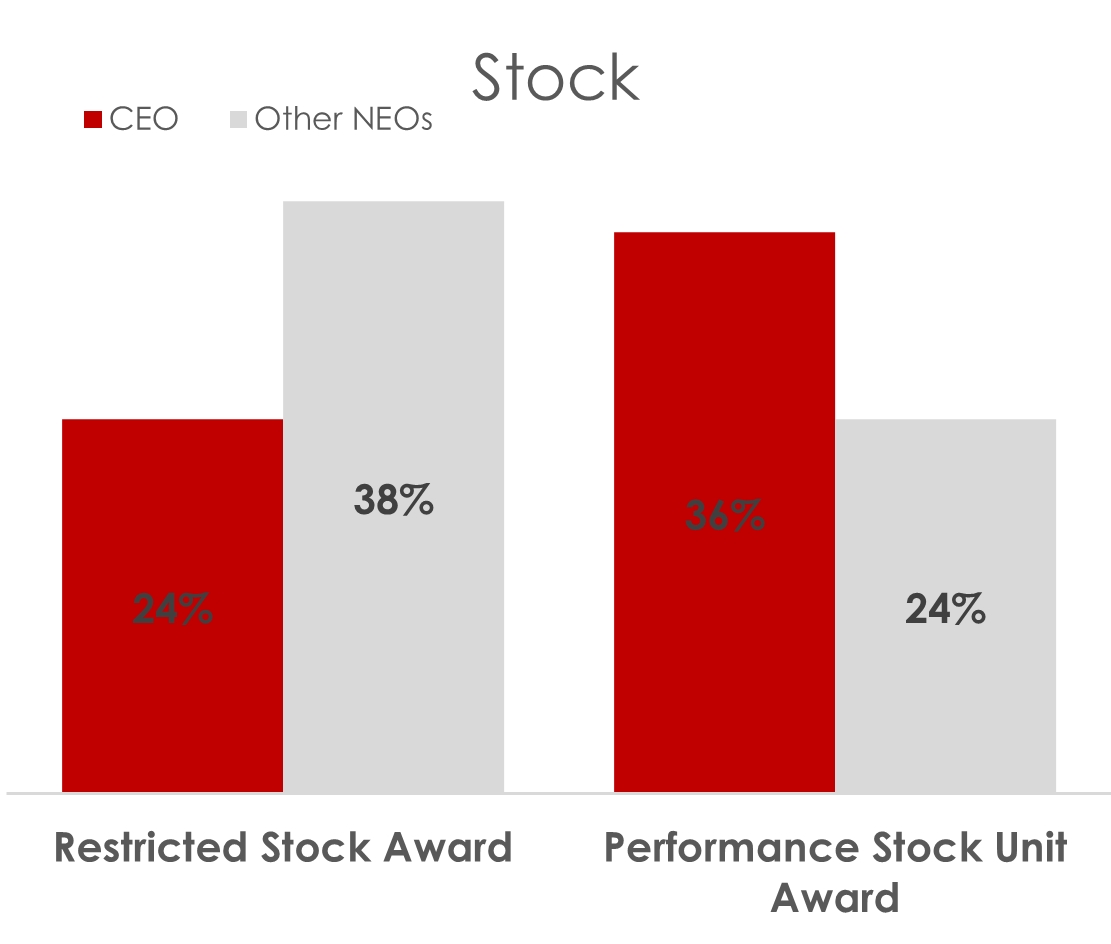

We structure our executive compensation program to attract, motivate, reward and retain high caliber talent who will lead the Company to deliver sustainable profitability and increase our competitive advantage by building a solid foundation for long-term growth while consistently achieving strong near-term results. To appropriately incentivize our key executives to deliver our mission and vision, the Compensation Committee designed an executive compensation program that strongly aligns with the interests of stockholders in creating long-term value by directly linking executive compensation to Company and individual performance.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 5 |

The mix of pay elements motivates our executives to guide and evolve the Company by offering short-term and long-term incentive awards that are both time and performance-based, each of which aligns the interests of our executives with our stockholders and encourages focus on long-term growth. As illustrated above, a considerable portion of the compensation payable to our named executive officers is “pay-at-risk” with 60% of the long-term incentive in the form of Performance Share Awards.

ITEM 3 |

Ratification of Independent Registered Public Accounting Firm

|

|

The Board recommends a vote FOR this proposal. |

See page 54 |

The Audit Committee evaluates the independence of Deloitte & Touche LLP and its fees annually. The Board believes the continued retention of Deloitte & Touche LLP is in the best interests of the Company and its stockholders.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 6 |

CORPORATE GOVERNANCE

Item 1: Election of Class III Directors

Our Board is comprised of 11 members, the majority of whom are independent. Board size is determined exclusively by the Board as provided in our Certificate of Incorporation. Our Board consists of three classes of directors, designated as Class I, Class II and Class III. The members of each class are elected to serve a three-year term, with the term of each class ending in successive years.

The term of the current Class III directors, Messrs. Chereskin, Mitchell, Syufy and Gamble, expire at the Annual Meeting. All nominees have been recommended by the Nominating and Corporate Governance Committee (“Governance Committee”) and nominated by the Board for re-election at the Annual Meeting.

Messrs. Chereskin, Mitchell, Syufy and Gamble have consented to be nominated for re-election to the Board as a Class III director. If elected, they will serve on the Board for a three-year term expiring on the date of our 2028 annual meeting of stockholders. At this time, we have no reason to believe that any nominee will be unable or unwilling to serve if elected. However, should any of them become unable or unwilling to serve before the Annual Meeting, your proxy card authorizes us to vote for a replacement nominee if the Board names one.

|

The Board recommends a vote FOR each director nominee. |

BOARD COMPOSITION

Director Skills and Qualifications

The nominees and continuing members of the Board possess a deep understanding of our industry and the Company, which allows them to provide the strategic stability and continuity necessary to guide the Company to achieve sustainable growth and reach its long-term goals. The mix of tenure among our Board members enhances the Company's performance and resilience by providing diverse perspectives and balanced governance. Recent examples of the Board's leadership strengths are the Company's ability to successfully navigate the challenges of both the COVID-19 pandemic and the 2023 Hollywood strikes.

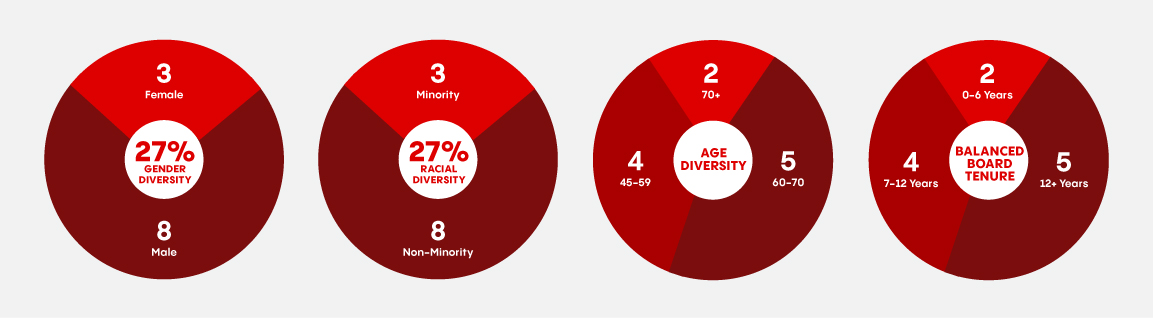

Our nominees and directors also possess broad-based business knowledge, outstanding achievement in their professional careers, a commitment to ethical values, executive leadership experience and meet the Company’s articulated director qualifications, including independence, accountability, integrity, sound judgment and diversity of background. In addition, our nominees and directors have demonstrated experience and expertise across a number of substantive areas relevant to the Company, such as theater and retail operations; e-commerce; strategic planning; real estate; risk management; legal, compliance and regulatory matters; mergers and acquisitions; and finance. Our Board reflects a diversity of experience in varying substantive areas relevant to our operations and industry, as well as background, gender, race and age. The following summarizes certain aspects of the Board’s current composition:

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 7 |

The following matrix provides information regarding the members of our Board, including certain types of skills, experience and attributes that our Board believes are relevant to our business. The

matrix does not encompass all of the skills or experience of our directors.

DIRECTOR QUALIFICATIONS AND EXPERIENCE

|

|||||||||||

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Benjamin |

Kevin |

Raymond |

Sean |

Nancy |

Steven |

Enrique |

Nina |

Darcy |

Carlos |

Mark |

|

|

|

|

|

|

|

|

|

|

|

|

Accounting and Oversight |

|

|

|

✓ |

✓ |

✓ |

|

|

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

CEO Experience |

|

✓ |

✓ |

✓ |

|

|

|

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Governance |

✓ |

|

|

|

✓ |

✓ |

|

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Experience |

✓ |

|

|

|

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Literacy |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Financial Management/ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Human Capital Management |

|

✓ |

✓ |

✓ |

|

|

|

✓ |

✓ |

|

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Industry Experience |

|

✓ |

✓ |

✓ |

|

|

✓ |

|

✓ |

|

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Information Technology |

✓ |

|

|

|

✓ |

✓ |

|

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mergers and Acquisitions |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Public Company |

✓ |

|

|

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Vision and Planning |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 8 |

class iii director nominees

Standing for Election

Benjamin Chereskin |

|||

Committee Membership: • Compensation • Strategic Planning Director Since: 2004 Age: 66 Previous Board Boulder Brands, Inc. (NASDAQ: BDBD) (2013-2016)

(NASDAQ: CDW (2008-2020) Education: MBA, Harvard Business School BA, Harvard College Nominee of: Board |

Key Qualifications Mr. Chereskin has consistently provided strategic leadership on key investment considerations and has been instrumental in guiding the Company's capital allocation priorities through variable economic cycles and industry challenges. His extensive experience in strategic growth, coupled with his substantial industry knowledge gained over years of service on our Board, has allowed him to provide the guidance and oversight necessary for the Company to achieve both its short-term and long-term goals.

Professional Highlights Profile Capital Management LLC - an investment management firm • President (2009-present) • Founder (2009)

Madison Dearborn Partners, LLC - a private equity firm • Managing Director (1993-2009) • Co-Founder (1993)

|

Select Skills Financial Oversight - Mr. Chereskin possesses extensive expertise in financial stewardship, demonstrated through his ability to navigate complex financial landscapes and ensure the Company's fiscal health. His deep understanding of capital allocation, strategic growth and risk management has been instrumental in guiding the Company through various economic cycles. Additionally, his experience in mergers and acquisitions, as well as strategic, intrinsic growth from his decades-long management of a variety of private equity portfolio companies, has provided invaluable insights that contribute to the Company's long-term financial stability and success.

Executive Leadership - As the founder and leader of two successful firms, Mr. Chereskin brings extensive leadership experience to the Company. His deep understanding of executive compensation and succession planning gained through years of hands-on experience, provides critical perspectives that have helped guide the Company. His proven track record in building and managing successful organizations underscores his ability to offer executive leadership necessary for the Company’s continued growth and success. |

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 9 |

Kevin Mitchell |

|||

Committee Membership: • Strategic Planning Director Since: 2023 Age: 56 Education: BA, University of Texas at Austin Nominee: Mr. Mitchell is a nominee of Mitchell Investors and the son of Cinemark's founder, Lee Roy Mitchell.

|

Key Qualifications Mr. Mitchell brings industry insight and leadership to our Board, having founded and managed his own motion picture exhibition company and a film distribution company. Early in Mr. Mitchell's career, he worked for Cinemark Theatres, in various operations, film licensing and real estate roles.

Mr. Mitchell's extensive industry knowledge is further enhanced by his service as an advisory board member for the National Association of Theatre Owners.

Mr. Mitchell has also served on the Board of Will Rogers Motion Picture Pioneers Foundation, Variety the Children’s Charity of Texas and Chuck Norris’ Kickstart Kids.

Professional Highlights ShowBiz Direct Distribution - a motion picture distribution company • Managing Member (2023-Present)

ShowBiz Cinemas - a motion picture theatrical exhibition company • Managing Member (2007-2021)

|

Select Skills CEO Experience - Mr. Mitchell's CEO experience provides him with the strategic vision and leadership, operational efficiency and adaptability and problem-solving skills needed to guide our Company. As a CEO for almost two decades, he brings unique insights and perspectives on executive leadership and human capital management.

Industry Experience - Mr. Mitchell's experience leading a motion picture exhibition company for almost two decades and his recent experience leading a film distribution company, along with his previous roles at Cinemark, give him direct industry knowledge and experience to guide our Company in areas such as operations and real estate. In addition, Mr. Mitchell's experience and relationships with motion picture studios enhances Cinemark's strategic partnerships.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 10 |

Raymond Syufy |

|||

Committee Membership: • Strategic Planning Director Since: 2006 Age: 62 Education: MBA, University of San Francisco BA, St. Mary's College of California Nominee of: Board |

Key Qualifications Mr. Syufy is an experienced executive with a rich history in the motion picture exhibition industry. Mr. Syufy joined the Board when Cinemark acquired Century Theatres in 2006. He began his work in the motion picture exhibition industry in 1977 for Century. After working in all aspects of Century operations and management, he rose to the CEO and board chair positions.

His knowledge of the industry as a whole and of Cinemark, allows him to guide the strategic direction and governance of our company.

Professional Highlights Syufy Enterprises, Inc. – A retail and real estate holding company with operations in California, Nevada, Arizona, Colorado, and Texas. • CEO (2006-Present)

Century Theatres - a movie exhibition company, acquired by Cinemark is 2006 • CEO and Chairman of the Board of Directors (2006) • President (1991-1995) |

Select Skills CEO Experience - By currently serving as the CEO of a retail and real estate holding company, as well has previously leading Century Theatres, Mr. Syufy is uniquely qualified to understand the opportunities and challenges facing Cinemark and to provide industry-specific guidance to Cinemark's leadership team.

Industry Experience - Mr. Syufy possesses extensive knowledge of the motion picture exhibition industry, having worked in every aspect of the business for thirty years. Mr. Syufy brings to the Board valuable expertise and guidance, helping successfully navigate competition from other forms of entertainment. Additionally, his extensive operational and real estate experience further strengthens our strategic capabilities.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 11 |

Sean Gamble |

|||

Committee Membership: N/A Director Since: 2022 Age: 50 Education: BS, Bucknell University Nominee of: Board |

Key Qualifications Mr. Gamble is an accomplished executive with extensive experience in the motion picture exhibition and entertainment industries. He has served as our President and Chief Executive Officer since January 2022 and has been our President since 2021. Prior to these roles, he was our Chief Operating Officer from 2018 and our Executive Vice President and Chief Financial Officer from 2014 until he became our CEO in 2022.

Before joining Cinemark, Mr. Gamble worked for Comcast Corporation as Executive Vice President and Chief Financial Officer of Universal Pictures within NBCUniversal. He joined Comcast after 15 years at the General Electric Company, where he held multiple senior leadership positions, including CFO of GE Oil & Gas Equipment based in Florence, Italy.

Professional Highlights NBCUniversal – a multimedia conglomerate that was a wholly-owned subsidiary of the General Electric Company until 2011 when it was acquired by Comcast Corporation • EVP, CFO Universal Pictures (2009-2014) • VP, Financial Planning & Analysis, Universal Studios (2004-2007)

The General Electric Company - a multinational conglomerate known for its contributions to technological advancements and its role in shaping modern industry • CFO; GE Oil & Gas Equipment (2007-2009)

|

Select Skills Industry Experience - As a veteran motion picture executive with exhibition and distribution experience, Mr. Gamble has guided the Company through many Company and industry evolutions, including recliner conversion, premium format expansion and the reduction of theatrical release windows. Also, Mr. Gamble led the company during its navigation of the COVID-19 pandemic and 2023 Hollywood strikes, achieving results that beat industry expectations and peer performance.

Strategic Planning - Mr. Gamble is a visionary leader, assessing organizational capabilities and external market conditions to identify opportunities and potential risks and defining clear and measurable objectives that align with our mission and vision. He fosters a culture of accountability and continuous improvement, instrumental in driving the company's strategic vision by enhancing financial discipline while spearheading growth initiatives. He has a proven ability to successfully navigate complex challenges in a competitive industry while focusing on innovation.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 12 |

class i directors

Term Expiring 2026

Nancy Loewe |

|||

Committee Membership: • Audit (Chair & Financial Expert) • Governance Director Since: 2017 Age: 57 Education: MBA, Southern Methodist University BA, Isenberg School of Management, UMass Amherst

Nominee of: Board |

Key Qualifications Ms. Loewe is an accomplished financial executive with over three decades of experience in operational financial management, corporate governance and strategy.

Ms. Lowe is an audit committee financial expert, as defined by SEC rules, and is the chair of the Audit Committee.

Professional Highlights

CelLink – a manufacturer of flex circuits and harnessing for EVs, Aerospace and related industries. • Private Co CFO (2022-Present)

Weyerhaeuser Company – one of the world's largest private owners of timberlands • Public Co CFO (2021-2022)

Visa, Inc. – a multinational payment card services corporation • SVP-Finance (2019-2021)

Kimberly-Clark International – a multinational consumer goods and personal care corporation • International CFO (2014-2017) • Chief Strategy Officer; Kimberly-Clark Corporation (2012-2014) • Corporate Treasurer; Kimberly-Clark Corporation (2011-2013)

Frito Lay North America – a leading manufacturer and marketer of snack foods • CFO (2009-2010)

|

Select Skills Financial and Accounting - Ms. Loewe's experience as CFO at high-profile private and public companies has equipped her with a deep understanding of financial management and financial literacy.

Risk Oversight - Ms. Loewe's decades-long experience in executive leadership finance roles allows her to identify potential risks and implement effective mitigation strategies that have been crucial to Cinemark's success in navigating complex financial landscapes.

Transaction Experience - Ms. Loewe has been significantly involved in executing multiple transactions, including acquisitions, spin-offs, capital transactions, as well as business transformations.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 13 |

Steven Rosenberg |

|||

Committee Membership: • Audit • Governance (Chair) Director Since: 2008 Age: 66 Current Public Company Texas Capital Bancshares, Inc. (NASDAQ: TCBI) (Since 1999) Previous Board PRGX Global, Inc. (NASDAQ: PRGX) (2005-2011)

Reddy Ice (NYSE: FRZ) (1998-2004) Education: BA, University of California, Berkeley

Nominee of: Board |

Key Qualifications Mr. Rosenberg brings a wealth of experience and strategic insight to Cinemark's Board. As the founder and manager of SPR Ventures Inc., and with his extensive background in manufacturing through SPR Packaging LLC, he offers valuable expertise in business operations and investment management that allow him to meaningfully contribute to the Company’s growth and governance.

Mr. Rosenberg has also served on many public company audit committees over the past 35 years.

Mr. Rosenberg is a member of the Audit Committee and chairs the Governance Committee.

Professional Highlights SPR Ventures Inc. – a private investment company, investing in manufacturing, finance, real estate, private equity and other alternative investments • Founder & Manager (1997-Present)

SPR Packaging, LLC - a manufacturer of flexible packaging • President US Division (2015-2018) (after acquisition by Grupo Armando Alverez) • Founder and CEO (2006-2014)

ConAgra Foods - a manufacturer of private label grocery products • President of Arrow Division (1992-1997)

Arrow Industries, Inc. - a manufacturer of private label grocery products • Various leadership roles (1980-1992)

|

Select Skills Financial and Accounting - Mr. Rosenberg's financial and accounting acumen comes from his decades of experience running an investment company. He applies his expertise, along with the industry knowledge gained over his years of service on our Board, to guide Cinemark through times of economic downturn and growth opportunities.

CEO Experience - Mr. Rosenberg has over four decades of CEO and other executive leadership experience in manufacturing and consumer products, including substantial experience leading companies through merges and acquisitions on both the buy-side and sell-side. Mr. Rosenberg's uses this substantial leadership experience to guide the Company and advise management.

Risk Management - Mr. Rosenberg has been instrumental in providing risk management expertise to Cinemark by leveraging his extensive experience in risk management and strategic planning to help the company navigate various challenges, overseeing and advising on risk mitigation strategies, including cybersecurity measures and loss prevention initiatives.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 14 |

Enrique Senior |

|||

Committee Membership: • Strategic Planning Director Since: 2004 Age: 81 Current Public Company Groupo Televisa S.A.B. (NYSE: TV) (Since 2000)

Coca-Cola FEMSA, S.A.B de C.V (NYSE: KOF) (Since 2000)

FEMSA (NYSE: FMX) (Since 2000) Previous Board Univision Communications (NYSE: UNV) (2012-2020) Education: MBA, Harvard Business School BA, Yale University Nominee of: Board |

Key Qualifications Mr. Senior's experience as an investment banker advising high-profile clients in film, media, entertainment and beverage industries, allows him to provide unique insights to guide our Company. Mr. Senior is a highly experienced investment banker with over five decades of expertise in mergers and acquisitions and corporate finance.

Professional Highlights Allen & Company LLC – a boutique investment bank • Managing Director (1972-Present)

|

Select Skills Finance and Capital Allocation - With his extensive background in financial planning and strategic investments, Mr. Senior plays a pivotal role in guiding Cinemark's capital allocation decisions. His experience includes overseeing significant acquisitions and investments, ensuring that the company's resources are optimally utilized to drive growth and shareholder value. By leveraging his deep understanding of financial markets and corporate finance, Mr. Senior helps Cinemark navigate complex financial landscapes, making informed decisions that align with the company's long-term strategic goals. His contributions are vital in maintaining Cinemark's financial health and competitive edge in the industry.

Industry Experience - As managing director of Allen & Company for over five decades, Mr. Senior has advised corporations including Coca-Cola Company, Columbia Pictures, Tri-Star Pictures, CapCities/ABC, General Electric and other entertainment companies. He applies the entertainment and film industry knowledge gained from working with these companies, along with the industry knowledge gained from serving on Cinemark's Board, to guide our company to achieve its strategic initiatives.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 15 |

Nina Vaca |

|||

Committee Membership: • Governance • Compensation (Chair) Director Since: 2014 Age: 53 Current Public Company Comerica, Inc. (NYSE: CMA) (Since 2008) Previous Board Kohls, Corp. (NYSE: KSS) (2010-2019) Education: BA, Texas State University Nominee of: Board |

Key Qualifications Ms. Vaca is an entrepreneur and CEO of the largest Hispanic-owned global workforce solutions company in North America, serving over twenty percent of the Fortune 100. She serves on the Cinemark Board with a dynamic leadership and strategic growth mind set. Her entrepreneurial spirit and commitment to excellence ensure that Cinemark remains competitive in our ever-evolving industry.

Ms. Vaca serves as chair of the Compensation Committee.

Professional Highlights Pinnacle Group, Inc. – a global workforce solutions company • Founder, Chairman & CEO (1996-Present) Presidential Ambassador for Global Entrepreneurship • White House Appointee (2014-Present) Aspen Institute • Henry Crown Fellow (2016 - Present) Council of Foreign Relations • Life Member (2019-Present)

|

Select Skills CEO Experience - Ms. Vaca leverages her extensive CEO experience to provide invaluable insights and strategic guidance to Cinemark's Board of directors. As the CEO and Chairman of Pinnacle Group, she has successfully transformed the company into a leading provider of workforce solutions and IT services. Her dynamic leadership and deep understanding of business operations enable her to contribute effectively to Cinemark's strategic planning and decision-making processes. Ms. Vaca's expertise in scaling businesses, managing large teams, and driving innovation helps Cinemark navigate complex challenges and seize growth opportunities.

Information Technology - With nearly three decades of experience in the technology sector, Ms. Vaca is a recognized leader in leveraging technology to scale businesses and enhance the human experience of work. She is a strong advocate for using technology to drive efficiency, innovation, and meaningful human connection.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 16 |

class Ii directors

Term Expiring 2027

Darcy Antonellis |

|||

Committee Membership: • Audit • Compensation • Strategic Planning (Chair) Director Since: 2015 Age: 62 Current Public Company Xperi (NYSE: XPERI) (Since 2022)

Bango PLC (LSE: PLC) (Since 2023) Previous Board N/A Education: MBA, Fordham University BS, Temple University Nominee of: Board |

Key Qualifications Ms. Antonellis is a highly accomplished executive who brings to our Board extensive experience in the technology, media and telecommunications sectors. She has a proven track record in strategic growth, operational leadership and innovation.

Ms. Antonellis is NACD.DC Directorship Certified and NACD Cybersecurity Oversight Certified. She is a SMPTE Fellow and holds patents in media distribution and audio manipulation.

Ms. Antonellis serves as the Chair of our Strategic Planning Committee.

Professional Highlights

ABS Capital Partners - a firm focused on emerging growth software and tech-enabled services with data foundations • Operating Advisor (2023-Present)

Amdocs Inc. (NASDAQ: DOX) - a leading software and services company to communications, media, financial and digital enterprises • Executive Advisor (2021-2023) • Division President (2018-2021)

Vubiquity - a provider of content monetization, distribution and processing technology used by entertainment and media companies • CEO (2014-2018)

Warner Bros Entertainment Inc. - a major motion picture studio and global leader in the entertainment industry • President, Technical Operations and Chief Technology Officer (2004-2014) • Executive Vice President/Corporate Senior Vice President (2003 - 2008) • Senior Vice President (1998 - 2003)

|

Select Skills Industry Experience - Ms. Antonellis brings a wealth of experience from the film industry to her role on Cinemark's Board. With a distinguished career that includes serving as President of Technical Operations and Chief Technology Officer at Warner Bros., she has been at the forefront of technological innovation in media and entertainment. Her expertise in digital distribution, content protection, and anti-piracy measures has been instrumental in shaping industry standards. At Cinemark, she leverages this extensive background to provide strategic insights and guidance, helping the company enhance its technological capabilities and improve operational efficiencies. Ms. Antonellis's deep understanding of the film industry's technical and operational aspects ensures that Cinemark remains a leader in delivering high-quality cinematic experiences.

Critical Technology/Cybersecurity Expertise - Ms. Antonellis led global technical operations and technology strategy for a major film studio, playing a key role in the digital transformation of the company's operations. She brings this expertise to the Cinemark Board, advising on all technical aspects of our company, including technological innovations, artificial intelligence and cybersecurity risk mitigation.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 17 |

Carlos Sepulveda Independent Chairman |

|||

Committee Membership: ▪ Audit ▪ Compensation ▪ Strategic Planning Director Since: 2007 Age: 67 Current Public Company Triumph Financial, Inc. (NASDAQ: TFIN) Previous Board Matador Resources Company (NYSE: MTDR) (2013-2017) Education: BA, University of Texas at Austin Nominee: Mr. Sepulveda is a nominee of Mitchell Investors.

|

Key Qualifications Mr. Sepulveda has served as Cinemark’s Board Chair since 2022, contributing critical institutional understanding of our industry’s business lifecycle and strategies that remain resilient through variable macroeconomic conditions. His career as a financial executive and advisor, along with his experience serving on public company boards, provides invaluable financial oversight and strategic counsel to Board discussions on investment strategies and shareholder value creation opportunities.

Mr. Sepulveda is a certified public accountant (CPA) and current member of the American Institute of CPAs and Texas Society of CPAs. Mr. Sepulveda is an audit committee financial expert, as defined by SEC rules.

Professional Highlights Interstate Batteries – an automotive and commercial battery distributor • President and CEO (2004-2013) • EVP (1995-2004) • EVP and CFO (1993-1995) • VP and CFO (1990-1993)

KPMG Peat Marwick – a professional audit, assurance and tax advisory firm • Associate SEC Partner (1979-1990)

|

Select Skills Financial and Accounting – Mr. Sepulveda acquired over a decade of experience serving as Audit Partner at a leading professional services firm, where he supported numerous public companies in navigating complex financial reporting matters, in addition to his subsequent service as a CFO in a private company.

CEO / Executive Leadership – Mr. Sepulveda has over two decades of experience in various executive leadership roles, including as CEO and CFO, at a battery distribution company, where he guided the company’s transformation to expand customer offerings in response to the market’s energy transition and shifting customer preferences.

Strategic Planning – As a longstanding director, Mr. Sepulveda has overseen Cinemark’s strategic growth through our evolving capital allocation priorities, investment considerations and global expansion efforts. He brings a strong understanding of market trends and our competitive landscape that he analyzes and applies through a pragmatic focus.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 18 |

Mark Zoradi |

|||

Committee Membership: • Strategic Planning Director Since: 2015 Age: 71 Previous Board National CineMedia, Inc. NASDAQ: NCMI (2014-2021) Education: MBA, University of California Los Angeles Graduate School of Management

Nominee of: Board |

Key Qualifications Mr. Zoradi is a 40+ year veteran of the entertainment industry and served as our CEO from 2015 to 2021. Through his direct experience leading our company, as well as leading major motion picture studios and a film marketing and distribution company, he provides key leadership and strategic insights for the achievement of our short-term and long-term objectives.

Prior to joining Cinemark, Mr. Zoradi served in a variety of positions of increasing responsibility with The Walt Disney Company, including as the General Manager of Buena Vista Television and President of Buena Vista International with responsibility for the international theatrical and home entertainment marketing and distribution of Disney, Touchstone and Pixar films. Mr. Zoradi also served as the President and Chief Operating Officer (COO) of Dick Cook Studios from 2011 until 2014 and the COO of DreamWorks Animation SKG, Inc. from 2014 until 2015.

Professional Highlights Cinemark Holdings, Inc. • CEO (2015-2021)

DreamWorks Animation SKG - a prominent animation studio known for producing high-quality animated feature films and short films • COO (2014)

Dick Cook Studios - a media and production company • President and COO (2011-2013)

The Walt Disney Company - a leading multinational entertainment and media conglomerate • President, Walt Disney Motion Picture Group (2007-2010) • President, Buena Vista International (1993-2006) • SVP, General Manager, Buena Vista Television (1987-1991) • Various Positions at Disney Channel and Home Entertainment (1980-1986)

|

Select Skills Industry Experience - Mr. Zoradi brings a wealth of industry experience to the Cinemark Board, having served as the company's CEO from 2015 to 2021. With over four decades in the entertainment business, his career includes significant roles at Walt Disney Motion Pictures Group and DreamWorks.

Strategic Planning - Mr. Zoradi brings exceptional strategic planning expertise to the Board, honed over his extensive career in the entertainment industry. As the former CEO of Cinemark, he led the company through significant growth and transformation. His tenure at Cinemark was marked by strategic initiatives that drove growth, including the expansion of recliner seating, enhancement of food and beverage offerings, omni-channel marketing and the introduction of North America's first exhibitor-driven subscription program.

|

|

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 19 |

Identifying and Evaluating Director Nominees

Members of the Governance Committee review and evaluate our policies and practices with respect to the size, composition and functions of the Board at least annually. Our Board currently possesses a unique combination of skills, industry experience and knowledge that have been and remain key. Recent examples of the Board's use of these skills and industry knowledge are the Company's successful navigation of the COVID-19 pandemic and the 2023 Writers Guild of America and SAG-AFTRA strikes, both of which had a significant impact on the Company and the industry as a whole. The Board continues to utilize its unique combination of skills, experience and knowledge to provide the stability and continuity needed to guide the Company in both the short and long term and support the Company in achieving its strategic goals.

The Governance Committee policy on director nominees recognizes that choosing a director is dependent upon a number of subjective and objective criteria, many of which are difficult to categorize. The Governance Committee, therefore, has not established any minimum qualifications for a director candidate or identified any specific set of qualities or skills that it deems mandatory.

Annual Board Assessment

The Governance Committee also oversees an annual performance evaluation of our Board and each of its committees. The Chair of our Governance Committee reviews the format and process of the annual evaluations, including the topics to be addressed. The evaluation is an anonymous questionnaire that elicits information used to improve Board and committee effectiveness and assess the effectiveness, size and composition of the Board and its committees. The evaluation topics cover several areas, including board and committee structure and composition, director access to management, and board strategy and performance measures. Many of the questions require narrative responses, and all questions provide space for and encourage candid commentary. The questionnaire and feedback are coordinated through an independent third-party to ensure a robust evaluation process. Feedback received from Board and committee evaluations is discussed during Board and committee meetings.

Board structure

Independent Non-Executive Chairman

Carlos Sepulveda has served as the non-executive Chairman of the Board (“Chairman”) since May 2022. The Chairman has the authority to preside at all Board meetings, including executive sessions of the non-management directors, and has the authority to call meetings of the directors. The Chairman serves as principal liaison between the non-management directors and Company management. In consultation with the CEO, the Chairman approves meeting schedules, agendas and the information provided to the Board. If requested by stockholders, and as appropriate, the Chairman is also available for consultation and direct communication as the Board’s liaison.

Separation of Chairman and CEO Roles

Although the Board does not have a formal policy on separation of the roles of the CEO and Chairman, we have kept these positions separate since 2007. Separating the Chairman and CEO roles allows us to develop and implement corporate strategy that is consistent with the Board’s oversight role, while facilitating strong day-to-day executive leadership.

The Board believes that its leadership structure is appropriate for Cinemark. The independence of the Board’s standing committees and the regular use of executive sessions of the non-management directors allows the Board to maintain independent oversight of risks to our business, our long-term strategies, annual operating plan, and other corporate activities.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 20 |

Board Independence

The majority of our Board is independent. In 2024, seven of the eleven directors were independent, and on January 1, 2025, the number of independent directors increased to eight of eleven when the Board deemed Mr. Zoradi independent three years after he stepped down from Cinemark's CEO position. Our Board determines the independence of directors by applying the New York Stock Exchange ("NYSE") listing standards’ independence test, which evaluates whether the director:

The Board, in coordination with our Governance Committee and the Company’s general counsel, evaluated the NYSE bright-line tests and considered the transactions between the Company and certain Board members, reported under the heading Certain Relationships and Related Party Transactions, and other relevant factors to determine the independence of the Board members. On the basis of this review, the Board affirmatively determined, in its business judgment, that in 2024 and currently, (a) the majority of the Board is independent, (b) each of Mss. Antonellis, Loewe and Vaca and Messrs. Chereskin, Rosenberg, Senior, and Sepulveda are independent, (c) Mr. Syufy is not independent due to his transactions with the Company exceeding $120,000 annually, (d) Mr. Mitchell is not independent due to his relationship with our founder and former Chairman, Lee Roy Mitchell, (e) in 2024, Mr. Zoradi was not independent because he was a former employee of the Company; however, on January 1, 2025, three years after Mr. Zoradi's employment ended, he became independent, (f) Mr. Gamble is not independent because he is a current employee of the Company, (g) each of Mss. Antonellis and Loewe and Messrs. Rosenberg and Sepulveda met all applicable requirements for membership in the Audit Committee, (h) Ms. Loewe and Mr. Sepulveda qualified as “audit committee financial experts” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC and satisfy the NYSE’s financial experience requirements, and (i) each of Mss. Vaca and Antonellis and Messrs. Chereskin and Sepulveda met all applicable requirements for membership in the Compensation Committee.

Director Development and Engagement

Continuing Director Education |

We provide each Director with a membership to the National Association of Corporate Directors (NACD), which provides access to educational programs relevant to their board responsibilities or interests. Upon request, we may also cover the cost for any Director who wishes to attend programs and seminars outside of their NACD membership on topics relevant to their service as Directors. From time to time, members of management also present to the Board or its committees on new developments in areas relevant to the Company, such as federal and state regulatory updates, cybersecurity updates and best practices, and emerging trends in artificial intelligence. |

Meeting and Attendance |

During 2024, the Board held four (4) meetings and took action by written consent on two (2) occasions. All directors attended at least seventy-five percent (75%) of all meetings held by the Board and all meetings held by committees of the Board on which such director served. |

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 21 |

Board Committees

The Board has four standing committees: Audit Committee, Compensation Committee, Governance Committee and Strategic Planning Committee. Three of the four committees (Audit, Compensation, and Strategic Planning) are chaired by female directors. From time to time and for specific purposes, the Board may establish additional committees.

Each member of our Audit Committee, Compensation Committee and Governance Committee meets the requirements for independence under the listing standards of the NYSE, regulations promulgated by the U.S. Securities and Exchange Commission (“SEC”) and the Company’s Corporate Governance Guidelines, as applicable. The charters for these committees are available on the Investor Relations portion of our website (https://ir.cinemark.com) under the "Governance" tab.

Audit Committee

2024 Meetings: 4

2024 Consents: 1

Each member of the Audit Committee satisfies the standards for independence of the NYSE and SEC as they relate to audit committees.

Members: Nancy Loewe (Chair), Darcy Antonellis, Steven Rosenberg, Carlos Sepulveda

Roles and Responsibilities:

Ms. Loewe serves as the Chair of the Audit Committee. Both Mr. Sepulveda, the past Chair, and Ms. Loewe qualify as “audit committee financial experts” within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC. See Ms. Loewe’s and Mr. Sepulveda’s biographies on page 13 and page 18, respectively, for further information regarding their qualifications to be an “audit committee financial expert.”

Primary committee functions include:

The Audit Committee meets on a quarterly basis with management and Deloitte & Touche to discuss, among other items, the Company’s financial statements to be filed with the SEC, any change in significant accounting policies and its impact on the Company’s financial statements and the earnings press release related to the quarter and the year (as applicable). The Audit Committee also meets, on a periodic basis, with Deloitte & Touche in executive sessions without members of management present.

The Audit Committee oversees the Company's management of risks related to information security to ensure that adequate resources are allocated to support and maintain the Company's information security readiness. At least twice a year, management updates the Audit Committee on any potentially significant risks related to information security, current threat and mitigation and remediation tactics implemented by the Company. Management also provides the Audit Committee updates on the recently conducted cybersecurity tabletop exercises and on the emerging technologies, trends and threats relating to artificial intelligence. The Audit Committee also oversees and monitors the enterprise level risks related to ethics and compliance with the Company’s code of business conduct. Management provides to the Audit Committee, at every quarterly meeting, the top claims (as determined by management) reported through the anonymous whistleblower hotline, and provides an annual summary of claims, for both domestic and international operations, with a comparison to previous years.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 22 |

The Board has also delegated the approval of related party transactions to the Audit Committee. The Company’s written policy regarding approval of related party transactions provides that management must present to the Audit Committee all potential related party transactions including the nature of the transaction and material terms regardless of the dollar value of the transaction. The Audit Committee approves such related party transaction if it determines that the transaction is fair and in the best interest of the Company. See Certain Relationships and Related Party Transactions on page 55 for further details on related party transactions.

Governance Committee

2024 Meetings: 3

2024 Consents: 0

Each of the Governance Committee members satisfies the standards for independence of the NYSE.

Members: Steven Rosenberg (Chair), Nancy Loewe, Nina Vaca

Roles and Responsibilities:

Compensation Committee

2024 Meetings: 4

2024 Consents: 1

Each member of the Compensation Committee satisfies the standards for independence of the NYSE as they relate to compensation committees and qualify as “non-employee directors” within the meaning of Rule 16b-3 promulgated under Section 16 of the Exchange Act.

Members: Nina Vaca (Chair), Benjamin Chereskin, Carlos Sepulveda, Darcy Antonellis

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 23 |

Roles and Responsibilities:

Strategic Planning Committee

2024 Meetings: 2

2024 Consents: 0

The Strategic Planning Committee is governed by the Strategic Planning Committee Charter setting forth the purpose and responsibilities of this committee. In addition to the two formal meetings noted above, a subcommittee of the Strategic Planning Committee met three times throughout 2024 regarding capital allocation strategies and financing activities to make recommendations to the full Board.

Members: Darcy Antonellis (Chair), Benjamin Chereskin, Kevin Mitchell, Enrique Senior, Raymond Syufy, Mark Zoradi

Roles and Responsibilities:

Compensation Committee Interlocks

and Insider Participation

The Compensation Committee currently consists of Mss. Vaca and Antonellis and Messrs. Chereskin and Sepulveda. Mss. Vaca and Antonellis and Messrs. Chereskin and Sepulveda have never been an officer or employee of the Company or any of its subsidiaries. None of our executive officers serve or has served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 24 |

Meetings and Attendance

During 2024, the Board met four times and acted by unanimous consent one time. Each director attended either in-person or via teleconference or video application at least 75% of the aggregate of all Board and applicable committee meetings during 2024.

Our non-management directors meet at least twice a year in executive sessions with no Company personnel present. A separate executive session of only independent directors is held at least once a year. Carlos Sepulveda presides over the executive sessions. During 2024, our non-management directors met four times and our independent directors met one time in executive sessions.

The Board strongly encourages its continuing members to attend the Annual Meeting of Stockholders. All but five of the then-current members of the Board were in attendance at the 2024 Annual Meeting of Stockholders, which was held in-person.

Key Areas of Board Oversight

Strategic

Throughout 2024, governance, risk management, and operational strategy continued to play critical roles in our Company. While we continued our recovery from the effects of the COVID-19 pandemic and the 2023 Writers Guild of America and Screen Actors Guild strikes, our long-term success continues to be contingent upon several key factors, including the volume of new film content available, the box office performance of new film content released, the duration of the exclusive theatrical release window and evolving consumer behavior with competition from other forms of in-home and out-of-home entertainment. Our experienced and industry-knowledgeable Board plays a pivotal oversight role in our strategy and execution in navigating these and other challenges and oversees the executive team’s management of risks related to business operations, industry developments, financial controls, liquidity, employee retention, health and safety protocols and information technology.

The Board actively oversees the Company’s long-term business strategy to ensure that we are positioned to navigate external headwinds, including to continue our recovery from the effects of the pandemic, to increase our competitive advantage and deliver sustainable growth and profitability. The Board is continuously engaged with senior management on critical business matters relevant to the Company’s long-term strategy.

Risk

The Board has responsibility for risk management oversight, although certain categories of risk may be allocated to particular committees of the Board, with the committee then reporting back to the full Board. The primary categories of risk on which the Board continually focuses include competitive, economic, operational, financial (accounting, credit, liquidity and tax), cybersecurity, legal, compliance, regulatory, compensation and reputational risks. Furthermore, the Board may from time to time establish additional committees for unique areas of risk.

Audit Committee |

|

Compensation Committee oversees risks related to compensation policies, practices, incentive plans and talent retention. |

|

Governance Committee oversees risks associated with governance structures, policies and processes and succession planning. |

|

Strategic Planning Committee |

Management is charged with identifying material risks in a timely manner, implementing strategies that are responsive to the Company's risk profile and specific material risk exposure, evaluating and managing risk with respect to business decision-making and promptly communicating relevant risk-related information to the Board or appropriate committee to enable them to conduct appropriate risk management oversight.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 25 |

Sustainability

Our sustainability efforts are managed by a cross-functional team that shapes and drives our sustainability strategy, tracks key performance indicators and manages the Company’s sustainability initiatives. Management presents sustainability topics to the Governance Committee and our Board throughout the year. The Governance Committee serves as the primary committee assisting the Board in oversight of the Company’s sustainability efforts. See Cinemark's 2024 Sustainability Report published in the Spring of 2025 and available on our investor relations website at https://ir.cinemark.com under the “Governance” tab for information on our sustainability initiatives.

Succession Planning and Talent Development

Succession planning and talent development are important at all levels in our Company. The Governance Committee and the Compensation Committee jointly oversee management’s succession plan for key positions at the senior officer level, and most importantly for the Chief Executive Officer position. At least annually, these Committees review and advise management on succession plans for senior management and the Chief Executive Officer, including both long-term and emergency succession planning. In addition, the Chief Executive Officer provides the Committees an assessment of the Company’s senior leaders and their potential to succeed at key senior management positions. Senior executives interact with our Board through formal presentations and during informal events. More broadly, the Board is updated on key initiatives for the overall workforce, including development and engagement programs.

Shareholder Engagement

We place immense value on shareholder engagement. We believe that maintaining an open and transparent dialogue with our shareholders is essential to our success. By actively listening and addressing concerns and suggestions of our shareholders, we are able to make informed decisions that align with their interests and enhance long-term value. Our commitment to shareholder engagement is reflected in our consistent outreach to our top institutional shareholders over the past five years. As a result of ongoing engagement with our institutional investors, we had a strong Say-On-Pay (97% in favor) vote at our 2024 Annual Meeting.

This year, we reached out to 77% of our institutional stockholder base. In addition, we offered meetings to representatives of Glass Lewis and Institutional Shareholder Services. During 2025, we met with all that accepted our request, totaling 44% of the total shares outstanding held by institutional stockholders, in addition to representatives from Glass Lewis. Key issues discussed included film content recovery, anticipated industry box office rebound in 2025 and 2026, executive compensation, a variety of corporate governance topics, talent management, corporate social responsibility and sustainability and the upcoming publication of our 2025 sustainability report.

Responsiveness to Shareholder Feedback

After considering stockholder feedback from our proactive engagement discussions, we have:

Corporate Governance Policies and Charters

The following documents make up our corporate governance framework:

Current copies of the above documents are available publicly on our website at https://ir.cinemark.com under the “Governance” tab.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 26 |

Code of Business Conduct and Ethics

The Company’s Code of Business Conduct and Ethics (the "Code") applies to our board of directors and employees. The Code sets forth our policies on critical business and ethical issues such as insider trading, anti-corruption, antitrust, protection of our assets, and other legal and ethical obligations. We will post on our website any amendment to, or a waiver from, a provision of the Code of Business Conduct and Ethics for directors and executive officers that have been approved by our Board or any Board committee. During 2024, there were no amendments to, or waivers from, any provision of the Code of Business Conduct and Ethics for any director or executive officer. The Code of Business Conduct and Ethics is available on our website at https://ir.cinemark.com under the “Governance” tab.

Insider Trading Policies and Procedures

The Company has

Stockholder Communications with the Board

As stated in our Corporate Governance Guidelines, any Company stockholder or other interested party who wishes to communicate with the non-management directors may direct such communications by writing to the:

Company Secretary

Cinemark Holdings, Inc.

3900 Dallas Parkway

Plano, TX 75093

The communication must be clearly addressed to the Board or to a specific director. If a response is desired, the individual should also provide contact information such as name, address and telephone number. All such communications will be reviewed initially by the Company Secretary, who will forward to the appropriate director(s) all correspondence, except for items of the following nature:

The Company Secretary will prepare a periodic summary report of all such communications for the Board. Correspondence not forwarded to the Board will be retained by the Company and will be made available to any director upon request.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 27 |

DIRECTOR COMPENSATION

2024 Director Compensation Table

Name |

Fees Earned or |

Stock Awards |

Total |

Darcy Antonellis |

115,000 |

134,982 |

249,982 |

Benjamin Chereskin |

97,500 |

134,982 |

232,482 |

Nancy Loewe |

115,000 |

134,982 |

249,982 |

Kevin Mitchell |

85,000 |

134,982 |

219,982 |

Steven Rosenberg |

112,500 |

134,982 |

247,482 |

Enrique Senior |

85,000 |

134,982 |

219,982 |

Carlos Sepulveda |

200,000 |

134,985 |

334,985 |

Raymond Syufy |

85,000 |

134,982 |

219,982 |

Nina Vaca |

115,000 |

134,982 |

249,982 |

Mark Zoradi |

85,000 |

134,982 |

219,982 |

In accordance with the Compensation Committee Charter, the Compensation Committee, in consultation with the Governance Committee, sets the compensation of our Board members. Pearl Meyer, the Compensation Committee’s independent compensation consultant, periodically reviews and provides the Compensation Committee with a comparison between the Company’s director compensation practices and those of other similarly situated companies. The Board makes changes to its director compensation practices only upon the recommendation of the Compensation Committee and following discussion and unanimous concurrence by the full Board.

The compensation of our non-employee directors is subject to our Third Amended and Restated Non-Employee Director Compensation Policy (“Director Compensation Policy”). Under the Director Compensation Policy, a non-employee director is one who is not (i) an employee of the Company or any of our subsidiaries or (ii) an employee of any of the Company’s stockholders which has contractual rights to nominate directors. Therefore, Mr. Gamble did not receive any compensation for his services on the Board or any of its committees for 2024.

The compensation of the directors during 2024 pursuant to our Non-Employee Director Compensation Policy is as follows:

Committee |

|

Chair ($) |

|

Member ($) |

Audit |

|

25,000 |

|

12,500 |

Compensation |

|

25,000 |

|

12,500 |

Governance |

|

20,000 |

|

10,000 |

Strategic Planning |

|

10,000 |

|

5,000 |

Annual cash retainers are paid in four equal quarterly installments at the end of each quarter for services rendered during the quarter. All directors are reimbursed for travel related expenses incurred for each Board meeting they attend.

In addition to the annual cash retainers, each non-employee director receives an annual grant of restricted stock valued at $135,000. The number of shares of restricted stock granted is determined by dividing $135,000 by the closing price of Common Stock on the grant date, rounded down to the nearest whole share. The grant date is typically on or around June 15. The annual stock awards vest on the first anniversary of the grant date subject to continued service to the Company through the vest date. The directors are also subject to our stock ownership guidelines and are required to retain common stock ownership five times the value of their base retainer. Our 2024 Long-Term Incentive Plan (the “2024 Plan”) imposes a $1,000,000 limit on the compensation that can be awarded to a non-employee director in any given fiscal year, including the sum of (i) cash compensation and (ii) the grant date fair value of equity compensation under the 2024 Plan.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 28 |

COMMITMENT TO SUSTAINABILITY

Cinemark is one of the largest and most influential theatrical exhibition companies in the world with approximately 495 theaters and approximately 5,650 screens in 14 countries. We are deeply committed to sustainability, encompassing our environmental impact, social responsibility, and community engagement. Our sustainability efforts are integral to our mission and values, reflecting our dedication to creating a positive and lasting impact on the world around us.

In 2022, Cinemark’s full Board established a framework to formally monitor and review environmental, social and governance matters. During 2023, Cinemark focused not just on advancing its efforts, but also on increasing transparency and communications concerning those efforts. Our executive leadership team established an internal cross-functional team that was tasked with driving continued progress in the initiatives that promote sustainability and further transparency. In 2023, the “ESG Working Group” was renamed to the “Sustainability Working Group” to reflect Cinemark’s comprehensive approach to sustainability policies, practices and goals.

We completed our initial assessment of sustainability priorities during 2023, publishing our first report in the summer of 2023. This process included examining key data points requested by a range of key stakeholders, including investors, customers, employees, and certain rating organizations and by studying industry peers. Our analysis of sustainability topics included alignment to the Sustainability Accounting Standards Board (SASB). We then drew upon subject matter expertise to collect and organize content.

In 2025, we plan to publish an updated report, which will continue to focus on environmental, social and governance matters and also add select disclosures to align with the Task Force on Climate-Related Financial Disclosures ("TCFD") framework in addition to SASB.

We routinely engage with our stakeholders to better understand their views on sustainability matters, carefully considering the feedback we receive and acting when appropriate. For more information on our sustainability program and policies, or to read our sustainability reports, please visit: https://ir.cinemark.com/Governance.

EXECUTIVE COMPENSATION

Item 2: Advisory Vote to Approve Compensation of

Named Executive Officers

As required by Section 14A of the Exchange Act, we provide our stockholders with the opportunity to vote to approve, on a non-binding and advisory basis, the compensation of our named executive officers. Because the vote on this compensation program is advisory in nature, it will not affect any compensation already awarded to any named executive officer and will not be binding on or overrule any decisions made by the Compensation Committee or the Board. The vote on this resolution is not intended to address any specific element of compensation. Rather, this vote relates to the compensation of our named executive officers as a whole, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC.

Our compensation program, overseen by the Compensation Committee, is designed to attract and retain a talented team of executives who can deliver on our commitment to build long term stockholder value. The Compensation Committee believes our program is competitive in the marketplace, links pay to performance and is aligned with the prevailing best practices on corporate governance as evidenced by our strong 2024 Say-On-Pay (97% in favor) vote.

The Compensation Committee and the Board considers the results of this advisory vote when formulating future executive compensation policy. The results of this vote serve as an additional tool to guide the Compensation Committee and the Board in continuing to align the Company’s executive compensation program with the interests of the Company and its stockholders. The results of this vote also guide the Compensation Committee and the Board to ensure that our executive compensation program is consistent with our commitment to high standards of corporate governance.

|

2025 NOTICE OF ANNUAL MEETING & PROXY STATEMENT | 29 |

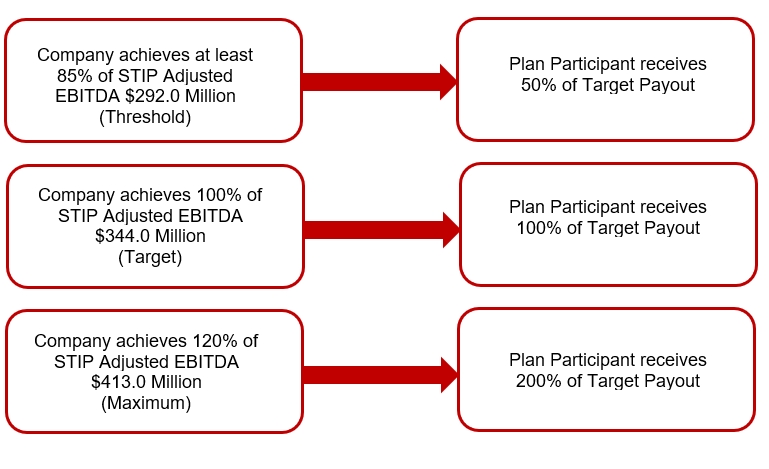

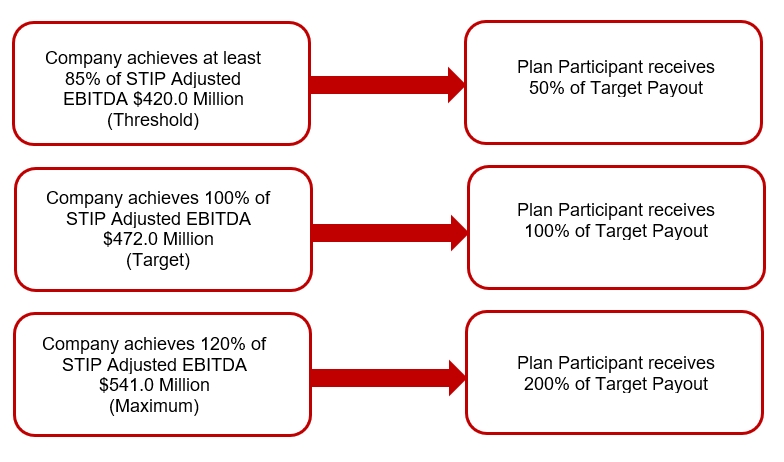

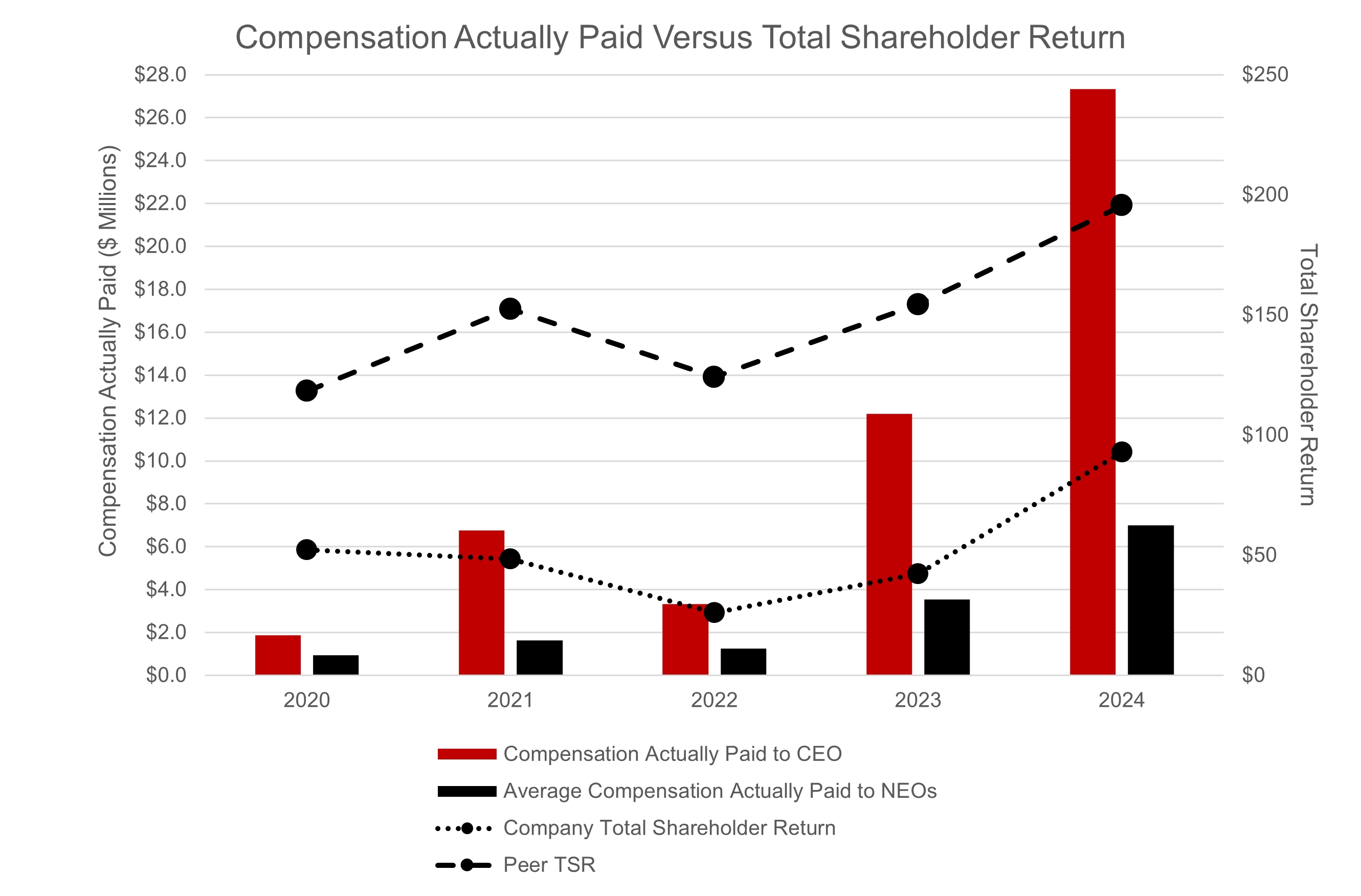

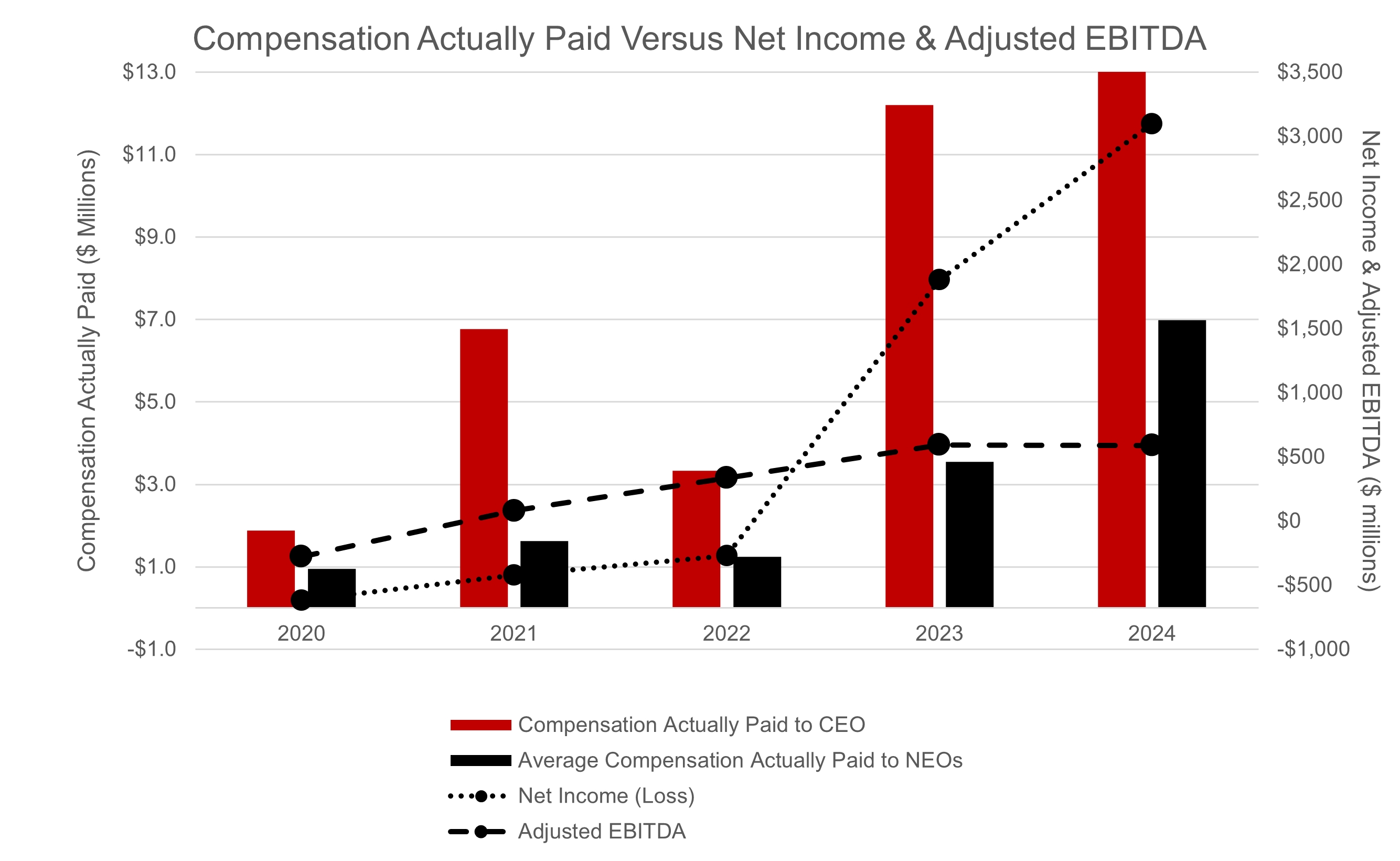

We ask our stockholders to vote on the following resolution at the 2025 Annual Meeting: